Guidelines for Loading Employee Tax Cards for Mexico

You must have one Calculation Card record for every Mexico employee you are maintaining taxes, social insurance, and loans data for.

Even if you are updating an existing Employee Tax Card and the calculation card itself isn’t being updated, you must still include the calculation card record to group other related data supplied in the file.

Employee Tax Card Calculation Card Attributes

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | A unique identifier for the Employee Tax Card calculation card. For new calculation card supply the source key attributes. You can also identify calculation cards with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the calculation card. |

| DirCardDefinitionName | N/A | The name of the card definition. Specify ‘Employee Tax Card’. |

| AssignmentId(SourceSystemId) | AssignmentNumber | Either supply the source system ID, or assignment number that identifies the employee assignment this calculation card is for. |

| EffectiveStartDate | N/A | The start date of the calculation card, typically the employee’s start date. |

| CardSeqeunce | N/A | A number to uniquely identify this card when multiple calculation cards for the same card definition exist for the employee. Not required when source keys are used. |

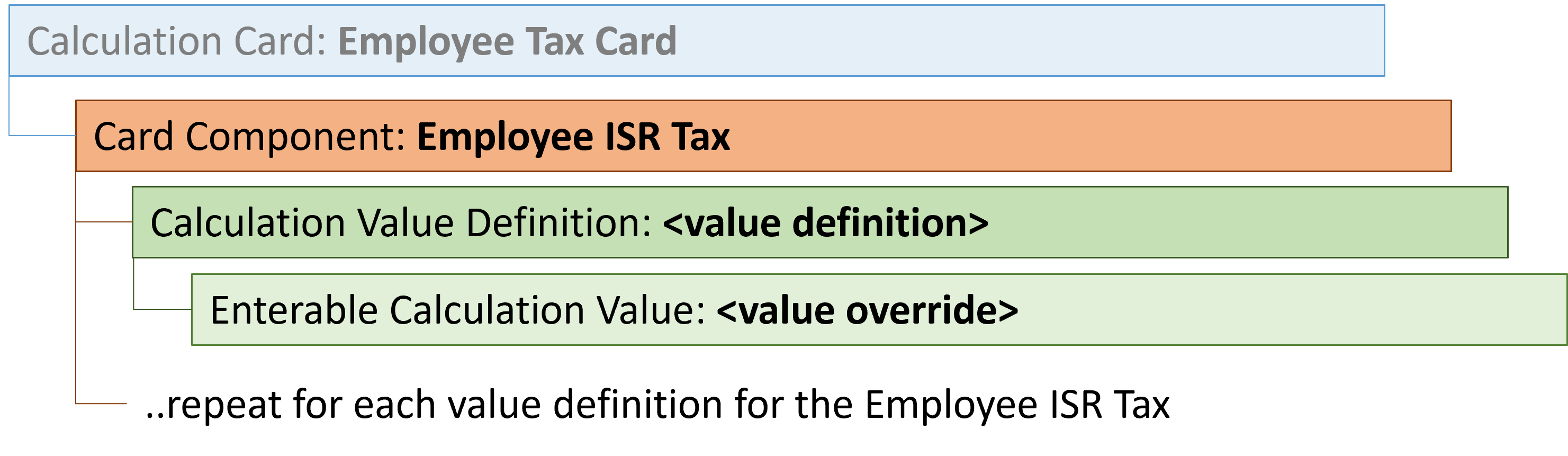

Employee ISR Tax Card Component

The Employee ISR Tax card component captures tax related information which allows overrides for the Employee ISR Tax Information value definition group. This card component is automatically generated for you if the Employee Tax Card is automatically generated.

If you need to update the defaulted tax information, provide an Employee ISR Tax card component and the value definitions and value overrides.

Card Component Attributes for Employee ISR Tax

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Employee ISR Tax card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Employee Tax Card calculation card should be

identified by using the same key type used to identify the

calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| EffectiveStartDate | N/A | The start date of the Employee ISR Tax card component, typically the employee’s start date. This must be on or after the EffectiveStartDate on the Employee Tax Card calculation card. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Employee ISR Tax’. |

| ComponentSequence | N/A | Specify ‘1’. |

Employee ISR Tax Value Definitions

| Value Definition Name | Functional Description |

|---|---|

| Exclude From Annual Adjustments | Employee’s exemption to ISR Annual Adjustments (overrides the

value stored in the Calculation Value Definition). Provides the option to exclude an employee from the annual tax adjustment process. The default value for this field is No. If you want to exclude the employee from the annual tax adjustment, select Yes. |

| ISR Severance Rule | Determines which Severance ISR tax calculation method to

use. The default is Subject Earnings Greater Than or Equal to Monthly Salary. This means that the Severance tax calculation method is used if the Severance ISR Subject portion is greater than or equal to the Monthly Salary. If you select None, the severance ISR calculation method is used with no comparison and regardless of the severance amount. If you choose Total Earnings Greater Than or Equal to Monthly Salary, the severance tax calculation method is used if the total severance payment (subject plus exempt portions) is greater than or equal to the Monthly Salary. |

| ISR Subsidy Adjustment on Regular Run Type | For each payroll run, the standard ISR calculation adjusts the

amount of subsidy for employment to prevent exceeding the monthly

cap. This adjustment compares the month-to-date (MTD) subject

earnings balance with the prorated monthly subsidy for employment

rates. This override determines if the ISR Subsidy for Employment is

adjusted during a Regular payroll run type. Subsidy for employment is calculated (adjusted or not) based on the rates determined by the existing ISR Subsidy Proration on Payroll Run Type override. The default is yes, whereby the Subsidy for employment is adjusted based on the MTD ISR subject earnings balance. If no is selected, the Subsidy for employment is calculated with no adjustment considering the current processing pay period ISR subject earnings (Run balance). |

| ISR Subsidy Proration on Payroll Run Type | This override determines if the ISR Subsidy for Employment is

calculated based on the periods in the month and on the proration of

the monthly Subsidy for Employment rates. The Subsidy for Employment

calculation basis will be the MTD ISR subject earnings balance in

all scenarios except if the ISR Subsidy for employment Adjustment on

Regular payroll run override is set to No. In this case, the basis

will be the Run balance. The payroll run type(s) excluded by this value definition will use a Subsidy for Employment rates factor of one (no proration). This means that the full monthly rates are used to calculate the Subsidy for Employment. The default is Regular and Monthly Tax Adjustment (Default). This means that the Subsidy for Employment Proration is applied to both payroll run types: Monthly Tax Adjustment and Regular. For None, no Subsidy for Employment proration (factor 1) is applied to both payroll run types, Monthly Tax Adjustment and Regular. If you select Regular, proration is applied only to the Regular run type. The Monthly Tax Adjustment run type will use a Subsidy for Employment proration factor of one. If you select the Monthly Tax Adjustment, proration is applied only to the Monthly Tax Adjustment run type. Regular run type will use a Subsidy for Employment proration factor of one. |

| ISR Tax Calculation | This override determines if the ISR tax is calculated. The

default value is 'Yes'. Note: If this override is set to 'No', it

takes precedence over all other Employee ISR Tax component

overrides. |

| ISR Tax Proration on Monthly Tax Adjustment Run Type | The standard Monthly Tax Adjustment ISR tax calculation procedure

calculates the tax rates based on a factor derived from the periods

the employee has worked in the month. This override applies only to the Monthly Tax Adjustment payroll run type and determines to calculate the tax based on the periods in the month. The tax calculation basis will be the month-to-date (MTD) ISR subject earnings balance. The default is yes. This means that the ISR tax calculation determines the tax rates based on a factor derived from the periods the employee has worked in the month. If you select No, the ISR Tax rates are applied with a factor of one (no proration), regardless of the period when the Monthly Tax Adjustment run type is processed nor the employee hire date. |

| Pay Subsidy for Employment on Payroll Run Type | When an employee has two or more employers, they must select

which employer will pay the subsidy for employment in the ISR tax

calculation. The options to determine when the subsidy is calculated include:

The subsidy for employment is calculated only for the monthly tax adjustment run type.

The subsidy for employment is never calculated.

The subsidy for employment is calculated only for the regular run type.

The subsidy for employment is calculated for both regular and monthly tax adjustment run types. |

| State Tax Exempt | Employee’s exemption to State Tax (overrides the value stored in

the Calculation Value Definition). Some companies or government agencies aren't required to pay the employer state tax. Select 'Yes', to exclude this employee from the state tax calculation. The default value for this field is 'No'. |

Calculation Value Definition Attributes for Employee ISR Tax

The Calculation Value Definition record type specifies the name of the value definition you are supplying an override value for.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the calculation value definition record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| SourceId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Employee ISR Tax card component should be referenced by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the parent Employee ISR Tax card component or the date the calculation value definition starts, if later. |

| DirCardCompDefName | N/A | The definition name of the parent Employee ISR Tax card component. Specify the same value as provided on the parent card component record. |

| ValueDefinitionName | N/A | The name of the value being overridden. The list of value definitions applicable to this card component are listed above. |

These attributes are supplied against the CalculationValueDefinition file discriminator and must be supplied along with a CardComponent record for the parent Employee ISR Tax card component and a CalculationCard record for the owning Employee Tax Card.

Enterable Calculation Value Attributes for Employee ISR Tax

The Enterable Calculation Value provides the override value for the value definition. It references the Calculation Value Definition record which defines the Value Definition being overridden.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the enterable calculation value record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the override value. |

| ValueDefnId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName, ValueDefinitionName | Identify the parent Calculation Value Definition record using the

same key type used to identify the calculation value definition.

When using source keys, supply this attribute with the value supplied for the calculation value definition’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent record. |

| EffectiveStartDate | N/A | The effective start date of the parent calculation value definition record, or the update to the override value if supplying date-effective history. |

| EffectiveEndDate | N/A | The optional end date of the override value, or if you are providing date-effective history, the last day of the date-effective changes |

| Value1 | N/A | The value for the value definition identified by the parent

calculation value definition record. Unlike other calculation cards, if you supply a value definition but have no value for it supply ‘-999999999’ to indicate a null value. |

These attributes are supplied against the EnterableValueDefinition file discriminator. You must supply an EnterableValueDefinition record for each CalculationValueDefinition record supplied.

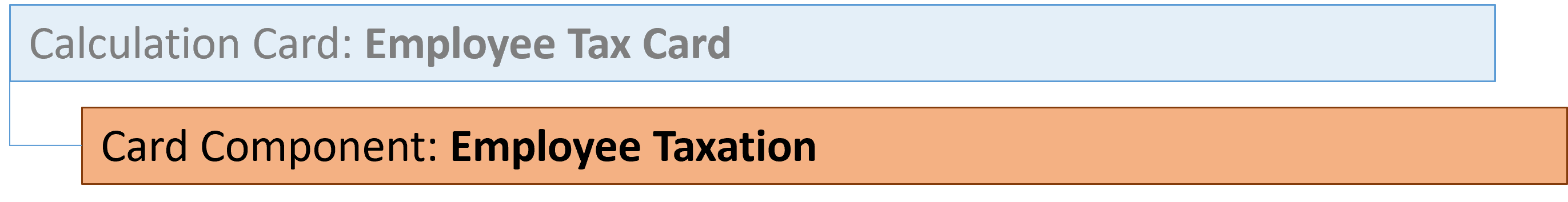

Employee Taxation Card Component

The Employee Taxation card component captures tax information, which is needed to compute Mexico taxes. This card component is automatically generated for you if the Employee Tax Card is automatically generated. If you need to update the defaulted tax information, provide an Employee Taxation card component and the value definitions and value overrides.

