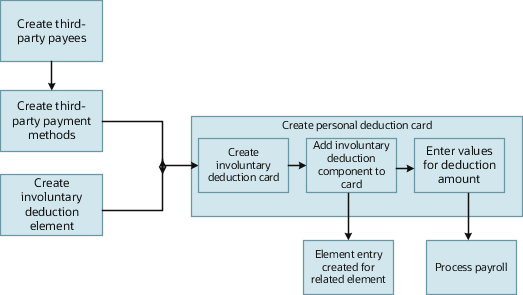

Add Involuntary Deductions to a Calculation Card for Mexico

Use the Elements task to create involuntary deduction elements such as child support. When you create the element, the calculation component is created which you add to a person's Involuntary Deductions calculation card, so the deductions are processed during a payroll run.

Before you Begin

Before you can add an involuntary deduction to a personal calculation card, you must first:

-

Create an organization payment method that's unique for the involuntary deductions. Associate this payment method to the payroll.

-

Create a third party (organization or person) to receive the payment and associate the organization payment method.

-

Create an involuntary deduction element and the element eligibility.

You can create multiple elements for the same involuntary deduction type if processing information or other details vary. For example, each jurisdiction you deal with may have different processing rules for court orders.

How to Create an Involuntary Deduction Calculation Card

Here are the steps for creating an Involuntary Deduction calculation card:

-

In the Payroll area under My Client Groups, search and select the Calculation Cards task.

-

Search for and select the payroll relationship.

-

If the person doesn't already have an involuntary deduction calculation card, click Create.

-

Enter a start date for the card and select the involuntary deduction card type.

-

Click Continue.

How to Add the Calculation Component to the Calculation Card

Add multiple calculation components for the same or different involuntary deduction types. For example, you could add two child support components and one garnishment component to the same calculation card.

On the Calculation Cards page:

-

In the Calculation Components section, click the Create icon.

-

Select the calculation component with the same name as the involuntary deduction element.

-

Optionally, enter a number in the Subprocessing Order field if the calculation card must include more than one calculation component.

By default, the payroll run processes these element entries in order by date received, starting with the oldest entry.

-

Enter a reference code to uniquely identify this deduction, such as a Child Support Order Reference or other identifier provided by the issuing authority.

-

Complete the fields on the Calculation Component Details tab.

-

In the Involuntary Deduction Payment Details section, select all payees for the deduction.

The payee fields display all third-party person payees associated with this payroll relationship and all external payees defined for your legislative data group.

-

In the Involuntary Deduction Rules section, specify the information you require, including:

-

The date of receipt of the involuntary deduction order

-

The issuing authority (such as a court)

-

The frequency of the deduction such as monthly or weekly, regardless of the payroll frequency. If you leave the Frequency field blank, the payroll frequency applies.

-

-

How to Add Involuntary Deductions Calculation Values on Calculation Cards

You enter the order amount, fee, or other amounts used in the calculation on the calculation card.

The rules presented here are specific for child support involuntary deductions.

Under the Enterable Calculation Values on the Calculation Cards tab, the values you can enter are described in the table below.

|

Calculation Value |

Description |

|---|---|

|

Child Support Order Amount |

Amount paid to the Order Amount Payee based on the frequency you specified. For example, if you specified a frequency of monthly in the component details, enter the amount to deduct each month, regardless of the payroll period. The application automatically calculates the correct amount to deduct in each payroll period. If you leave the Frequency field blank, this amount is deducted at the payroll frequency defined at the assignment level. |

|

Child Support Order Percentage |

Rate paid to the Order Amount Payee based on the frequency you specified. Enter a rate if you want the application to calculate the amount as a percentage of available pay. For example, to define a rate of 20 percent for the order amount, enter a rate value of 0.20 in this field. Enter the percentage rate as a decimal value. For example, 25 percent is entered as 0.25. The same rules for frequency as defined for Child Support Order Amount apply to the Percentage. |

|

Protected Pay Amount |

Amount of the net pay an employee is left with after the involuntary deduction is taken. |