Examples of HCM Organization Models for China

Let's look at examples of different models for Chinese organizations in Human Capital Management (HCM). Each example includes a legislative data group (LDG). LDGs aren't an organization classification, but they're included in the example to show how you associate them with a payroll statutory

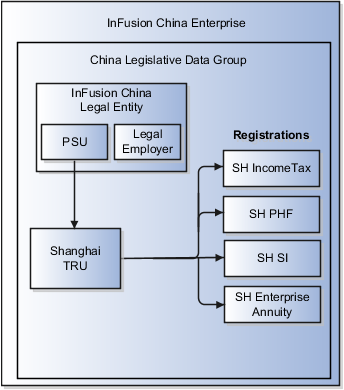

Single Company with Single Payroll Statutory Unit and Single Tax Reporting Unit

Let's look at an example of a single company with individual income tax (IIT), public housing fund (PHF), and social insurance (SI) registrations in a single location. InFusion China is a legal entity registered in Shanghai. Tax calculation, Public Housing Fund (PHF) management, and social insurance management all follow Shanghai (SH) rules and report to the Shanghai local government authorities through the Shanghai tax reporting unit (TRU).

Setup for this model involves these steps:

-

Define an InFusion China enterprise using the Manage Enterprise HCM Information task.

-

(Optional) Create a Chinese LDG. For China, the application automatically creates an LDG when you create a legal entity for the first time.

-

Define legal jurisdictions for IIT, PHF, social insurance, and enterprise annuity. These are required when you define registration information.

-

Create a legal entity for InFusion China. Designate it as both a legal employer and a PSU.

Note: The application automatically creates the main legal reporting unit when you create a legal entity. The main legal reporting unit carries the registration information of the predefined identifying jurisdiction, China Income Tax. -

Set the Legal Reporting Unit Classification to Tax Reporting Unit on the Manage Legal Reporting Unit HCM Information page.

-

Define registration information needed to calculate payroll deductions, such as:

-

SH Income Tax. Required for calculating and reporting individual income tax.

-

SH Public Housing Fund. Required for calculating and reporting public housing fund contributions.

-

SH Social Insurance. Required for calculating and reporting social insurance contributions. A single social insurance registration is sufficient for all types of social insurances, including basic pension, basic medical, supplementary medical, unemployment, maternity and work-related injury.

-

SH Enterprise Annuity. Required for calculating and reporting enterprise annuity contributions.

-

SH Company Law. Optional; captures business license registration numbers of the TRU and legal employer.

-

Single Company with Single Payroll Statutory Unit and Multiple Tax Reporting Units

Let's look at an example of a single company under a single PSU with IIT, PHF, and SI registration in multiple locations. InFusion China is a registered legal entity in Shanghai. It has its head office in Shanghai and branch offices in Beijing and Guangzhou. The head office and each branch office share one payroll. It's possible for each to set up its own designated payrolls. The head office and each branch office are registered with the tax authority in their local area and submit IIT statutory reports to the local tax office on a monthly basis. Likewise, the head office and each branch office are registered with the PHF and SI management centers in their local area and submit statutory reports to the local authority. In this example, the employees' SI area and PHF contribution areas are the same as their tax area.

Setup for this model involves the same steps as in the previous example. In addition, you must create TRUs for the Beijing and Guangzhou branches and set up registration information. Each TRU should have a set of registrations for each type of deduction that reports to a different authority. For example, the Shanghai, Guangzhou, and Beijing TRUs would each have separate registrations for income tax, PHF, social insurance, and so on. A TRU can't have multiple registrations of same legislative category. For example, a single TRU can't have registrations for Beijing income tax reporting and Shanghai income tax reporting.

In this model, when an employee transfers from one TRU to another, the payroll run calculates the employee's PHF and SI contribution amounts according to the transfer-in TRU's policy.

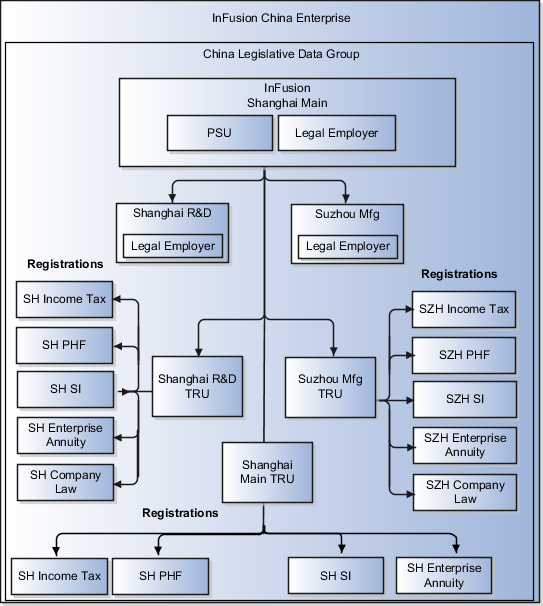

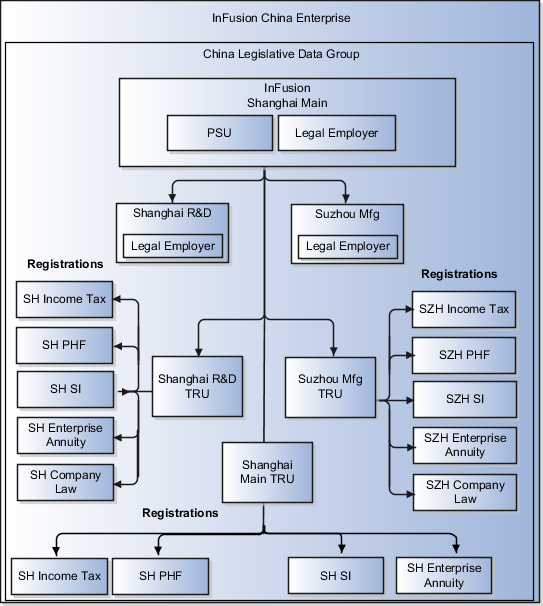

Group Company with Single PSU and Multiple TRUs

Let's look at an example of an enterprise with multiple legal employers under a single PSU. The payroll data is under one PSU, but tax, PHF, and social insurance registrations are at multiple locations. InFusion China Enterprise comprises three legal entities: the main company in Shanghai, a Research and Development company in Shanghai, and a manufacturing company in Suzhou. The main Shanghai office is also a PSU. The Shanghai and Suzhou companies handle tax, PHF, and social insurance independently, and each reports to its local tax office, PHF authority, and SI authority separately. The employees' SI and PHF areas are the same as their tax area.

To set up this type of model, you must define three separate legal entities. The main Shanghai office is a payroll statutory unit (PSU) and a legal employer, and the other legal entities are legal employers associated with the main Shanghai office PSU. The application automatically creates three main legal reporting units, one for each legal entity. For each legal reporting unit, set the Legal Reporting Unit Classification to Tax Reporting Unit on the Manage Legal Reporting Unit HCM Information page. The three tax reporting units all report to the main Shanghai office PSU. However, you can't convert an LRU into a TRU if the LRU is under a legal entity that's not a PSU.