Derive the Partner Account for Credit Memos

You create credit memos to make adjustments to invoice transactions.

To ensure accurate accounting, the credit memos must be created using the accounts on the posted invoices. This is automatically achieved if the Receivables profile option AR_USE_INV_ACCT_FOR_CM_FLAG is set to “No” for the Site profile level. When this profile option is set to “Yes”, any account override on the invoice when it’s posted isn’t carried across to the credit memo. To make sure that the correct partner account on the posted invoice is used on the credit memo, you must create an account rule to derive the correct account for the Revenue Accounting class.

You must then add this account rule to a journal entry rule set for credit memos.

Create an Account Rule

-

Navigate to Setup and Maintenance and select the Receivables functional area under the Financials offering.

-

Select Show – All Tasks and then click the Manage Account Rules task.

-

On Manage Account Rules: Receivables, click Create.

-

On Create Account Rule, enter the following details:

-

Name.

-

Short Name.

Enter a name that identifies that this rule is for credit memos. You’ll need to select this account rule later in a journal entry rule set for credit memos.

-

Rule Type. Select Account Combination.

-

-

In the Rules section, click Add and enter the following details:

-

Value Type. Select Source.

-

Value. Select Joint Venture Receivables Account Code Combination ID. This is a preconfigured flexfield that retrieves the account combination of the original transaction the joint venture distribution came from.

-

-

In the Rule 1: Conditions section, enter the following condition:

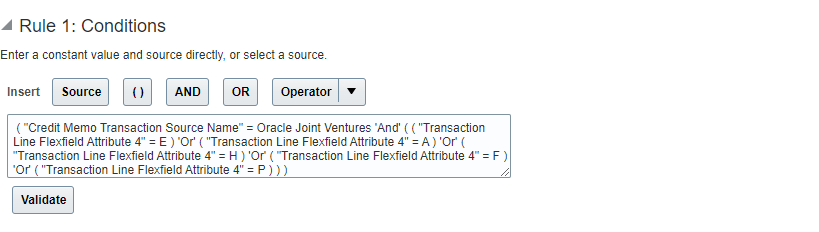

"Credit Memo Transaction Source Name" = Oracle Joint Ventures 'AND' ( ( "Transaction Line Flexfield Attribute 4" = E ) 'OR' ("Transaction Line Flexfield Attribute 4" = A ) 'OR' ("Transaction Line Flexfield Attribute 4" = H ) 'OR' ("Transaction Line Flexfield Attribute 4" = F ) 'OR' ("Transaction Line Flexfield Attribute 4" = P ) )

-

Click the Validate button. If you have correctly entered the condition, you will get a message that the validation is complete.

Click Save.

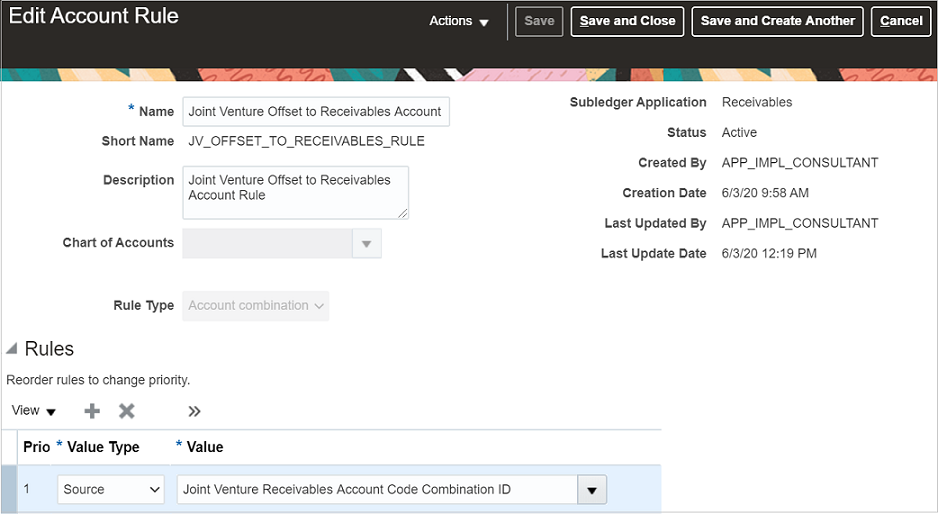

The following image shows an account rule with the Rule Type “Account combination.” The value type Source is mapped to the value Joint Venture Receivables Account Code Combination ID. This is the preconfigured flexfield that will retrieve the complete account combination on the posted invoice. This value will override the account combination in the Revenue accounting class on each joint venture credit memo line.

