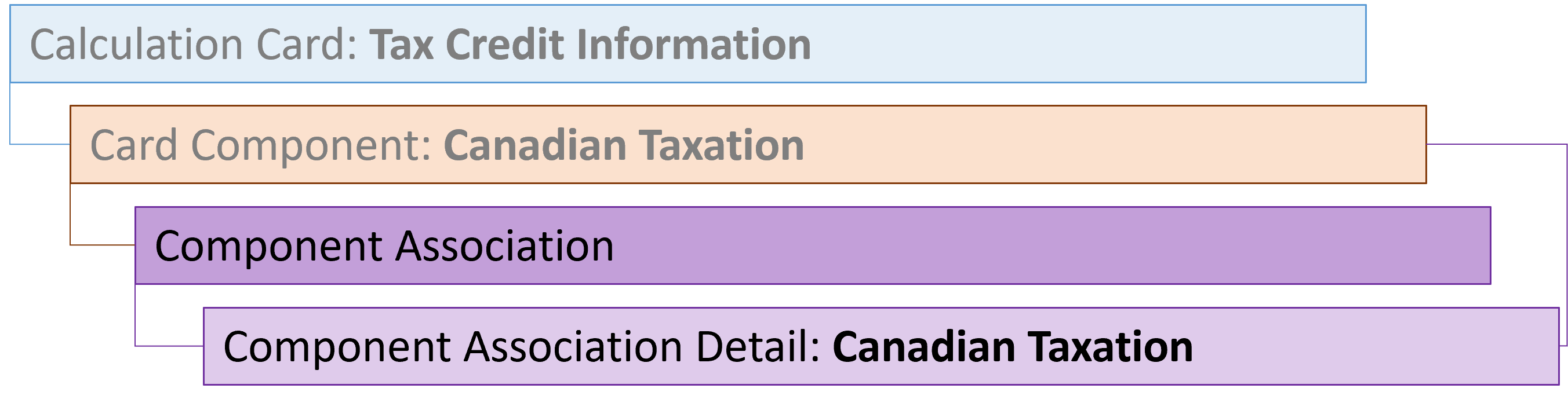

Guidelines for Loading Canadian Taxation Component Associations

The component association record type associates the Tax Credit Information calculation card with a tax reporting unit.

Tax Credit Information Candian Taxes Association

Component Association Attributes for Canadian Taxations

The associated tax reporting unit is defined in the component association.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, TaxReportingUnitName, LegislativeDataGroupName, AssignmentNumber, DirCardDefinitionName, DirCardCompDefName, ComponentSequence | A unique identifier for the Canadian Taxation card component association. For new card component associations supply the source key attributes. You can also identify card components associations with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card definition. |

| DirCardCompId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Canadian Taxationes card component should be identified by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| EffectiveStartDate | N/A | The start date of the card component association or the update to the card association if you are providing date-effective history. This must be after or equal to the EffectiveStartDate provided for the Tax Credit Information calculation card. |

| TaxReportingUnitName | N/A | The name of the tax reporting unit to associate with the Canadian Taxation card component. If source keys are used to identify the card association, you must still specify the LegislativeDataGroupName attribute to identify the tax reporting unit. |

Component Association Detail Attributes for Canadian Taxation

The component association details record associates the Canadian Taxation card component with the payroll assignments for the employee. If the employee has more than one payroll assignment provide a card association detail record for each payroll assignment.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | DirCardDefinitionName, AssignmentNumber, LegislativeDataGroupName, CardSequence, TaxReportingUnitName, DirCardCompDefName, ComponentSequence, AssociationAssignmentNumber | A unique identifier for the component association detail record. For new card associations supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card definition. |

| DirRepCardId(SourceSystemId) | CardSequence, ComponentSequence, TaxReportingUnitName, LegislativeDataGroupName, AssignmentNumber, DirCardDefinitionName, DirCardCompDefName | The parent component association record should be identified by using the same key type supplied to against the card association. When using source keys, supply this attribute with the value supplied for the card’s association SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card association. |

| EffectiveStartDate | N/A | The effective start date of the card association. |

| EffectiveEndDate | N/A | The effective end date of the card association. |

| AssociationAssignmentId(SourceSystemId) | AssociationAssignmentNumber | Identify the employee’s assignment to associate with card component. |