Deriving the Pay Reference Period

The pay reference period (PRP) is the period of time over which earnings are assessed for automatic enrolments. The PRP relates to the period for which payments are made (and considered payable), regardless of when they're earned.

If the PRP is aligned with pay periods, it is set to the start and end dates of the payroll period effective on the date paid or regular process date of the payroll.

If the PRP is aligned with tax periods, the PRP is set to the start and end dates of the tax or statutory period effective on the date paid or regular process date of the payroll.

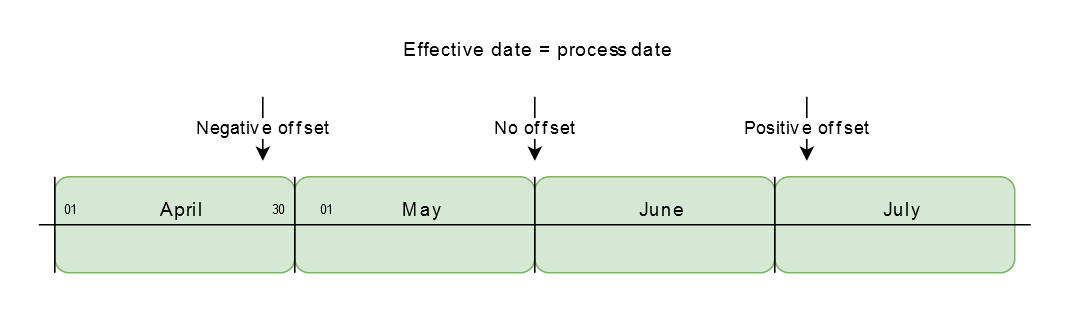

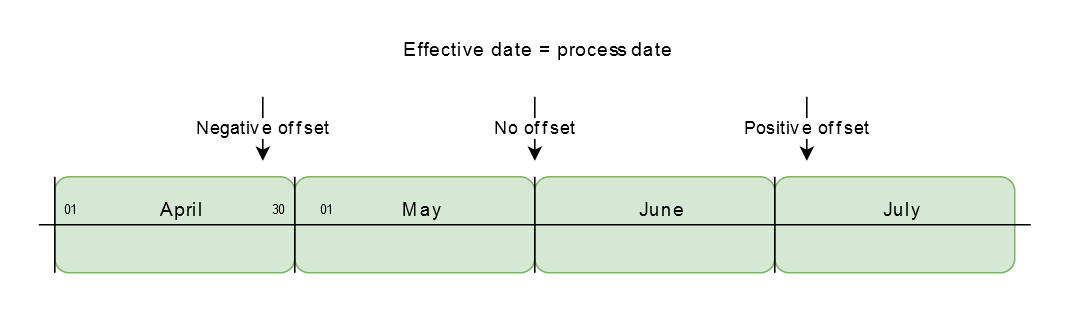

If any payroll offsets have been defined, this will have an impact on how the PRP is

calculated and can be illustrated as below: