Statutory Deductions and Reporting Calculation Card Components for Netherlands: How They Work Together

The Dutch Statutory Deductions and Reporting Card consists of statutory deductions and information related to the Wage Report for a particular payroll relationship.

The calculation components on this card correspond to the Wage Report and the payroll elements for social insurance and taxes defined at the legislative level. Depending on whether the calculation card is created automatically or manually, the calculation components and component details are created. The sector fund details may vary by employee. For example, if an employee has multiple assignments that correspond to different sector funds, you can create multiple Sector Fund WW calculation components, one for each assignment associated with the calculation card.

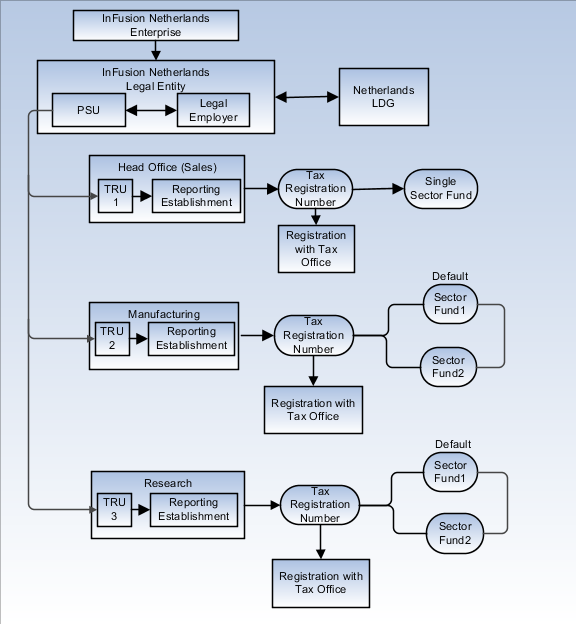

Tax Reporting Unit Association

Associating a tax reporting unit (TRU) with a calculation card enables the payroll process to apply rules and rates defined for the TRU for calculating deductions. The Statutory Deductions and Reporting Card can only be associated with a single TRU. In an automatically created card, the association with the TRU is automatically-created and can't be edited.

In a manually created card, you create the association between the calculation card and the TRU in the Tax component. All assignments attached to the card are automatically associated with the TRU.

Wage Report Calculation Component

The Wage Report calculation component belongs to the Wage Reporting Information calculation group. When the card is created either manually or automatically, the application automatically creates the Wage Report component and the component details. There can only be one Wage Report component for a calculation card.

The Wage Report calculation component details contain data that's reported to the tax office. The Contract Type is a required field in the Wage Report for contract codes. The contract type in the calculation card is derived from the contract type that's specified during the new hire process. For example, if a two-tier employment model is used and no value was specified, this is set to Unlimited contract.

Tax Calculation Component

The Tax deduction component belongs to the deduction group for Taxes.

-

Standard-Rate Tax: When you create the calculation card, the application automatically creates the Tax component and Standard-Rate Tax component details record.

-

Income code and tax code is required for standard-rate tax.

-

You can select a nonstandard tax code from the list of predefined statutory values.

-

To define a standard tax code, you must enter the taxation type, tax table, and the payroll period.

-

The payroll period is the same as the one defined for the associated TRU.

-

The 30 percent rule, defined for foreign nationals, reduces the earnings basis for social insurance and tax by thirty percent.

-

-

Special-Rate Tax: When the calculation card is created automatically, the application also automatically creates the Special-Rate Tax component and component details. If you created the card manually, this component isn't automatically created and must be created manually, if required. The Special-Rate Annual Income is calculated based on the previous year income and is used to calculate the special-rate tax.

Use the Enterable Values on Calculation Cards tab to create overrides for special-rate tax. You can specify values for individual percentage or specify the amount for previous year annual income. The individual percentage value overrides the values specified at the legislative levels.

Social Insurance Component

The Social Insurance component belongs to the Social Insurance calculation group. In an automatically created card, all the Social Insurance components and component details are created automatically.

When the card was created automatically, the sector fund is derived from the default sector fund specified in the TRU card. In the manually created card, you must choose the Sector Fund WW components from the sector funds that apply to the TRU. You can create multiple instances of the Sector Fund WW calculation component, if the sector funds are defined for the TRU.

In the Social Insurance Information component details, you can review or modify the relevant health care insurance (ZVW) information for the employee. You can also specify information related to unemployment, invalidity, disability, and work schedule.

The Subsidies and Discounts component details enables you to specify which tax and social insurance discounts apply to the card.

Assignments Association Details for Sector Funds

The assignments in the calculation card are automatically associated with the default sector fund for the TRU. If the card was created manually, you must associate the sector funds with the assignments. In case of multiple assignments, each employment term may correspond to a different sector fund or the same sector fund.

The following rules apply when creating associations between sector funds and assignments:

-

You can associate one assignment with one sector fund only.

-

You can associate multiple assignments with a single sector fund.

-

You can associate each assignment with a different sector fund, when multiple assignments exist.

-

You must have created components for sector funds, and entered funds as contexts of those components for the calculation card.

If additional assignments are added, the existing card isn't updated automatically nor is a new card created. If required, you must create a new card (for example, for a different TRU) or update the existing calculation card with the assignments, provided the same tax and social insurance rules apply to the new set of terms or assignments.