- Using Financials for Asia/Pacific

- Define Tax Setups

Define Tax Setups

There are multiple types of customs duties applicable on import of goods to India, such as the basic customs duty, anti-dumping duty (applicable for specified goods), education cess on customs duty, higher education cess on customs duty and IGST. For the given case, you must define these tax setups:

-

Create a tax regime:

- Sign in as a Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Select Transaction Tax.

- Search for the Manage Tax Regimes task.

-

Click Add and create a tax regime with these attributes:

This table displays the attributes required to create a tax regime:

Tax Regime Code

Configuration Owner Tax Regime Name Country Tax Currency SA_IN_GST

Global configuration owner

SA_IN_GST India INR Note: The custom taxes and the normal GST can share the same tax regime.

-

Create taxes:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Manage Taxes task.

-

Click Add and create taxes.

The tax reporting code CUSTOMS will be seeded from 19.07. It isn’t available in 19.04. You must assign the code to the respective custom tax defined in the application from 19.07. The application will identify Payables invoices with the taxes assigned to CUSTOMS tax reporting code as BOE invoice, and run the recovery mechanism process and validation for import of goods.

-

Create three taxes as follows:

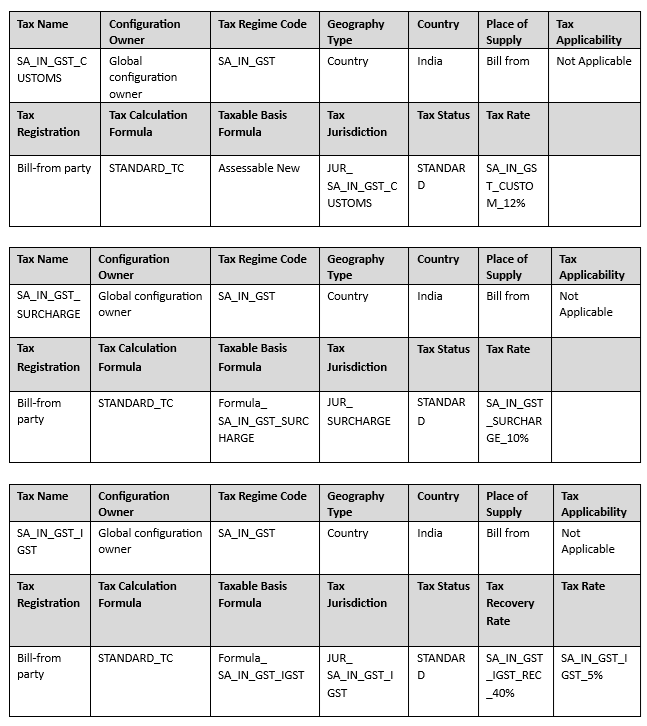

This image shows the taxes to be created and their details:

-

Create tax reporting and collecting authority:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Manage Legal Authorities task.

-

Click Add and create the legal authority. Enter these values:

This table displays the details of the legal authority to be created:

Attributes Values Comments Name Customs Authority- India User discretion Tax Authority Type Collecting and reporting Select from the list of values. Address Applicable address User discretion Purpose Payment You can add multiple purposes as required. Legislative category Transaction Tax You can add multiple legislative categories as required. Note: Search for the legal authority and note the organization number. This number is used to establish a relationship between the tax authority and a new supplier, which is created with the supplier type as a tax authority to pay custom taxes.

-

Assign tax authority to custom taxes under Reporting and Collection:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance and select Financials.

- Search for and select the Manage Taxes task.

- Search the taxes created previously (in step 3) and associate them with tax authority.

-

Enter these values:

This table displays the details of the taxes to be associated with tax authority:

Tax Reporting Tax Authority Collecting Tax Authority SA_IN_GST_CUSTOMS Customs Authority- India Customs Authority- India SA_IN_GST_SURCHARGE Customs Authority- India Customs Authority- India SA_IN_GST_IGST Customs Authority- India Customs Authority- India

-

Create a tax jurisdiction:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Manage Tax Jurisdiction task.

-

Click Add and create tax jurisdictions with these attributes.

This table displays the list of attributes for tax jurisdictions:

Tax Jurisdiction Code Tax Jurisdiction Name Tax Regime Code Tax Geography Type Geography Name Set as default jurisdiction JUR_SA_IN_GST_CUSTOM JUR_SA_IN_GST_CUSTOM SA_IN_GST SA_IN_GST_ CUSTOMS COUNTRY India Yes JUR_ SURCHARGE

JUR_ SURCHARGE

SA_IN_GST SA_IN_GST_ SURCHARGE COUNTRY India Yes JUR_SA_IN_GST_IGST

JUR_ SA_IN_GST_IGST

SA_IN_GST SA_IN_GST_ CUSTOMS COUNTRY India Yes

-

Create a tax status:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Manage Tax Statuses task.

-

Click Add and create a tax status with these attributes.

This table displays the list of attributes for a tax status:

Tax Regime Code Configuration Owner Tax Tax Status Code Tax Status Name Set as default status SA_IN_GST Global configuration owner SA_IN_GST_CUST OMS STANDARD STANDARD Yes SA_IN_GST Global configuration owner SA_IN_GST_SURC HARGE STANDARD STANDARD Yes SA_IN_GST Global configuration owner SA_IN_GST_IGST STANDARD STANDARD Yes

-

Create a tax rate and tax recovery rate:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Manage Tax Rates and Tax Recovery Rates task.

-

Click Add and create tax rates with these attributes.

This table displays the list of attributes for a tax rate:

Tax Regime Code Configuration Owner Tax Tax Status Code Tax Rate Code Tax Rate Type Rate Percentage Set as default rate SA_IN_GST Global configuration owner SA_IN_GST_ CUSTOMS STANDARD SA_IN_GST_CUSTOM_12% Percentage 12 Yes SA_IN_GST Global configuration owner SA_IN_GST_S URCHARGE STANDARD SA_IN_GST_SURCHARGE_10% Percentage 10 Yes SA_IN_GST Global configuration owner SA_IN_GST_I GST STANDARD SA_IN_GST_ IGST_5% Percentage 5 Yes SA_IN_GST Global configuration owner SA_IN_GST_I GST SA_IN_GST_IGST_REC_40% STANDARD Recovery 40 Yes

-

Define the taxable basis formula:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, and select Financials and Transaction Tax.

- Search for and select the Manage Tax Formulas task.

-

Click Add and create Taxable Basis Formulas with these attributes.

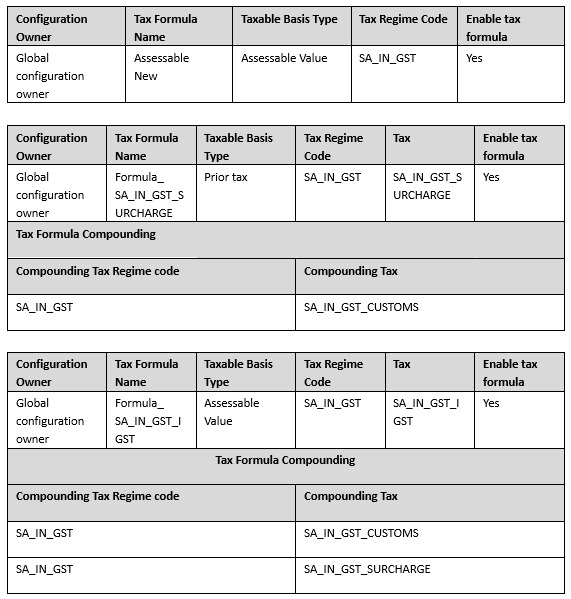

Enter these values to create tax formula:

This image shows the taxes to be created and their details:

-

Define transaction-based fiscal classifications:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, and select Financials and Transaction Tax.

- Search for and select the Manage Transaction-Based and Maintenance task.

- Search for Transaction Business Category Codes PURCHASE_TRANSACTION.

-

Click Create Child Node and create a child

transaction business category with these attributes.

This table displays the list of attributes for a tax rate:

Fiscal Classification Code Path Code Name Country PURCHASE_TRANSACTION IMPORT OF GOODS_ORDERINV IMPORT OF GOODS_ORDERINV India PURCHASE_TRANSACTION IMPORT OF GOODS_BOEPRE IMPORT OF GOODS_BOEPRE India PURCHASE_TRANSACTION IMPORT OF GOODS_BOEINV IMPORT OF GOODS_BOEINV India

-

Create tax determining factor sets:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Tax Determining Factor Sets task.

-

Click Add and create a tax-determining factor set with these

attributes.

This table displays the list of attributes for a tax-determining factor set:

Attributes Values Comments Tax Determining Factor Set Code TDFS for SA_IN_GST User discretion Tax Regime Code SA_IN_GST Tax Determining Factor Class Transaction generic classification Tax Class Qualifier Null Tax Determining Factor Name Transaction business category

-

Create tax condition sets:

- Sign in as Tax Manager.