Card Component Attributes for Employee Taxation

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Employee Taxation card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Employee Tax Card calculation card should be

identified by using the same key type used to identify the

calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| EffectiveStartDate | N/A | The start date of the Employee Taxation card component, typically the employee’s start date. This must be on or after the EffectiveStartDate on the Employee Tax Card calculation card. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Employee Taxation’. |

| ComponentSequence | N/A | Specify ‘1’. |

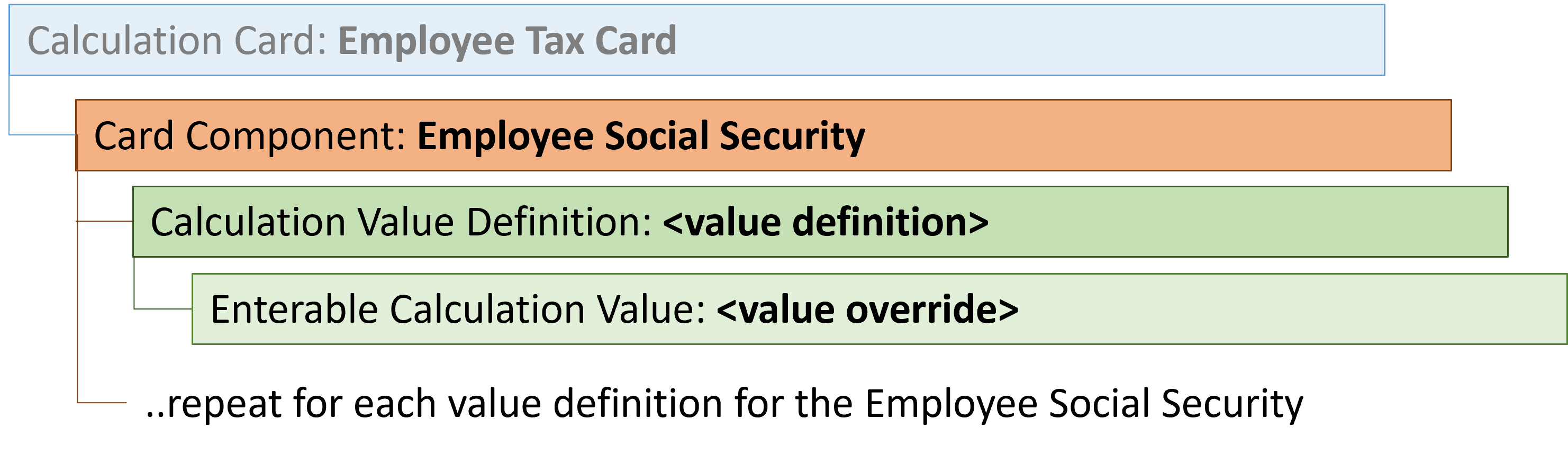

Employee Social Security Card Component

The Employee Social Security card component captures social insurance related information which is needed to calculate the employee social security and retirement contributions. This card component is automatically generated for you if the Employee Tax Card is automatically generated.

If you need to update the defaulted social insurance information, provide an Employee Social Security card component and the applicable value definitions and value overrides.

Card Component Attributes for Employee Social Security

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Employee Social Security card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Employee Tax Card calculation card should be

identified by using the same key type used to identify the

calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| EffectiveStartDate | N/A | The start date of the Employee Social Security card component, typically the employee’s start date. This must be on or after the EffectiveStartDate on the Employee Tax Card calculation card. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Employee Social Security’. |

| ComponentSequence | N/A | Specify ‘1’. |

Employee Social Security Value Definitions

The Employee Social Security card component uses value definitions to supply override values.

| Value Definition Name | Functional Description |

|---|---|

| Economic Zone | To override the Minimum Wage Economic Zone of the TRU the employee is associated with, select either Zone A or Zone B. |

| Additional Quota Exempt | Determines if the employee is exempt from having the Additional

Quota calculated. The default value for this field is No. If you want to exclude the employee from Additional Quota calculation, select 'Yes'. |

| Additional Quota Percentage | Enter the percentage of additional quota for this employee if it’s required to be different to the default. |

| Benefits in Cash Exempt | Determines if the employee is exempt from having Benefits in Cash

calculated. The default value for this field is 'No'. If you want to exclude the employee from Benefits in Cash, select 'Yes'. |

| Benefits in Cash Percentage | Enter the percentage of benefits in cash for this employee if it’s required to be different to the default. |

| Day Care Centers Exempt | Determines if the employee is exempt from having Day Care Centers

calculated. The default value for this field is No. If you want to exclude the employee from Day Care Centers, select 'Yes'. |

| Day Care Centers Percentage | Enter the percentage of day care centers for this employee if it’s required to be different to the default. |

| Disability and Death Exempt | Determines if the employee is exempt from having Disability and

