Derive the Partner Account for Reimbursement Invoices

To derive the partner account for receivables invoices that are created to reimburse the joint venture costs incurred by the managing partner, you need to complete the following tasks:

-

Create a mapping set.

-

Create an account rule.

-

Add journal entry rule sets to an accounting method.

-

Associate the accounting method with the primary ledger of the joint venture business unit.

If your joint venture uses partner contributions to cover joint venture costs, then your invoice will include separate invoice lines for the partner contribution amount and the net invoice amount. Information on how to override the revenue account for partner contribution invoice lines is detailed separately in the section Derive the Liability Account for Partner Contribution Invoice Lines in Joint Venture Invoices.

Create a Mapping Set

Create a mapping set to replace the value of at least a segment of the partner account with a specific account that’s not set up as distributable in Joint Venture Management. This prevents processed transactions from routing back into Joint Venture Management.

This topic provides an example on how to replace the natural account segment value of the partner account.

-

Navigate to Setup and Maintenance and select the Receivables functional area under the Financials offering.

-

Select Show – All Tasks and then click the Manage Mapping Sets task.

-

On Manage Mapping Sets: Receivables, click Create.

-

Enter the following details:

-

Name.

-

Short Name.

-

Output Type. Change the output type to Segment.

-

-

In the Input Sources section, click Select and Add and then enter details for the following search criteria:

-

Subledger Application. Select Receivables.

-

Event Class. Select Invoice.

-

Source. Search for and select all or a combination of the following input sources.

Note: It’s important to select the required input sources because the application displays columns for filtering joint venture invoices only for the input sources that you specify here.-

Transaction Source Name. This will enable you to select only joint venture invoices.

-

Transaction Line Flexfield Attribute 1. This attribute will enable you to select joint venture invoices by joint venture.

-

Transaction Line Flexfield Attribute 2. This attribute will enable you to select joint venture invoices by the primary segment value.

-

Transaction Line Flexfield Attribute 4. This attribute will enable you to select joint venture invoices by joint venture distribution type.

-

-

-

In the Chart of Accounts section, click Add and enter the chart of accounts of the primary ledger for the joint venture and select the segment for which you want to override the value of.

-

In your "your chart of accounts name": Mappings section, click Add.

The Input section displays columns based on your input sources.

-

Enter the following input values to filter and select joint venture invoices for which you want to replace the default natural account segment value:

-

Transaction Source Name. Enter Oracle Joint Ventures. This value distinguishes joint venture invoices from other invoices.

-

Transaction Line Flexfield Attribute 1. Enter the joint venture for which invoices will be selected.

-

Transaction Line Flexfield Attribute 2. Enter the primary segment value based on which invoices will be selected. You can enter * to include all primary segment values.

-

Transaction Line Flexfield Attribute 4. Enter the joint venture distribution type based on which invoices will be selected. This can be operating expenses, capital expenditures, overhead, or fees and other charges and are recorded as account type E (Expense), A (Assets), H (Overhead), and F (Fees and other charges) respectively in the Joint Venture Distributions work area.

-

-

Under Output, in the Account field, enter an account to override the original natural account in the partner account for the selected joint venture invoices.

Important: Make sure that the account you enter isn’t an account that’s identified as distributable in your joint venture definition. This prevents invoice and journal transactions generated by Joint Venture Management from being identified and processed by Joint Venture Management again. As an alternative to this setup, you can enable the "Exclude joint venture transactions" option in your joint venture definition. This option automatically excludes invoice and journal transactions generated by Joint Venture Management from being identified for distribution. See Exclude Joint Venture Invoices and Journals from Oracle Joint Venture Management Processing for more information. -

Click Save.

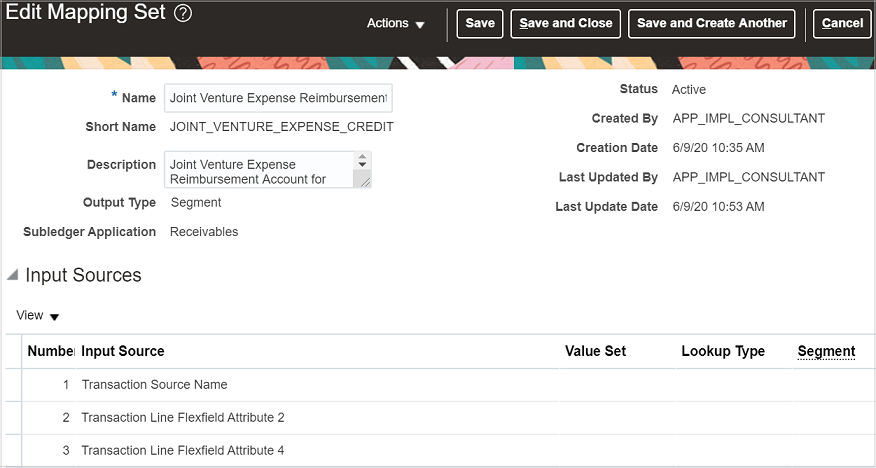

The following image shows the Edit Mapping Set page for a mapping set that has "Joint Venture Expense Reimbursement Account" as the name and description, and output type "Segment." The input sources selected for the mapping set are: Transaction Source Name, Transaction Line Flexfield Attribute 2, and Transaction Line Flexfield Attribute 4.