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Tax Condition Sets task.

-

Click Add and create tax condition sets with these attributes.

This table displays the list of attributes for a tax condition set:

Attributes Values Comments Tax Condition Set Code TCS for SA_IN_GST User discretion Tax Determining Factor Set Code TDFS for SA_IN_GST Enter the tax determining factor set that you created. Operator Equal to Value PURCHASE_TRANSACTION/ IMPORT OF GOODS_BOEINV

-

Create tax rules:

- Navigate to Setup and Maintenance, Financials, and Transaction Tax.

- Search for and select the Tax Rules task.

- Select the rule type as Tax Applicability Rules.

-

Click Add and create tax rules with these attributes.

This table displays the attributes and values for SA_IN_GST_CUSTOMS tax rule:

Attributes Values Comments Tax Applicability Rule Rule Code Tax Rule for SA_IN_GST_CUSTOMS User discretion Tax Determining Factor Set Code TDFS for SA_IN_GST Enter the tax determining factor set that you created. Tax Regime Code SA_IN_GST Tax SA_IN_GST_CUSTOMS Tax Conditions Tax Condition Set Code Result Comments TCS for SA_IN_GST Applicable This table displays the attributes and values for SA_IN_GST_SURCHARGE tax rule:Attributes Values Comments Tax Applicability Rule Tax Determining Factor Set Code TDFS for SA_IN_GST Enter the tax determining factor set that you created. Tax Regime Code SA_IN_GST Tax SA_IN_GST_SURCHARGE Tax Conditions Tax Condition Set Code Result Comments TCS for SA_IN_GST Applicable Enter the tax condition set that you created. This table displays the attributes and values for SA_IN_GST_IGST tax rule:

Attributes Values Comments Tax Applicability Rule Rule Code Tax Rule for SA_IN_GST_IGST User discretion Tax Determining Factor Set

Code

TDFS for SA_IN_GST Enter the tax determining factor set that you created. Tax Regime Code SA_IN_GST Tax SA_IN_GST_IGST Tax Conditions Tax Condition Set Code Result Comments TCS for SA_IN_GST Applicable Enter the tax condition set that you created. This table displays the attributes and values for Normal GST Not Applicable tax rule:

Attributes Values Comments Tax Applicability Rule Rule Code Tax Rule for Normal GST Not Applicable User discretion Tax Regime Code Normal GST Regime Enter tax regime code for normal GST that you created Tax Normal CGST/SGST/UGST/IGST Enter taxes that you created Tax Determining Factor Set Code TDFS for SA_IN_GST Enter the tax determining factor set that you created. Tax Determining Factor Class Transaction generic classification Tax Determining Factor Name Transaction Business Category Tax Conditions Tax Determining Factor Name Operator Value of From Range Result Transaction Business Category Equal to PURCHASE_TRANSACTION/IMPORT OF GOODS_ORDERINV

Not Applicable - Transaction Simulation in P2P

Enter and validate the invoice pertaining to purchase of goods in Payables.

- Payables Transaction Line

Enter and validate the Payables transaction line.

This table displays the list of attributes for a Payables Transaction Line:Line Line Amount Assessable Value Transaction Business Category Total Amount 1 0 101000 IMPORT OF GOODS_BOEINV 19048.6 Total in INR 19048.6 INR - Tax Determination Process

The SA_IN_GST_CUSTOMS is levied at 12% on assessable value (101000*12%=12120 INR) and SA_IN_GST_SURCHARGE is levied at 10% on custom duty (12120*10%=1212 INR). The SA_IN_GST_IGST is levied on the sum of the assessable value, custom duty, and surcharge

[(101000+12120+1212)*5%=5716.6].The tax engine looks for the transaction business category in the transaction line and determines the tax and tax rate. The following tax lines are created upon successful completion of the Tax Determination process.

- Tax Lines

Enter the tax lines.

This table displays the list of attributes for tax lines.Tax Line Rate Name Rate Tax Amount Tax Regime Tax Name Tax Status 1 SA_IN_GST_CUSTOM_12% 12% 12120 SA_IN_GST SA_IN_GST_CUSTOMS STANDARD 2 SA_IN_GST_SURCHARGE_10% 10% 1212 SA_IN_GST SA_IN_GST_SURCHARGE STANDARD 3 SA_IN_GST_IGST_5% 5% 5716.6 SA_IN_GST SA_IN_GST_IGST STANDARD

- Transaction Simulation in P2P