Balance Adjustment Examples

Here are some examples to describe the balance adjustments for fiscal year 2021 profit sharing calculation for most common customer scenarios.

One Payroll Relationship (Go-Live Date: Jan 1, 2021)

In this scenario, there is one payroll relationship PSU A, and the employee hire date is before 2018.

The details for the balance adjustment are as follows:

| BALANCE DIMENSION | BALANCE | PERIOD VALUES | ADJUSTMENT DATE |

|---|---|---|---|

|

PSU A Relationship NoCB Year to Date |

Mexico Profit Sharing statutory balance |

Jan 1 – Dec 31, 2018 |

As of Dec 31, 2019 |

|

Jan 1 – Dec 31, 2019 |

As of Dec 31, 2020 |

||

|

Jan 1 – Dec 31, 2020 |

As of Dec 31, 2021 |

One Payroll Relationship (Go-Live Date: Jan 1, 2022)

In this scenario, there is one payroll relationship PSU A, and the employee hire date is before 2018.

The details for the balance adjustment are as follows:

| BALANCE DIMENSION | BALANCE | PERIOD VALUES | ADJUSTMENT DATE |

|---|---|---|---|

|

PSU A Relationship NoCB Year to Date |

Mexico Profit Sharing statutory balance |

Jan 1 – Dec 31, 2018 |

As of Dec 31, 2019 |

|

Jan 1 – Dec 31, 2019 |

As of Dec 31, 2020 |

||

|

Jan 1 – Dec 31, 2020 |

As of Dec 31, 2021 |

||

|

Eligible Compensation for Profit Sharing |

Jan 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

|

Eligible Worked Days for Profit Sharing |

Jan 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

One Payroll Relationship (Mid-Year Go-Live Date)

In this scenario, there is one payroll relationship PSU A, and the employee hire date is before 2018.

