Account the Inbound Custom Charges and Its Cost Allocation

This is a sample case study for accounting the inbound custom charges and its cost allocation.

An organization VISION CORPORATION imports goods A (Unit Price: USD 200 and quantity: 200) and B (Unit

Price: USD 300 and quantity 200) from one foreign supplier XYZ. The customs notified exchange rate for USD to INR is 60. Air freight payable to Air India for the consignment is USD 1000 and freight payable to DHL from Chennai Airport to Bangalore is USD 8000.

Basic customs duty is calculated on the landed cost up to the port of entry, assume tax rate for basic customs duty is 12%, 100% is non recoverable. Surcharge (just like education cess and higher education cess) is calculated on basic customs duty, assume the tax rate for surcharge is 10%, 100% is non recoverable. IGST is calculated on cost up to the port of entry, customs duties and all the surcharges, assume tax rate for IGST is 5%, and 40% of IGST is recoverable. The freight from Chennai Airport to Bangalore needs to calculate normal IGST with 18% tax rate.

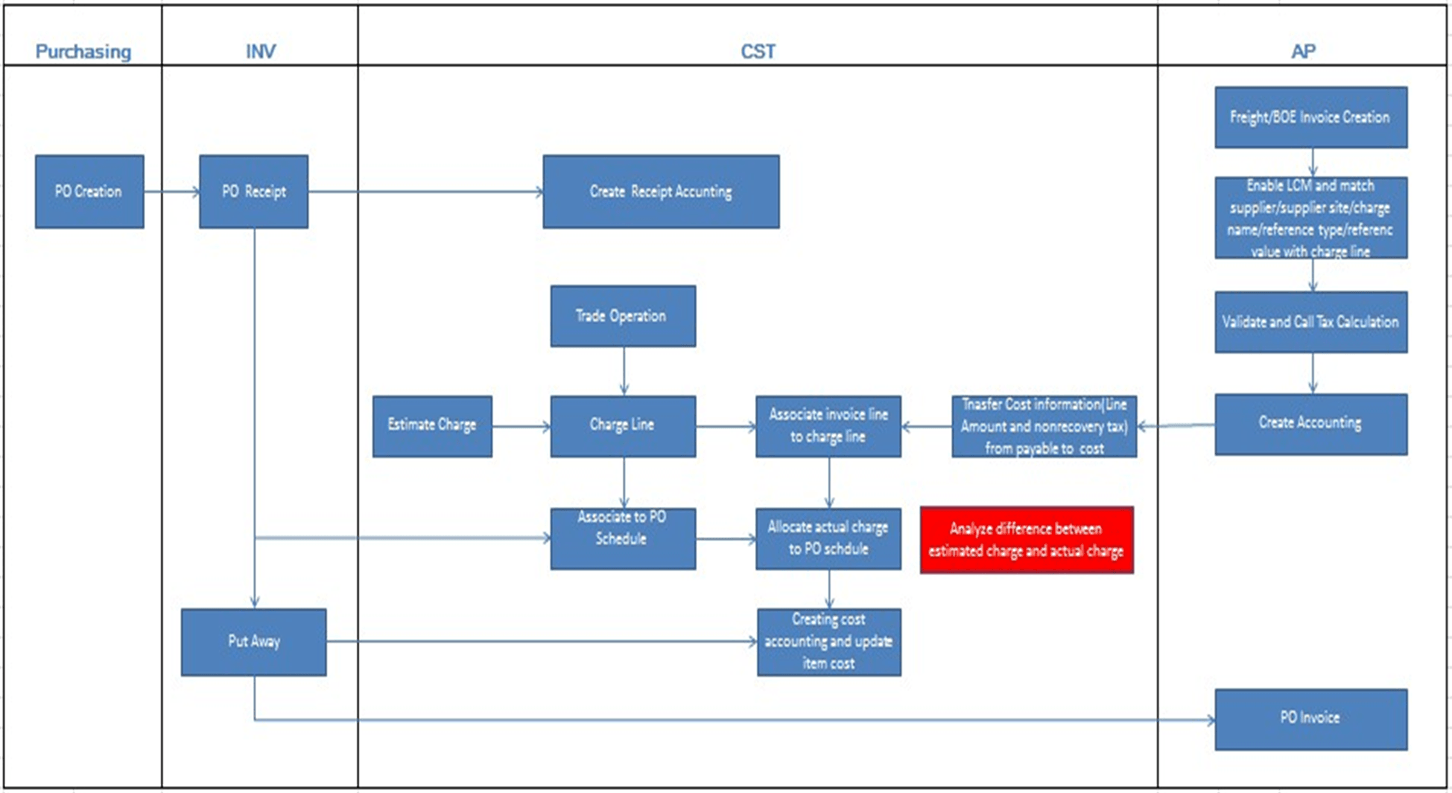

The given case study requirement can be achieved in ERP Cloud using the Landed Cost Management feature.

This image displays the work flow for this case study.

Here are the prerequisite setups:

- Define charge names to capture landed cost:

- Navigate to Manage Charge Name.

- Define charge names for specific procurement sets.

BOE charge and India freight are defined for this case study.

- Define reference type to capture charge-related document details:

- Navigate to Manage Reference Type.

- To match landed cost charge to payables invoice lines, define the reference

type such as PO number, shipment number, ASN, ASBN, and BPA number.

PO number is selected as the reference type for this case study.

- Enable compound tax on the assessable value:

- Navigate to Setup and Maintenance.

- Enable Compound Tax on the Assessable Value under Financials opt-in feature.