Example of Loading Federal Tax Levy Involuntary Deductions for US Employees

A tax levy order is an administrative action by the Internal Revenue Service (IRS) to seize property to satisfy a tax liability.

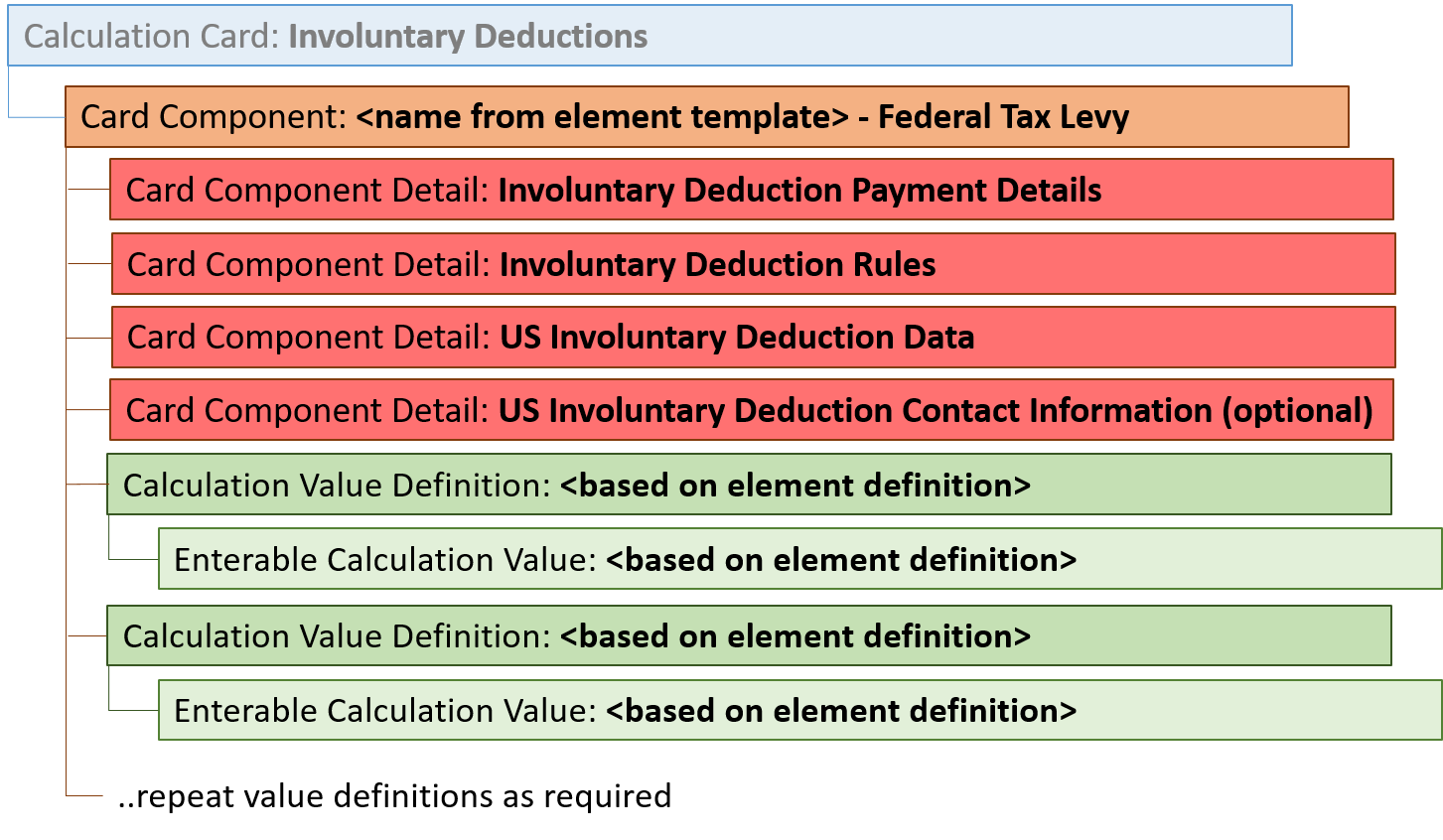

An involuntary deduction element using this secondary classification needs to be configured prior to creating the card component.

The card component name is defined by the element configuration, as are the value definitions which are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Refer to the Loading a Card Component for an Involuntary Deduction for details of each of the record types and attributes you need to supply for an involuntary deduction.

The example file lines in the section below are always supplied together in the same CalculationCard.dat file.

Calculation Card

Always supply the CalculationCard record for the Involuntary Deduction, even if the calculation card already exists for the employee.

Here let's create a new Involuntary Deductions card for Payroll Relationship Number 6485851 starting 03-Jan-2022.

METADATA|CalculationCard|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardDefinitionName|EffectiveStartDate|EffectiveEndDate|CardSequence|PayrollRelationshipNumber

MERGE|CalculationCard|VISION|ID_6485851|USA LDG|Involuntary Deductions|2022/01/03|||6485851

Card Component

Define the type of Involuntary Deduction using the CardComponent record type.

| Attribute Name | Value |

|---|---|

| Context1 | Supply a reference code. This value must be unique by deduction type. |

In this example, let's create a Federal Tax Levy card component from 01-Jan-2018 that has a reference code of IRS-34586

METADATA|CardComponent|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|Context1|Context2|Subpriority

MERGE|CardComponent|VISION|ID_TAX_LEVY_6485851|USA LDG|ID_6485851|2022/01/03||Vision Federal Tax Levy|IRS-34586||

The parent Involuntary Deduction Calculation Card is identified by the DirCardId(SourceSystemId) attribute which has a value that matches the SourceSystemId attribute on the CalculationCard record.

