Set Up Subledger Accounting Rules for Posting Stakeholder Reporting Journals

Set up subledger accounting rules to enable the Joint Ventures subledger to create stakeholder reporting journals for posting to stakeholder reporting ledgers.

Stakeholder reporting journals are generated from joint venture distributions. The account on the distributions is the account for the ledger that the source transaction was identified from. As each ledger has different accounts, the account on the distribution must be mapped to its corresponding account in the stakeholder reporting ledger. To accomplish this, you must map the segments in the source accounts to the segments in the COA structure that you set up for the stakeholder reporting ledger. You must also define the source for the stakeholder segment in the stakeholder reporting COA.

For this setup, you create account rules that define the source for each segment in the stakeholder reporting COA. Next, you assign the account rules to a journal entry rule set. After you complete the journal entry rule set, you assign it to the accounting method that you created for stakeholder reporting.

In the Setup and Maintenance work area, make sure to access each application from the Joint Venture Management functional area under Financials. You can find the tasks under the Show – All Tasks view. This opens each application in the context of the Joint Ventures subledger, which provides predefined setups that you can use for your configuration.

Create Account Rules

Create account rules to define the source for each segment in your stakeholder reporting COA, including the stakeholder segment.

In Setup and Maintenance, select the Manage Account Rules task in the Joint Venture Management functional area. The application provides the following predefined sources that you can use to define the sources for the segments in your stakeholder reporting COA:

- Original Transaction GL Account Segment 01

- Original Transaction GL Account Segment 02

- Original Transaction GL Account Segment 03 - 30

Each source represents a possible segment that can make up an account in the COA of your source ledger—the primary ledger or secondary ledger associated with the primary ledger.

Refer to the examples in this topic to define the source for a standard accounting segment and a stakeholder segment.

If the stakeholder segment in the stakeholder reporting COA was configured with a value set of stakeholder IDs, then you must create an account rule that will convert stakeholder IDs to text. You can set up an account rule with the predefined Stakeholder Identifier Segment formula for this purpose, which is shown in an example below.

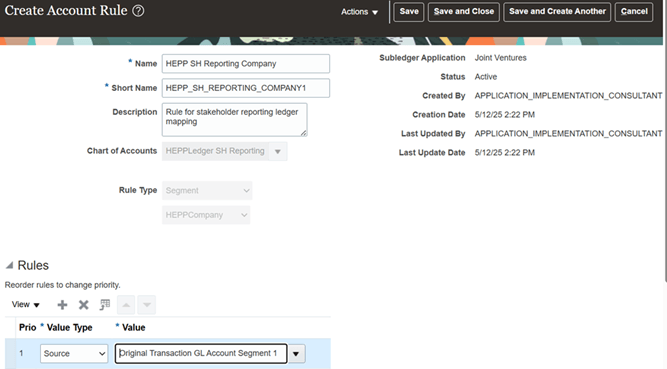

The following image shows an account rule named HEPP SH Reporting Company that’s set up to define the source for segment HEPPCompany in a stakeholder reporting COA. The account rule header area includes these values to identify the segment:

- Chart of Accounts = HEPPLedger SH Reporting

- Rule Type = Segment

- “Segment value” = HEPPCompany

In the Rules section, these values define the source for the segment:

- Value Type = Source

-

Value = Original Transaction GL Account Segment 1

This is the source that represents the Company segment in the primary ledger.

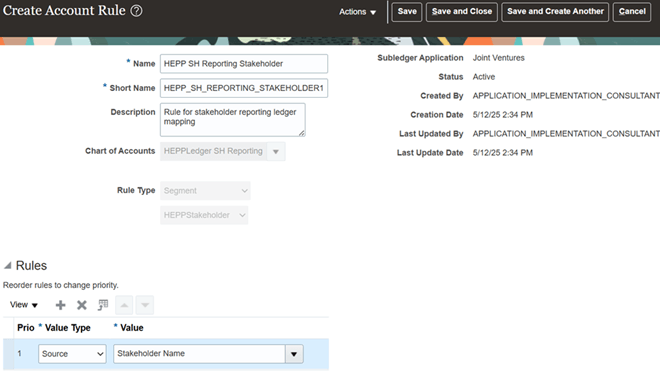

Example of Defining the Source for the Stakeholder Segment in a Stakeholder Reporting COA

The following image shows an example of an account rule name HEPP SH Reporting Stakeholder that’s set up to define the source for the stakeholder segment in a stakeholder reporting COA. The account rule header area includes these values to identify the segment:

- Chart of Accounts = HEPPLedger SH Reporting

- Rule Type = Segment

- “Segment value” = HEPPStakeholder

In the Rules section, these values define the source for the HEPPStakeholder segment:

- Value Type = Source

-

Value = Stakeholder Name

You can also select Stakeholder ID for this value.

