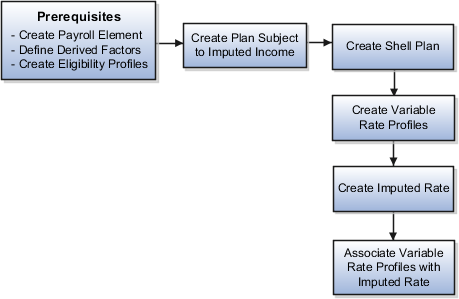

Create Imputed Rates

Imputed income refers to certain forms of indirect compensation that US Internal Revenue Service Section 79 defines as fringe benefits. The IRS taxes the recipient accordingly.

Examples include:

-

Employer payment of group term life insurance premiums over a certain monetary amount

-

Personal use of a company car

-

Other noncash awards

If a plan is subject to imputed income:

-

You must create an imputed rate, in addition to the standard rates for the plan.

-

You must create a shell plan to record the imputed income calculation.

-

Typically, you associate variable rate profiles with the imputed rate, because imputed income taxes vary based on a person's age.

Prerequisites

Perform the following tasks before you create an imputed rate.

-

Use the Manage Elements task in the Setup and Maintenance work area to define the payroll element for the rate.

-

Define derived factors for each age band (or any other factors) where the rate varies, such as ages 20-25, 26-30, and so on. Use the Manage Derived Factors task in the Plan Configuration work area.

-

Define an eligibility profile for each age band and attach the appropriate derived factors. Use the Manage Eligibility Profiles task in the Plan Configuration work area.

-

Define any other objects required by the specific rate, such as formulas. To define formulas, use the Manage Fast Formulas task in the Setup and Maintenance work area.

Creating the Imputed Income Plan

Create the benefit plan that is subject to imputed income using the Manage Benefit Plan Details task in the Plan Configuration work area. Set the Subject To Imputed Income field to the appropriate person type for this rate, such as participant, spouse, or dependent.

Creating the Shell Plan

Create another plan to hold the results of the imputed income calculation with the following settings. Again, use the Manage Benefit Plan Details task in the Plan Configuration work area.

|

Field |

Value |

|---|---|

|

Plan Type |

Imputed Shell |

|

Plan Function |

Imputed Shell |

|

Imputed Income Calculation |

The person type that is subject to the imputed income:

|

The imputed income calculation assumes that the employer pays 100 percent of the benefit, and doesn't subtract employee contributions from the calculation.

Creating the Variable Rate Profiles

Create variable rate profiles for each variable rate with the following settings. Use the Manage Benefit Rates task in the Plan Configuration work area.

-

Set the activity type to Imputed Benefit.

-

Select the appropriate eligibility profile for the age band.

-

Set the calculation method to Flat Amount.

-

Enter the rate amount.

-

Provide additional information as applicable for the rate.

Creating the Imputed Rate

Create the imputed rate with the following settings. Again, use the Manage Benefit Rates task in the Plan Configuration work area

-

On the Standard Rates tab Create menu, select Create Imputed Rate.

-

In the Imputed Shell Plan field, select the shell plan you created earlier.

-

Provide additional rate information as applicable.

Associating the Variable Rate Profiles with the Imputed Rate

Select and add the variable rate profiles to the imputed rate.