Component Details

Use the ComponentDetail record type to provide flexfield segment values. This example supplies a subset of the flexfield segments available.

METADATA|ComponentDetail|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardCompId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|DirInformationCategory|FLEX:Deduction Developer DF|orderAmtPayee_Display(Deduction Developer DF=INVLN_DEDN_PAYEE_DETAILS)|receivedDate(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|startDate(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|description(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|remittanceIdentifier(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Filing_Status_Display(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_STATEMENT_OF_EXEMPTIONS_REC(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|third2dpartyInvoluntaryDe(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|involDedEarnType(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|documentTrackingNumber(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|contactType(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|firstName(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|middleName(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|lastName(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|addressLine1(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|addressLine2(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|city(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|county(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|postalCode(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|state(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|country(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|workPhone(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA) |mobilePhone(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|otherPhone(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|emailAddress(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)|comments(Deduction Developer DF=HRX_US_INV_DEDN_CONTACT_INFO_DATA)

MERGE|ComponentDetail|VISION|ID_TAX_LEVY_IDPD_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|INVLN_DEDN_PAYEE_DETAILS|INVLN_DEDN_PAYEE_DETAILS|IRS||||||||||||||||||||||||||

MERGE|ComponentDetail|VISION|ID_TAX_LEVY_IDSD_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|INVLN_DEDN_SUPPORT_DATA|INVLN_DEDN_SUPPORT_DATA||2022/01/03||Federal Tax Levy|||||||||||||||||||||||

MERGE|ComponentDetail|VISION|ID_TAX_LEVY_IDD_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|HRX_US_INV_DEDN_DATA|HRX_US_INV_DEDN_DATA|||||8883346|Single|2022/01/03|1||DocID1237|||||||||||||||||

MERGE|ComponentDetail|VISION|ID_TAX_LEVY_IDC_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|HRX_US_INV_DEDN_CONTACT_INFO_DATA|HRX_US_INV_DEDN_CONTACT_INFO_DATA|||||||||||Attorney|John|Anthony|Doe|100 Main Street|Suite 200|Atlanta|Fulton|30202|GA|United States||770-555-1212||john.doe@legal.com|

The parent Card Component is identified on the ComponentDetails records by the DirCardCompId(SourceSystemId) attribute, which has a value that matches the SourceSystemId on the CardComponent record.

Value Definitions

Use the CalculationValueDefinition and EnterableValueDefinition record types to provide override values for the value definitions.

| Value Definition | Value |

|---|---|

| Tax Levy Total Owed Amount | 5566.77 |

| Tax Levy Total Allowances | 2 |

| Tax Levy Deductions At Time of Writ Pretax Amount | 100 |

| Tax Levy Deductions At Time of Writ Deferred Compensation Rate | .05 |

METADATA|CalculationValueDefinition|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|SourceId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|ValueDefinitionName

MERGE|CalculationValueDefinition|VISION|ID_TAX_LEVY_VD1_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|Tax Levy Total Owed Amount

MERGE|CalculationValueDefinition|VISION|ID_TAX_LEVY_VD2_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|Tax Levy Total Allowances

MERGE|CalculationValueDefinition|VISION|ID_TAX_LEVY_VD3_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|Tax Levy Deductions At Time of Writ Pretax Amount

MERGE|CalculationValueDefinition|VISION|ID_TAX_LEVY_VD4_6485851|USA LDG|ID_TAX_LEVY_6485851|2022/01/03||Vision Federal Tax Levy|Tax Levy Deductions At Time of Writ Deferred Compensation Rate

METADATA|EnterableCalculationValue|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|ValueDefnId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|Value1|

MERGE|EnterableCalculationValue|VISION|ID_TAX_LEVY_VD1_ECV_6485851|USA LDG|ID_TAX_LEVY_VD1_6485851|2022/01/03||5566.77

MERGE|EnterableCalculationValue|VISION|ID_TAX_LEVY_VD2_ECV_6485851|USA LDG|ID_TAX_LEVY_VD2_6485851|2022/01/03||2

MERGE|EnterableCalculationValue|VISION|ID_TAX_LEVY_VD3_ECV_6485851|USA LDG|ID_TAX_LEVY_VD2_6485851|2022/01/03||100

MERGE|EnterableCalculationValue|VISION|ID_TAX_LEVY_VD3_ECV_6485851|USA LDG|ID_TAX_LEVY_VD2_6485851|2022/01/03||0.05

The parent Card Component is identified on the CalculationValueDefinitions records by the SourceId(SourceSystemId) attribute which has a value that matches the SourceSystemId on the CardComponent record.

The parent for each Calculation Value Definition is identified on each EnterableCalculationValue record using the ValueDefnId(SourceSystemId) attribute, which has a value that matches the SourceSystemID attribute on the parent CalculationValueDefinition record.