Balance Initialization and Adjustments

The various timelines to be considered for profit sharing balance initialization and adjustments are explained.

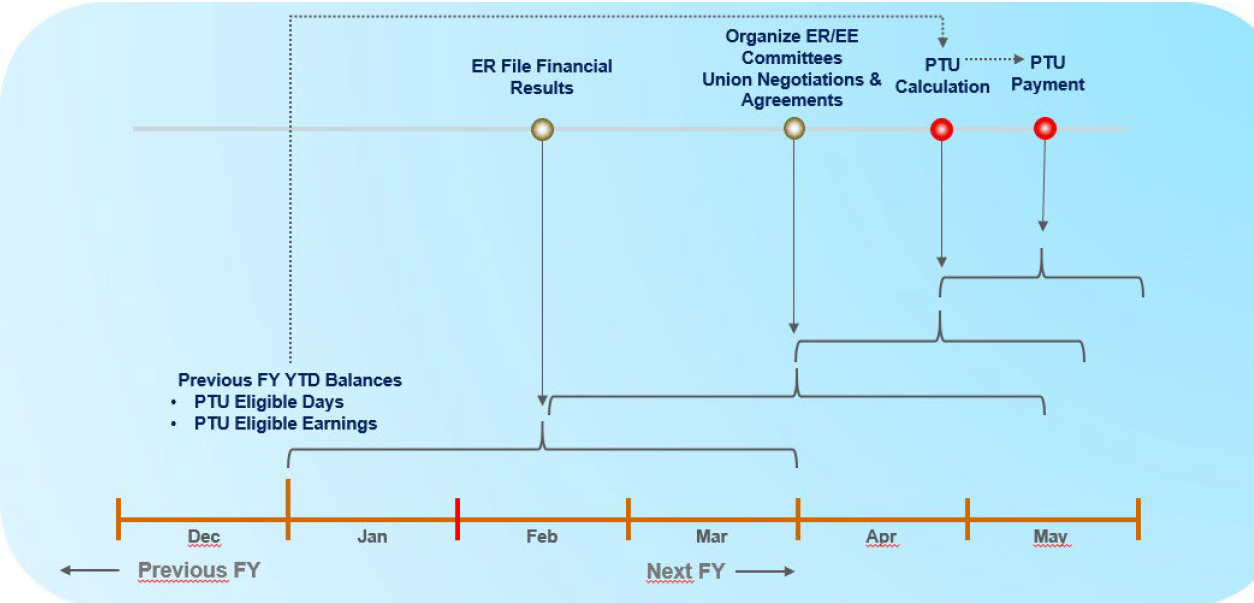

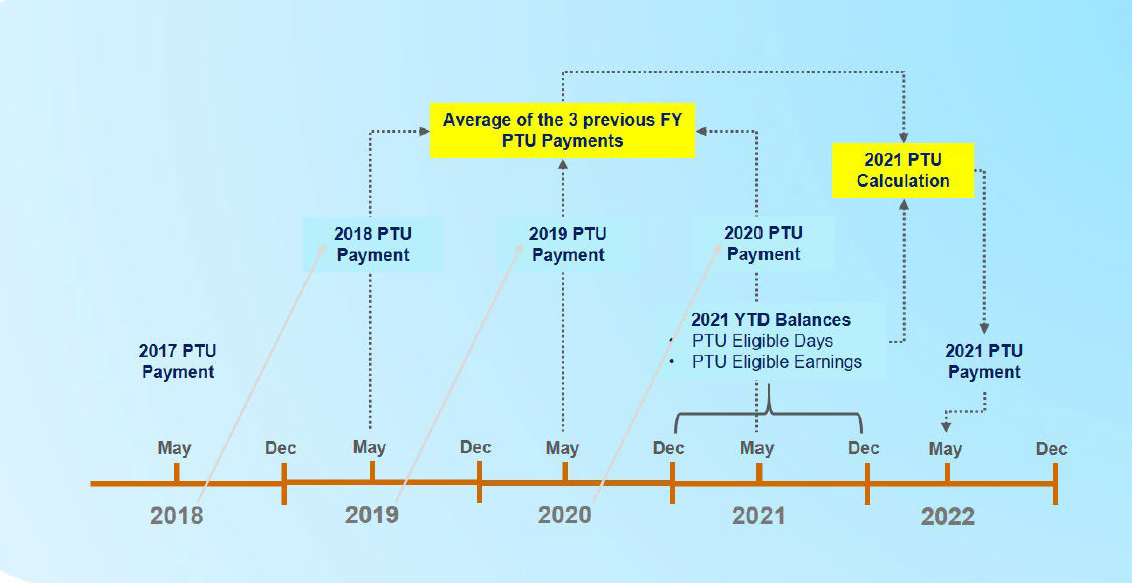

You need to consider these timelines for Profit Sharing processing:

-

The Profit Sharing is paid on May of the next fiscal year to the year that PTU was computed.

For example: 2021 fiscal year, PTU (Profit Sharing payment, known as Participación a los Trabajadores de las Utilidades) will be paid in May 2022.

-

The previous three years PTU payments are used to compute the new cap introduced by the recent Federal Labor Law update. For example, the PTU payments for 2018, 2019 and 2020 are used for the fiscal year 2021 PTU calculation.

Understanding how the balances are managed and what values are stored in the time and payroll relationship balance dimensions is important for the accurate Mexico profit sharing calculation.

To initialize or adjust balances, these conditions need to be met:

-

Payroll definition and payroll pay periods exist at the time the balance dimension is initialized or adjusted.

-

Employee payroll relationship exist at the time the balance dimension is initialized or adjusted.

-

No payroll process is run for the employee payroll relationship (applicable only for balance initialization).

In addition, to determine how the profit sharing balances are initialized or adjusted, analyze these points:

-

PTU payment history availability.

-

Cloud Mexico Payroll go-live date.

For more information about adjusting balances, see the Balance Adjustment topic of the Initializing and Adjusting Balances chapter in the HCM Data Loading Business Objects book available on Oracle Help Center.