The go-live date is March 1, 2022

| BALANCE DIMENSION | BALANCE | PERIOD VALUES | ADJUSTMENT DATE |

|---|---|---|---|

|

PSU A Relationship NoCB Year to Date |

Mexico Profit Sharing statutory balance |

Jan 1 – Dec 31, 2018 |

As of Dec 31, 2019 |

|

Jan 1 – Dec 31, 2019 |

As of Dec 31, 2020 |

||

|

Jan 1 – Dec 31, 2010 |

As of Dec 31, 2021 |

||

|

Eligible Compensation for Profit Sharing |

Jan 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

|

Jan 1 – Feb 28, 2022 |

As of Feb 28, 2022 |

||

|

Eligible Worked Days for Profit Sharing |

Jan 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

|

Jan 1 – Feb 28, 2022 |

As of Feb 28, 2022 |

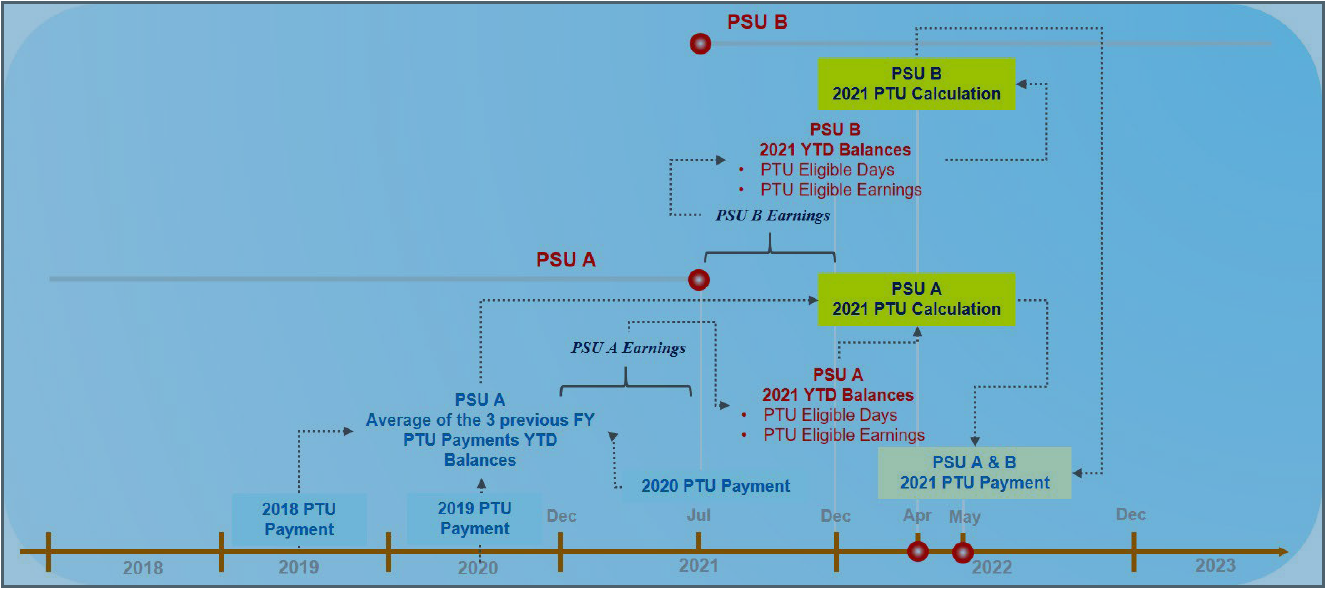

Employee Transfer (Go-Live Date: Jan 1, 2022)

In this scenario, there are 2 payroll relationships PSU A and PSU B.

-

PSU A: Start Date: Before 2018 and End Date: Jun 30, 2021.

-

PSU B: Start Date: July 1, 2021 and End Date: No date (Active)

| BALANCE DIMENSION | BALANCE | PERIOD VALUES | ADJUSTMENT DATE |

|---|---|---|---|

|

PSU A Relationship NoCB Year to Date |

Mexico Profit Sharing statutory balance |

Jan 1 – Dec 31, 2018 |

As of Dec 31, 2019 |

|

Jan 1 – Dec 31, 2019 |

As of Dec 31, 2020 |

||

|

Jan 1 – Dec 31, 2020 |

As of Dec 31, 2021 |

||

|

Eligible Compensation for Profit Sharing |

Jan 1 – Jun 30, 2021 |

As of Jun 30, 2021 |

|

|

Eligible Worked Days for Profit Sharing |

Jan 1 – Jun 30, 2021 |

As of Jun 30, 2021 |

|

|

PSU B Relationship NoCB Year to Date |

Eligible Compensation for Profit Sharing |

Jul 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

Eligible Worked Days for Profit Sharing |

Jul 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

Employee Transfer (Mid-Year Go-Live Date)

In the scenario, there are two payroll relationships PSU A and PSU B.

-

Go-Live Date is March 1, 2022

-

Payroll relationship: PSU A - Start Date: Before 2018 and End Date: Jun 30, 2021

-

Payroll relationship: PSU B - Start Date: July 1, 2021 and End Date: No date (Active).

| BALANCE DIMENSION | BALANCE | PERIOD VALUES | ADJUSTMENT DATE |

|---|---|---|---|

|

PSU A Relationship NoCB Year to Date |

Mexico Profit Sharing statutory balance |

Jan 1 – Dec 31, 2018 |

As of Dec 31, 2019 |

|

Jan 1 – Dec 31, 2019 |

As of Dec 31, 2020 |

||

|

Jan 1 – Dec 31, 2020 |

As of Dec 31, 2021 |

||

|

Eligible Compensation for Profit Sharing |

Jan 1 – Jun 30, 2021 |

As of Jun 30, 2021 |

|

|

Eligible Worked Days for Profit Sharing |

Jan 1 – Jun 30, 2021 |

As of Jun 30, 2021 |

|

|

PSU B Relationship NoCB Year to Date |

Eligible Compensation for Profit Sharing |

Jul 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

Jan 1 – Feb 28, 2022 |

As of Feb 28, 2022 |

||

|

Eligible Worked Days for Profit Sharing |

Jul 1 – Dec 31, 2021 |

As of Dec 31, 2021 |

|

|

Jan 1 – Feb 28, 2022 |

As of Feb 28, 2022 |