Earnings Assessment for Pensions Automatic Enrolment for the UK

To determine eligibility for automatic enrolment, the Pensions Automatic Enrolment Assessment process estimates the automatic enrolment pensionable earnings to be paid in the pay reference period (PRP) and compares it to the earnings thresholds defined by HM Revenue and Customs (HMRC).

Assessable Earnings

For each employment being assessed, the process identifies all element entries attached to the assignment (or multiple assignments if earnings are aggregated) for the given PRP that match this criteria:

-

A primary classification of Regular Earnings or Irregular Earnings

-

A subclassification of Pensions Automatic Enrolment Assessable

The process then calculates the net sum of the pay values for each element entry to derive the estimated Automatic Enrolment Pensionable Earnings for the pay reference period.

Classification for Automatic Enrolment

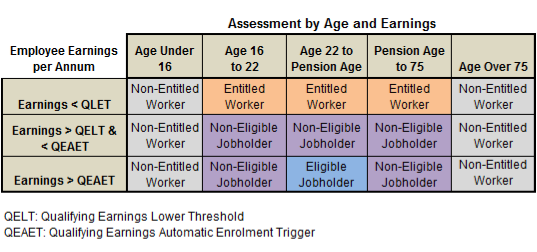

This figure illustrates how earnings are assessed to determine worker classification for automatic enrolment:

The process compares assessable earnings against the Qualifying Earnings Automatic Enrolment Trigger. It classifies employees aged 22 to State Pension Age (SPA) whose earnings exceed the threshold, as eligible jobholders and automatically enrolls them into a qualifying pension scheme.

Qualifying Earnings Thresholds

Threshold values are stored in the calculation value definitions. HMRC periodically updates the thresholds. They may not change every year, and they may change on a date other than 6th April. Oracle provides updated calculation value definitions as the Department of Work and Pensions (DWP) makes the new thresholds available.

After calculating the automatic enrolment assessable earnings, the process derives the qualifying earnings by calculating the portion of the assessable amount that's between the lower and upper thresholds relevant for the pay frequency.