Configure Overtime Rate Elements for the US

The payroll process doesn't calculate overtime hours. It calculates only the overtime rate. For it to do this, you need to define elements that calculate your standard and premium overtime pay.

The element configuration involves these steps.

|

What you need to do |

How you do it |

|---|---|

|

Define a standard overtime element |

This element pays the base rate of any overtime hours. |

|

Define a premium overtime element |

This element pays the premium rate of any overtime hours. The default premium multiple is 50%. |

|

Configure the premium overtime multiple |

Once you have created the premium overtime element, you can modify its multiple factor. |

|

Create element eligibility for the overtime premium adjustment element |

This indirect element is created when you create the premium overtime element. |

|

Configure existing elements for overtime calculation |

Rather than create elements, you can use existing ones, so long as they meet the requirements. |

For further info, see the following sections.

Define a Standard Overtime Element

This element captures the regular rate for overtime hours for your nonexempt employees. It isn't impacted by the person's overtime status.

For example, if you wanted to define an overtime element that uses the Hours * Rate calculation rule, you could configure it this way.

|

Field name |

What you enter |

|---|---|

|

Primary Classification |

Standard Earnings |

|

Secondary Classification |

Overtime |

|

At which employment level should this element be attached? |

Assignment Level |

|

Does this element recur each payroll period, or does it require explicit entry? |

Nonrecurring |

|

Can a person have more than one entry of this element in a payroll period? |

Yes |

|

Process and pay element separately or with other earnings elements? |

Process and pay with other earnings |

|

What is the calculation rule? |

Hours * Rate |

|

What is the default periodicity of this element? |

Hourly |

|

Should this element be included in the earnings calculation of the overtime base rate? |

Yes |

|

Should this element be included in the hours calculation of the overtime base rate? |

Yes |

Define a Premium Overtime Element

This element calculates the premium portion of the person's pay.

For example, you could configure a premium overtime element like this.

|

Field name |

What you enter |

|---|---|

|

Primary Classification |

Standard Earnings |

|

Secondary Classification |

Premium |

|

At which employment level should this element be attached? |

Assignment Level |

|

Does this element recur each payroll period, or does it require explicit entry? |

Nonrecurring |

|

Can a person have more than one entry of this element in a payroll period? |

Yes |

|

Process and pay element separately or with other earnings elements? |

Process and pay with other earnings |

|

Is the element subject to retroactive changes? |

Yes |

Attach this element to your nonexempt employees.

Configure the Premium Overtime Multiple Factor

The default multiple factor for premium amount calculation is 0.50. Once you have created the premium overtime element, you can modify its multiple factor.

For standard premium overtime elements, set the new factor on the Default value of its Multiple input value.

To change the multiple for a Time Card premium overtime element:

-

Start the Calculation Value Definitions task.

-

Select your US legislative data group.

-

Search for and select your premium overtime element.

-

Click Time Factor.

-

Under Calculation Values, click Edit and then Correct.

-

In Rate, enter the new overtime multiple. For example, enter

1.0to change the rate to 100%. -

Click Submit.

Create Element Eligibility

When you define a nonrecurring earnings element using the Premium secondary classification, the Elements task creates a <Base Element Name> Premium Adjustment indirect element. You must create element eligibility for this element.

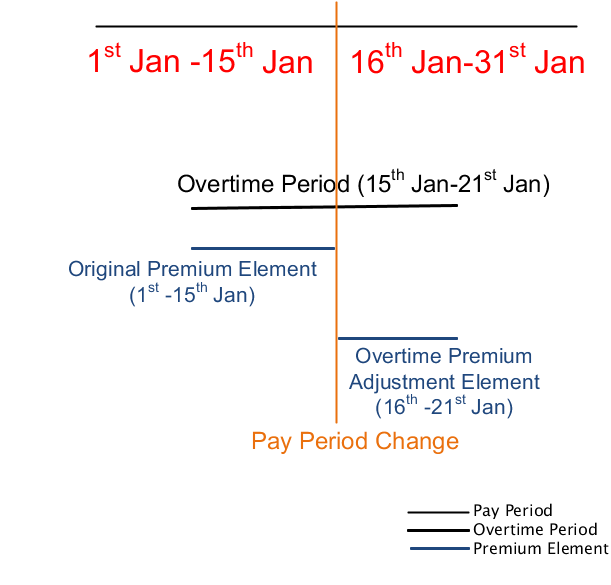

In certain situations, the payroll process automatically includes this indirect element in the element entry. You don't need to add it. For example, if there is any overlap in overtime irrespective whether adjustment for overtime premium is available or not, the process creates the element entry for the adjustment element. In this case, the process:

-

Creates an adjustment for the premium portion of overtime for the entire overtime period

-

Automatically initiates a proration event

Whether the element entry is created depends on the base premium element.

|

If this is true about the base premium element |

Will element entry be created? |

|---|---|

|

Defined as nonrecurring |

Yes |

|

Defined as recurring |

No |

|

Has an earned date that falls between the last overtime period start date and the current pay period end date |

Yes |

|

Doesn't have an earned date that falls between the last overtime period start date and the current pay period end date |

No |

|

Earned date is null |

No |

When the process creates the premium adjustment element entry, the effective start date is equal to the current payroll period end date + 1 day. The effective end date is equal to the last overtime period end date.

Configure Existing Elements

Rather than define elements, you can use existing ones for standard and premium overtime calculations. These elements must have the following settings.

|

Field name |

What you enter |

|---|---|

|

Primary Classification |

Standard Earnings |

|

Secondary Classification |

Overtime or Premium |

|

At which employment level should this element be attached? |

Assignment Level |

|

Does this element recur each payroll period, or does it require explicit entry? |

Nonrecurring |

|

Can a person have more than one entry of this element in a payroll period? |

Yes |

|

Process and pay element separately or with other earnings elements? |

Process and pay with other earnings |

|

What is the calculation rule? |

Hours * Rate |

|

What is the default periodicity of this element? |

Hourly |

Use the Balance Definitions task to feed the predefined balances for the existing element. Search for the Overtime Hours and Overtime Earnings balances, and set the feeds.