Apply Periodic Adjustments to an Overhead Method

Apply periodic adjustments to a fixed amount or to one or more percentages or rates in an overhead method.

Perform these steps only if you’ve set up a periodic adjustment factor and assigned it to an overhead method. If you don’t need to adjust the overhead amount or calculation, then proceed to the next task to run the process to calculate joint venture overhead.

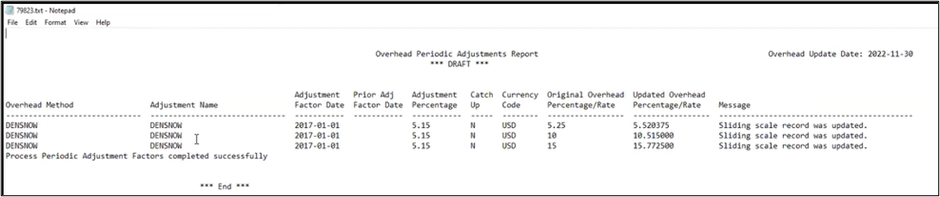

To apply periodic adjustment factors to overhead methods, run the Process Joint Venture Overhead process in the Apply Periodic Adjustment Factors mode. You can run it in a draft mode before running it in a final mode to review the adjustments that will be applied to the overhead methods.

You have the option to run the process in draft mode before running it in final mode to review how the values in the overhead method will be adjusted. When the process completes, you can access the text file generated by the process and verify that the percentage, rate, or fixed amount was adjusted as expected. This gives you the opportunity to make any corrections to the periodic adjustment factor, if necessary, before running the process in final mode.