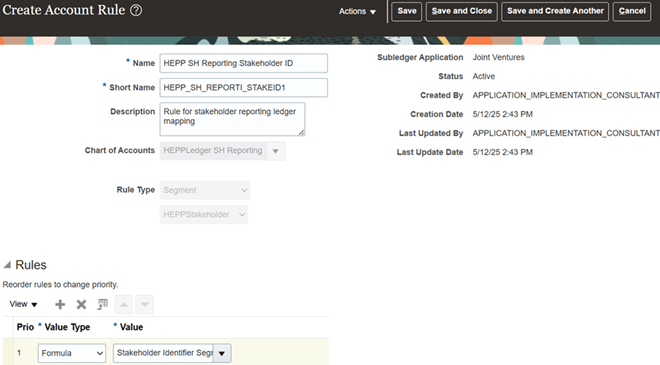

If the value set for the stakeholder segment is Stakeholder ID, instead of creating the preceding account rule, you need to create an account rule for the stakeholder segment using the predefined Stakeholder Identifier Segment formula. This account rule is required to convert the stakeholder IDs to text.

The following image shows an example of an account rule named HEPP SH Reporting Stakeholder ID. The Rules section contains a record with a Formula value type and Stakeholder Identifier Segment is selected for the value.

Assign the Account Rules to a Journal Entry Rule Set

Create a copy of the predefined Stakeholder Reporting Books journal entry rule set and configure it with the account rules you created.

To access the journal entry rule set, in Setup and Maintenance, select the Joint Venture Management functional area and then select the Manage Subledger Journal Entry Rule Sets task.

The following image shows an example of a copy of the predefined journal entry rule set named HEPP Stakeholder Reporting Books. Remember the following details as you set up your journal entry rule set:

- Associate the chart of accounts for the stakeholder reporting ledger with the journal entry rule set.

-

In the Stakeholder Reporting journal line rule, in the Segment Rules section, select the account rule that you set up as the source for each segment.

Note: The Stakeholder Reporting journal line rule is predefined and is set up with the debit line type by default.

Also, you can click the predefined Stakeholder Reporting journal line rule to view the following default settings:

- Debit is selected for the side

- Accounting attributes are set up to define the amount and currency for stakeholder reporting journals

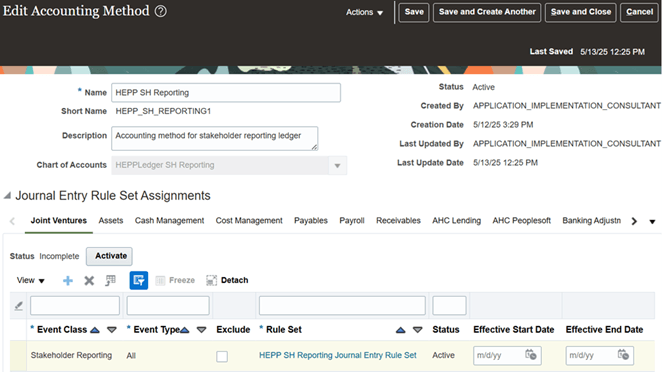

Assign the Journal Entry Rule Set to the Accounting Method

Access the accounting method that you set up for stakeholder reporting and assign the journal entry rule set to it.

The following image shows an example of an accounting method named HEPP SH Reporting in the Accounting Method application. It’s associated with the chart of accounts for the stakeholder reporting ledger. The Journal Entry Rule Set Assignments area includes a record with the following fields and values to assign the journal entry rule set to the accounting method:

- Event Class = Stakeholder Reporting (predefined value)

- Event Type = All

- Rule Set = HEPP SH Reporting Journal Entry Rule Set