Overview of Employee Tax Card for Mexico

The Employee Tax Card calculation card stores all information required to accurately compute employee state tax, employee ISR tax, contributions for social insurance and loans (Employee INFONAVIT).

Considerations and Prerequisites

If the product license is set to Payroll or Payroll Interface, Employee Tax Card calculation cards are automatically created when a new employee is entered using the New Hire task with a set of default values specified at the Payroll Statutory Unit (PSU) or Tax Reporting Unit (TRU) level.

TRU association and association details for the employee are created automatically when the TRU is selected during the hire process. There may be cases where this information needs to be loaded in bulk:

During Data Migration:

Employee Tax Card information must be uploaded into Oracle Fusion Payroll, to ensure that contributions and taxes are calculated correctly.

If HCM Data Loader is used to migrate employee records, a default Employee Tax Card is automatically created. In some cases, the default won’t reflect the employee’s actual calculation information, and therefore the card must be updated.

Ongoing Bulk Updates:

- When you bulk load New Hire information, a default Employee Tax Card may be automatically generated (if the new hire records are created through HCM Data Loader or the interface with Taleo). In this case, you need to update the default card with the correct information and create the association for the TRU.

It is recommended to have a good understanding of the Employee Tax Card calculationcard and the information it contains prior to attempting mass upload as it has a direct impact on statutory deductions and reporting. For further information, see Oracle Fusion HRMS (Mexico): HR Implementation and Use (Doc ID 2175160.1) and Oracle Fusion Capital Management for Mexico: Federal Income Tax (ISR) (Doc ID 2541656.1).

Employee Tax Card Record Types

The Employee Tax Card is uploaded with HCM Data Loader using the Global Payroll Calculation Card business object. This generic object hierarchy provides record types to support the various country-specific requirements.

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee assignment that it captures information for. | CalculationCard |

| Card Component | Used to group and segregate data required by the calculation card. The following sections describe the card components applicable to this calculation card and the child records that are required for each card component. | CardComponent |

| Calculation Value Definition | Allows the creation of value definitions so that overriding values can be specified on the card component. Details of the specific value definitions are provided in the following sections. | CalculationValueDefinition |

| Enterable Calculation Value | Used to specify an overriding value for each calculation value definition. | EnterableCalculationValue |

| Card Association | Associates the calculation card with the Tax Reporting Unit the employee reports to. | CardAssociation |

| Card Association Detail | Associates card components with the employee’s assignments. | CardAssociationDetails |

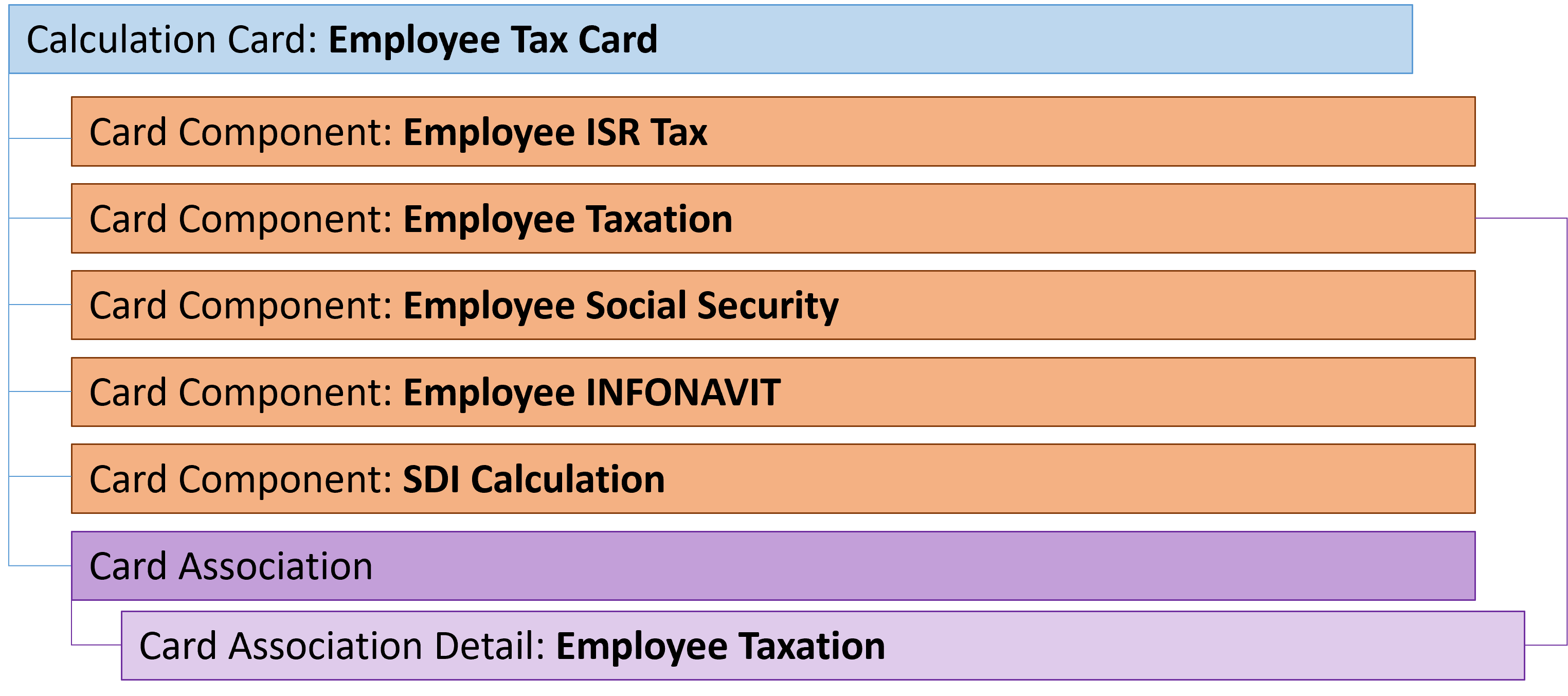

Employee Tax Card Calculation Card Hierarchy

The hierarchy of calculation card components applicable to Employee Tax Card are described in this diagram: