Manage Unavailable or Partially Available Average Weekly Earnings

To ensure that the eligibility and payment of a UK statutory absence is correct, the Average Weekly Earnings (AWE) need to be ascertained for employees.

The Average Weekly Earnings (AWE) is calculated using rules set out by HMRC, and includes a certain period of time called the Relevant Period.

If payroll information is not available for the relevant period, then the AWE calculation might not be performed; or for certain absences can be calculated in an alternative way. If the calculation cannot be performed this could imply that the employee does not have the requisite service and is not be eligible for the absence. To perform the calculation accurately, you must have all the payroll data for the relevant period.

The following UK absences are affected: SSP/SAP/SPP/ShPL/SMP.

Alternative AWE Values

You can store the AWE information in a different application and so require to be able to bring that value into the calculation. You can bring in an AWE value from an outside source by means of a hook, which has been provided. It is up to you what logic is used to calculate the AWE value used by the hook. It should be noted that Oracle Corporation cannot accept any responsibility for the AWE figure generated through the hook mechanism. If the AWE figure is not at par with HMRC rules, then you might be liable to action from HMRC.

To be able to use the hook for absences (except for Shared Parental Leave) you will need to:

OP_AWE_OVERRIDE= <Value>

RETURN OP_AWE_OVERRIDEThe variable <value> can be either coded or reference another source of information, this is up to you.

To be able to use the hook for all Shared Parental Leave absences you will need to:

OP_AWE_OVERRIDE= <Value>

RETURN OP_AWE_OVERRIDEThe variable <value> can be either coded or reference another source of information, this is up to you.

You only need to create the formulas one time.

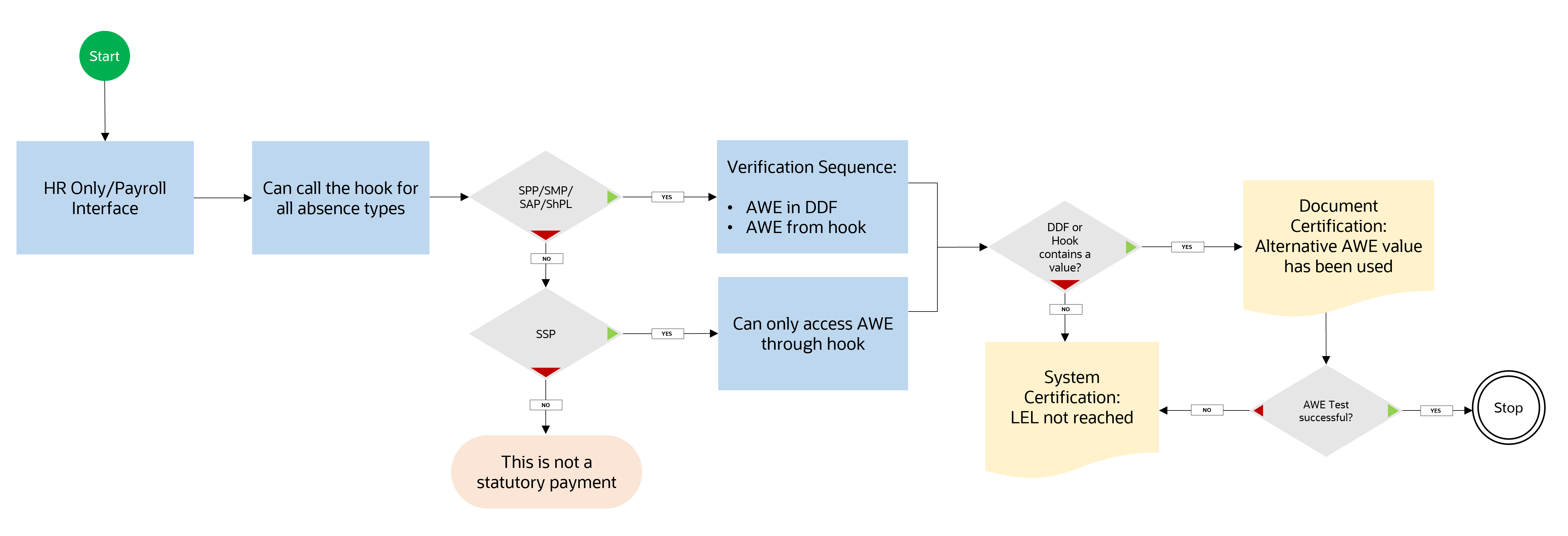

The hook can only be used in certain circumstances and this can be ascertained using the flow diagrams contained in the Appendix (HR only, Payroll Interface, and Payroll).

AWE Recalculation for Pay Rises

- Statutory Paternity Pay – Manually recalculate the

AWE value and enter it in the Override Average Weekly Earnings field on the

case record. You can then re-evaluate the absence manually. Note: If the absence was not payable earlier, but is now payable, it will push new records to payroll that can be processed.

- Shared Parental Leave – You can manually recalculate

the AWE value and enter it in the Agreement Override Average Weekly Earnings

field in the Legislative Information section. You need to select the value

UK Shared Parental Leave from the Context Segment list of values to display

Agreement Override Average Weekly Earnings field. You can then reevaluate

the absence manually. Note: If any agreement associated with the absence has been authorized, it might need to be withdrawn to alter the eligibility.

- SAP - Manually recalculate the AWE value and enter it

in the Override Average Weekly Earnings field on the case record. You can

then re-evaluate the absence manually.

If the absence was not payable earlier, but is now payable, it will push new records to payroll that can be processed.

This statutory absence has an enhanced pay period. The enhanced pay rate is calculated by using the AWE value. If an AWE value is recorded in the AWE Override field, even if the statutory absence has been processed, it causes the enhanced pay to be recalculated using the new AWE Override value.

For the next period, the overridden AWE is used. If a retroactive run is triggered by any event causing the previous payroll period to be recalculated, then the retro run should use the overridden value and re-compute the absence that has already been processed and paid in the previous period.

- SMP – For more information see the Support for Alabaster ruling topic.