The following image shows the Rule 1: Conditions section of the page. It includes a condition that the account will be updated only for those joint venture credit memos associated with operating expenses (E), Assets (A), overhead expenses (H), Fees and other charges (F), and partner contributions (P).

Add a Journal Entry Rule Set to an Accounting Method

Create a journal entry rule set for the accounting event “Credit Memo” and assign the rule set to the accounting method that you use for your chart of accounts.

You assign the account rule that you created in the preceding task to the journal entry rule set. If you didn’t need to create this account rule, you must assign the predefined account rule to the journal entry rule set for credit memos.

You can create journal entry rule sets before you assign them to accounting methods. The following steps show how to create or edit a journal entry rule set within an accounting method.

-

Navigate to Setup and Maintenance and select the Receivables functional area.

-

Select Show – All Tasks and then click the Manage Accounting Methods task.

-

On Manage Account Methods: Receivables, select your accounting method and click Edit.

-

On Edit Accounting Method, in the Journal Entry Rule Set Assignments section for Receivables, check if a record already exists for the event class “Credit Memo” and event type “All”. If it exists, click the rule set to edit it. If it doesn’t, you need to create the record. To do so, click Add and enter the following details:

-

Event Class. Select Credit Memo.

-

Event Type. Select All.

Rule Set. If a rule set already exists with the following information, then you just need to select the rule set. If it doesn’t exist, click Create from the drop-down list and enter the following details:

-

In the Create Subledger Journal Entry Rule Set page, enter the Name and Short Name that identifies that the journal entry rule set is for joint venture credit memo.

-

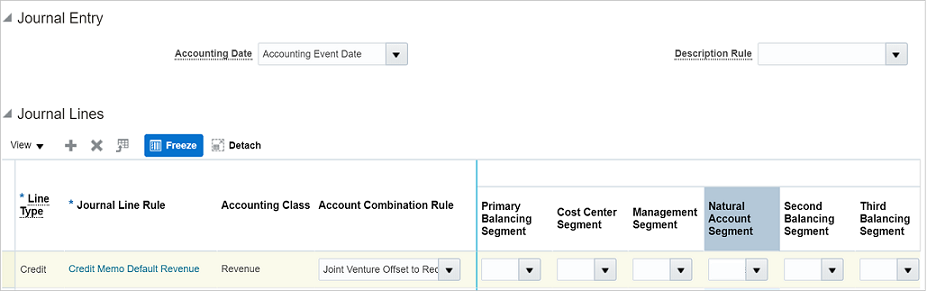

Under Journal Lines, you can add a new journal line or edit existing journal lines.

Note: If this is an existing rule set, it might already contain a journal line for Credit line type and Credit Memo Default Revenue journal line rule. If this is the case, you just need to edit the journal line to assign the account rule in the Account Combination Rule field.To add a new journal line, click Add and enter the following details:

-

Line Type. Select Credit.

-

Journal Line Rule. Select Credit Memo Default Revenue.

-

Account Combination Rule. If the Receivables profile option AR_USE_INV_ACCT_FOR_CM_FLAG is set to “Yes” for the Site profile level, enter the account rule for credit memos that you created in the preceding task.

If this profile option is set to “No”, make sure that the predefined account rule “Transaction Distribution GL Account” is assigned in this column. This account rule will automatically assign the accounts used when posting the invoices to General Ledger.

-

This example shows the journal entry rule set that’s set up to derive the partner account for joint venture credit memos when the Receivables profile option is set to “Yes”. The account rule specified in the Account Combination Rule column will be used to derive all the segment values of the partner account from invoiced joint venture distributions.

-

-

-

Verify that the journal entry rule sets for the other systems that you stored in this accounting method are intact.

-

To activate the journal entry rule sets, click Activate.

-

Make sure the status of the accounting method is Active and then save it.

-

Click Save and Close.