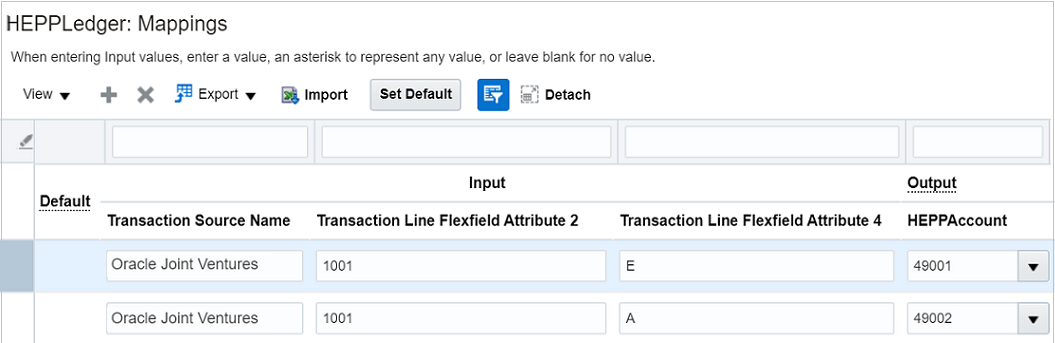

The following image shows the Mappings section of the page. It includes two mapping set rows with the values "Oracle Joint Ventures" in the Transaction Source Name column and "1001" in the Transaction Line Flexfield Attribute 2 column. This means that the system will map output values only for joint venture invoices that are created for the cost center 1001. The Transaction Line Flexfield Attribute 4 shows different values for each row. The value of E (Expense) in this column indicates that all joint venture invoices that are created to reimburse the operating expenses for cost center 1001 will be recorded in the natural account 49001. The value of A (Assets) in the second row indicates that the joint venture invoices created to reimburse the capital expenditures for cost center 1001 will be recorded in the natural account 49002.

Create an Account Rule

Create an account rule to assign the mapping set that you created in the preceding task.

-

Navigate to Setup and Maintenance and select the Receivables functional area.

-

Select Show – All Tasks and then click the Manage Account Rules task.

-

On Manage Account Rules: Receivables, click Create.

-

On Create Account Rule, enter the following details:

-

Name.

-

Short Name.

-

Chart of Accounts. Select the chart of accounts of the primary ledger of your joint venture.

-

Rule Type. Select Segment.

Then, for the chart of accounts you selected, select the natural account segment value from the drop-down list.

-

-

In the Rules section, click Add and enter the following details:

-

Value Type. Select Mapping set.

-

Value. Select the name of the mapping set that you created in the preceding task.

-

-

Click Save.

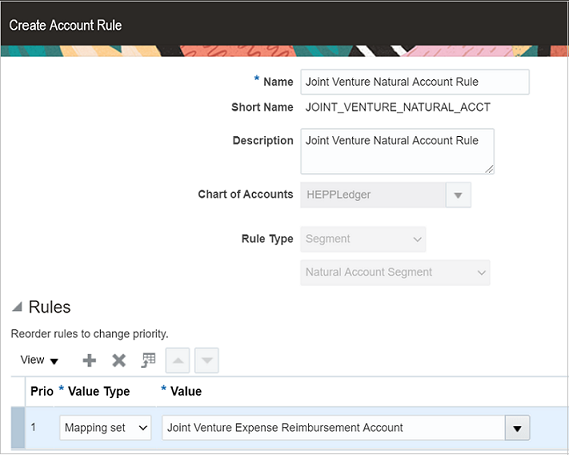

The following image shows the Create Account Rule page with information entered to create an account rule with the Rule Type “Natural Account Segment.” A mapping set is specified in the Value field. This indicates that the mapping set referenced in this account rule is for the natural account segment for receivables invoices.

Add a Journal Entry Rule Set to an Accounting Method

The account rules that you created must be assigned to journal entry rule sets. Journal entry rule sets provide the definition for generating a complete subledger journal entry for an accounting event. For joint venture receivables invoices, you must create journal entry rule sets for the accounting events, invoice and credit memo, and assign the rule sets to an accounting method.