Death calculated. The default value for this field is 'No'. If you want to exclude the employee from Disability and Death, select 'Yes'. |

| Disability and Death Percentage | Enter the percentage of disability and death for this employee if it’s required to be different to the default. |

| Fixed Quota Exempt | Determines if the employee is exempt from having Fixed Quota

calculated. The default value for this field is No. If you want to exclude the employee from Fixed Quota, select 'Yes'. |

| Fixed Quota Percentage | Enter the percentage of fixed quota for this employee if it’s required to be different to the default. |

| Mexico TRU Transfer Leaving Reason | Records the social security leaving reason when an employee

transfers from one tax reporting unit to another. Validated by lookup type ORA_HRX_MX_SS_LEAVE_REASON. |

| Pensions and Beneficiaries Exempt | Determines if the employee is exempt from having Pensions and

Beneficiaries calculated. The default value for this field is No. If you want to exclude the employee from Pensions and Beneficiaries, select Yes. |

| Pensions and Beneficiaries Percentage | Enter the percentage of pensions and beneficiaries for this employee if it’s required to be different to the default. |

| Retirement Exempt | Determines if the employee is exempt from having Retirement

calculated. The default value for this field is No. If you want to exclude the employee from Retirement, select 'Yes'. |

| Retirement Percentage | Enter the percentage of retirement for this employee if it’s required to be different to the default. |

| Social Security Exemption | Determines if the employee is exempt from having social security

quota liabilities calculated. The default value for this field is No. If you want to exclude the employee from having social security quota liabilities calculated, select 'Yes'. |

| Suspension in Age Outpost and Oldness Exempt | Determines if the employee is exempt from having Suspension in

Age of Outpost and Oldness calculated. The default value for this field is No. If you want to exclude the employee from Suspension in Age Outpost and Oldness, select 'Yes'. |

| Suspension in Age Outpost and Oldness Percentage | Enter the percentage of Suspension in Age of Outpost and Oldness for this employee if it’s required to be different to the default. |

| Tax Reporting Unit for Social Security | Select the tax reporting unit to be used for reporting this employee's social security quotas if it's different to the calculation card Association's tax reporting unit. |

Calculation Value Definition Attributes for Employee Social Security

The Calculation Value Definition record type specifies the name of the value definition you are supplying an override value for.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the calculation value definition record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| SourceId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Employee Social Security card component should be referenced by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the parent Employee Social Security card component or the date the calculation value definition starts, if later. |

| DirCardCompDefName | N/A | The definition name of the parent Employee Social Security card component. Specify the same value as provided on the parent card component record. |

| ValueDefinitionName | N/A | The name of the value being overridden. The list of value definitions applicable to this card component are listed above. |

These attributes are supplied against the CalculationValueDefinition file discriminator and must be supplied along with a CardComponent record for the parent Employee Social Security card component and a CalculationCard record for the owning Employee Tax Card.

Enterable Calculation Value Attributes for Employee Social Security

The Enterable Calculation Value provides the override value for the value definition. It references the Calculation Value Definition record which defines the Value Definition being overridden.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the enterable calculation value record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the override value. |

| ValueDefnId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName, ValueDefinitionName | Identify the parent Calculation Value Definition record using the

same key type used to identify the calculation value definition.

When using source keys, supply this attribute with the value supplied for the calculation value definition’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent record. |

| EffectiveStartDate | N/A | The effective start date of the parent calculation value definition record, or the update to the override value if supplying date-effective history. |

| EffectiveEndDate | N/A | The optional end date of the override value, or if you are providing date-effective history, the last day of the date-effective changes |

| Value1 | N/A | The value for the value definition identified by the parent

calculation value definition record. Unlike other calculation cards, if you supply a value definition but have no value for it supply ‘-999999999’ to indicate a null value. |

These attributes are supplied against the EnterableValueDefinition file discriminator. You must supply an EnterableValueDefinition record for each CalculationValueDefinition record supplied.