Guidelines for Loading Canadian Taxation Card Components

Supply a Canadian Taxation card component and detail values for each tax reporting unit for the employee.

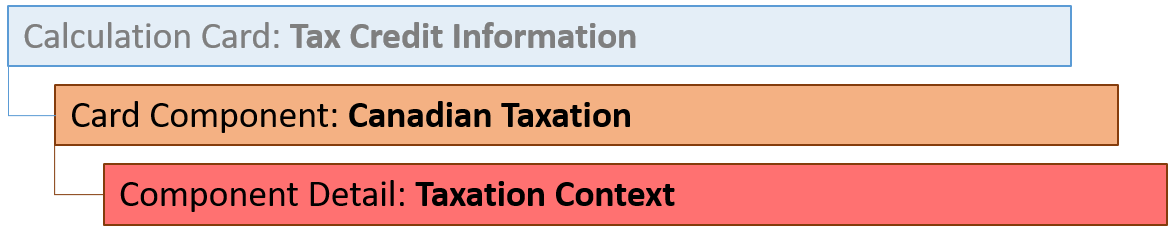

Canadian Taxation Card Component Hierarchy

The Canadian Taxation card component uses the Taxation Context flexfield context and data for this is loaded using the Component Detail record type. The employee’s tax reporting unit is associated with the Canadian Taxation card component. This association is described in the Guidelines for Loading Canadian Taxation Component Associations topic.

Card Component Attributes for Canadian Taxation

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Canadian Taxation card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Tax Credit Information calculation card should be identified by using the same key type used to identify the calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| EffectiveStartDate | N/A | The start date of the Canadian Taxation card component. This must be the same as the EffectiveStartDate on the Tax Credit Information calculation card. If updating an existing Canadian Taxation card component, the effective start date must be original start date of the component. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Canadian Taxation’. |

| ComponentSequence | N/A | The component sequence for the Canadian Taxation card component is the surrogate ID of the employee's tax reporting unit. It is an application-generated value to uniquely identify the tax reporting unit. Refer to Cloud Customer Connect topic Report: Tax Reporting Units for details on how to extract this information. |

| Context1 | N/A | The surrogate ID of the employee’s tax reporting unit. Supply the same value as provided for the ComponentSequence. |

Card Component Detail Attributes for Canadian Taxation

In addition to the attributes defined here, include the necessary flexfield segment attribute values for the flexfield context:

- Taxation Context (HRX_CA_WTH_TAXATION)

Note: You can find the flexfield segment attribute names for this flexfield context

using the View Business Objects task.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, DirInformationCategory, LegislativeDataGroupName, AssignmentNumber, DirCardDefinitionName, DirCardCompDefName | A unique identifier for the component detail. For new component detail records supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardCompId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Canadian Taxation card component should be referenced using the same key type used to identify the parent record. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the component detail, or update to the component detail if you are providing date-effective history. This must be after or equal to the EffectiveStartDate provided for the Canadian Taxation card component. |

| EffectiveEndDate | N/A | The optional end date of the component detail, or if you are providing date-effective history the last day of the date-effective changes. |

| DirCardCompDefName | N/A | The name of the card component this detail is for. This is used to identify the flexfield context and should be supplied even when a source key is used to identify the parent card component. |

| DirInformationCategory | N/A | The code for the flexfield context, such as ‘HRX_CA_WTH_TAXATION’. Flexfield context codes are visible on the Flexfield Attributes tab of the View Business Objects task. |

| FLEX:Deduction DeveloperDF | N/A | Supply the same value as for the DirInformationCategory attribute. |