Examples of Pay Reference Period for Pensions Automatic Enrolment for the UK

The Payroll Assessment Run task performs a payroll run for the selected payroll and payroll period. This calculates assessable earnings for enrolment and re-enrolment assessment. The first step in assessing an employee is to determine the PRP.

The Worker Postponement Rule and Eligible Jobholder Rule includes these options:

- Next pay reference period start date: The derived postponement period end date would be the current assessment period end date.

- Last pay reference period start date within deferment: The derived postponement period end date would be 1 day before 3 months added to the current assessment period start date, or employee's hire date whichever is smaller.

- None

The process doesn't support any partial pension deductions through pension automatic enrolment. During the assessment run, the pension components are created from deduction period start date when the employee's postponement end date falls before the current assessment period end date. And, the current period's assessment date varies if the payroll has any positive offset defined.

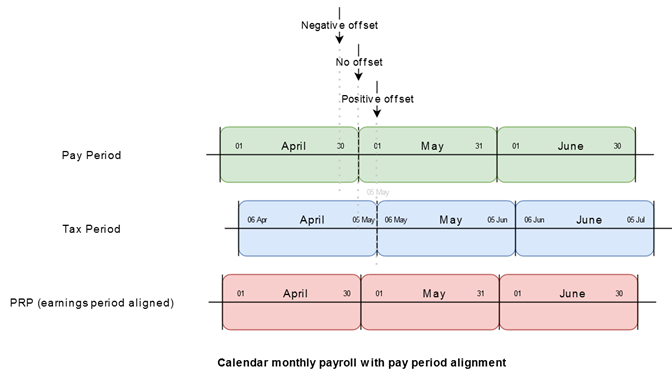

Calendar Monthly Payroll with Pay Period Alignment

If you have chosen to align the PRP with pay periods, then the PRP aligns with the calendar month for a monthly payroll or with the week for a weekly payroll.

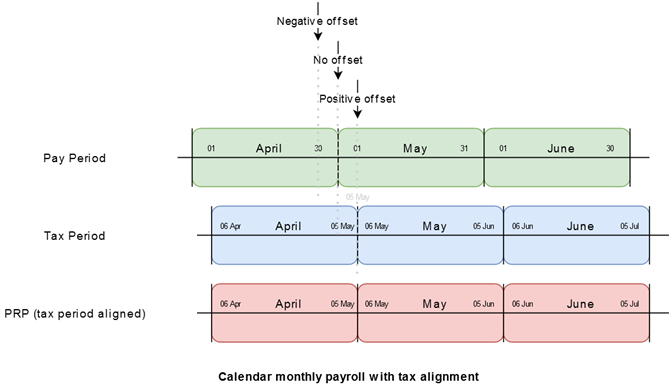

Calendar Monthly Payroll with Tax Period Alignment

If you have chosen to align the PRP with tax periods, the first PRP starts on 06 April, for a calendar monthly payroll. In this example, a positive offset of up to 5 days would still mean that the April tax month is chosen as the PRP.

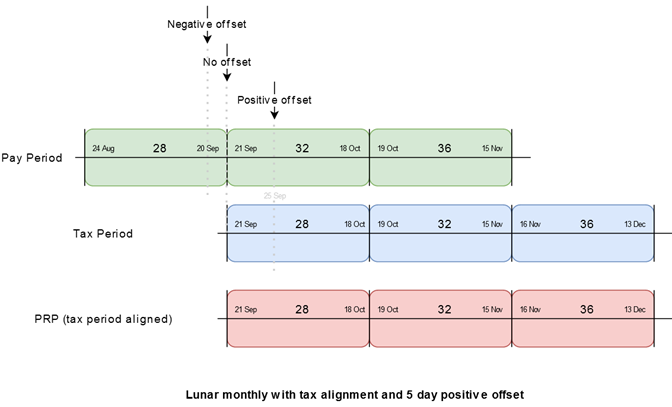

Lunar Monthly Calendar with Tax Alignment

Here's an example of some pay frequencies (such as the lunar monthly) which could have a substantial difference between the pay period and the related tax period.