Accounting methods are specific to chart of accounts. Therefore, you will assign journal entry rule sets for Oracle Joint Venture Management to the accounting method that is defined with the chart of accounts used in your joint venture.

You can create journal entry rule sets before you assign them to accounting methods. The following steps show how to create or edit journal entry rule sets within an accounting method.

-

Navigate to Setup and Maintenance and select the Receivables functional area.

-

Select Show – All Tasks and then click the Manage Accounting Methods task.

-

On Manage Account Methods: Receivables, select your accounting method, click the Actions drop-down menu and click Duplicate.

-

On Create Accounting Method, enter the following details and click Save and Close:

-

Name.

Short Name.

The Edit Accounting Method page is displayed for the accounting method you created.

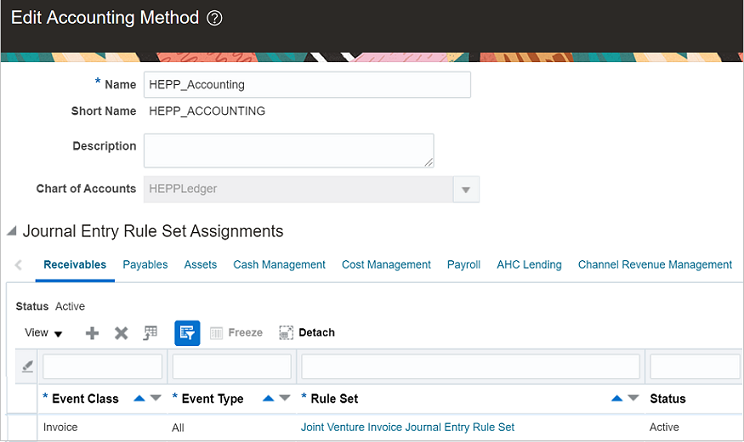

The following example shows an accounting method for a chart of accounts.

-

-

In the Journal Entry Rule Set Assignments section for Receivables, check if a record already exists for event class “Invoice” and event type “All”. If it exists, click the rule set to edit the credit line. If it doesn’t, you need to create the record. To do so, click Add (+ icon) and enter the following details:

-

Event Class. Select Invoice.

-

Event Type. Select All.

Rule Set. If a rule set already exists with the following information, then you just need to select the rule set. If it doesn’t exist, click Create from the drop-down list and enter the following details:

-

In the Create Subledger Journal Entry Rule Set page, enter the Name and Short Name that identifies that the journal entry rule set is for joint venture invoices.

-

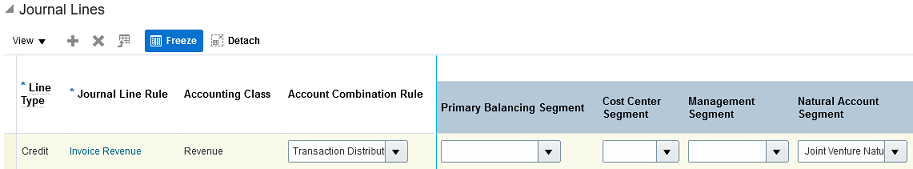

Under Journal Lines, you can add a new journal line or edit existing journal lines.

Note: If this is an existing rule set, it might already contain a journal line for Credit line type and Invoice Revenue journal line rule. If this is the case, you just need to edit the journal line to assign the correct account rule in the Natural Account Segment field.To add a new journal line, click Add and enter the following details:

-

Line Type. Select Credit.

-

Journal Line Rule. Select Invoice Revenue.

-

Account Combination Rule. Make sure this field is populated with the default account rule, Transaction Distribution GL Account.

-

Natural Account Segment. Search and select your account rule that you created to derive the natural account segment of the partner account for joint venture invoices.

-

-

Click Save and Close.

The following image shows a journal entry rule set that’s set up with an account rule in the Natural Account Segment column. This account rule will derive the natural account with the account specified in the associated mapping set.

-

-

-

Verify that the journal entry rule sets for the other systems that you stored in this accounting method are intact.

-

To activate the journal entry rule set, click Activate.

-

Make sure the status of the accounting method is Active and then save it.

-

Click Save and Close.

Associate the Copied Accounting Method with the Primary Ledger of the Joint Venture Business Unit

You must associate the copied accounting method with the primary ledger of the joint venture business unit.

-

In Functional Setup Manager, access the General Ledger functional area under the Financials offering.

-

Click the Specify Ledger Options task.

-

On Specify Ledger Options: <your ledger name>, in the Accounting Method field, enter the name of your copied accounting method. You can search for and select the accounting method from the drop-down list.

-

Click Save and Close.