How Payroll Run Results Are Calculated

The calculation of payroll run results begins with identifying the payroll relationships and element entries to process. A series of gross-to-net calculations based on legislative requirements create run results and balances.

You can verify these results by viewing the statement of earnings and payroll reports. If you implement costing, the process also calculates the cost distributions.

Parameters That Affect Processing

This table lists flow submission parameters determine, which determine the records that the Calculate Payroll task processes.

|

Parameters |

Required |

Result |

|---|---|---|

|

Payroll Flow Name, Payroll Name, Payroll Period, Run Type |

Yes |

Determine which payroll relationships and element entries to process, and the time period dates to use for the calculations |

|

Element Group, Payroll Relationship Group |

No |

Restrict the people and elements processed by the flow |

|

Process Configuration Group |

No |

Determine performance parameters, such as logging and chunk size |

How Results Are Calculated

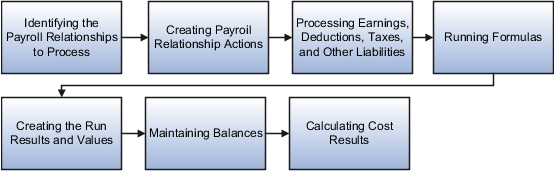

Before submitting the Calculate Payroll flow, you submit the Recalculate Payroll for Retroactive Changes flow to process separately elements enabled for retroactive pay. Payroll calculation and recalculation occur at the payroll relationship level. They involve these actions.

The main steps of the payroll run processing:

-

The calculation process:

-

Identifies the payroll relationships to process

-

Evaluates the assignment status of each identified payroll relationship to determine whether to include the assignment.

-

-

The process creates these actions:

-

Payroll action representing the payroll run

-

Payroll relationship action for each relationship processed, with child actions for each run type used in the run.

-

-

The calculation process loads the element entries for a payroll relationship and uses this information:

-

Processing sequence by determining priority of the element and the subpriority of the element entry, if specified.

-

Processing type and rules.

-

Processing calculations for:

-

Unprocessed nonrecurring entries

-

Recurring entries, in accordance with frequency rules and skip rule formulas associated with the element.

-

-

-

If the element is associated with a calculation component, the process references information held on the calculation card, including:

-

Calculation factors that indicate the correct values

-

Calculation type to use in the calculation based on formula contexts

-

Calculation value definition to use and any overriding values

-

-

The process uses a proration formula to calculate elements enabled for proration if the value of the element entry changed within the payroll period.

-

The process identifies the payroll formula to run and how to handle the results:

-

The status processing rule associated with the element determines which formula the process uses to calculate the element entry, based on the assignment status.

-

Formula result rules determine how to use the results generated by the formula, such as:

-

Message

-

Direct result

Indirect result

Indirect results affect the further processing of the current element or another element, as defined in the formula result rule.

-

The formula for some payroll calculations involves multiple steps, calling other formulas. For example, the iterative formulas for calculating gross-up earnings include multiple steps. The formula for calculating a deduction could have a prerequisite step to calculate the exemption amount.

-

-

The calculation process ends with one run result value for each element entry value. If the element entry involves currency conversion, the payroll calculation uses the current exchange rate and rounds the monetary result based on the formula rules.

-

For each run result, the process determines which balances the result to feed with the run result values. The process then writes and updates the balances to the database.

-

If you implemented costing, the process calculates the cost and offset entries for your run results.

Example

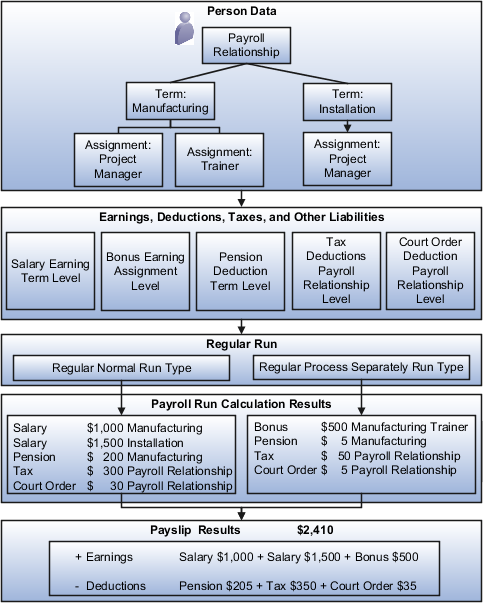

This shows you how the results for a regular run calculate at the payroll relationship level of entries at the assignment, and payroll relationship level, including:

-

Pension, tax, and court order entries processed at the payroll relationship level for the regular run

-

The salary element processed and paid with other earnings

-

The bonus element processed separately, and paid with other earnings