How Payroll Statutory Units, Legal Employers, and Tax Reporting Units Work Together for China

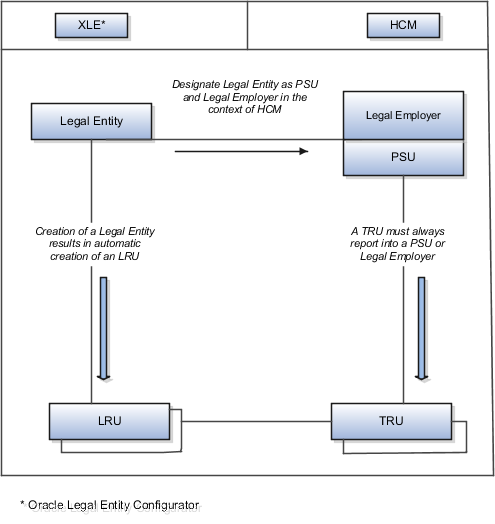

When you set up legal entities, you can identify them as legal employers and payroll statutory units (PSUs), which makes them available for use in Oracle Fusion Human Capital Management (HCM).

When implementing Global Payroll for China, it's recommended that you create only one payroll statutory unit.

Legal Employers and Payroll Statutory Units

Payroll statutory units enable you to group legal employers so that you can perform statutory reporting at a higher level, such as China individual income tax calculation. In some cases, a legal employer is also a payroll statutory unit. However, your organization may have several legal employers in one payroll statutory unit. A legal employer can belong to only one payroll statutory unit.

Payroll Statutory Units and Legal Reporting Units

PSUs and legal reporting units (LRU) have a parent-child relationship, with the PSU being the parent. An LRU is the lowest level component of a legal structure that requires registrations.

Tax Reporting Units and Legal Employers

TRUs are indirectly associated with a legal employer through the PSU. One or more TRUs can be used by a single legal employer, and a TRU can be used by one or more legal employers. For example, assume that a single TRU is linked to a PSU. Assume also that two legal employers are associated with this PSU. In this example, both legal employers are associated with the single TRU.

Use the Manage Legal Reporting Unit HCM Information task to designate an existing legal reporting unit (LRU) as a TRU. If you create a new LRU that belongs to a legal employer (that's not also a PSU), you select a PSU and then, when you run the Manage Legal Reporting Unit HCM Information task, you designate it as a TRU and select the legal employer.