Loading Allowance Payments Based on Percentage of Salary

Use HCM Data Loader to calculate allowance payments that are based on a percentage of salary. The percentage rate is based on a condition, such as worker's location.

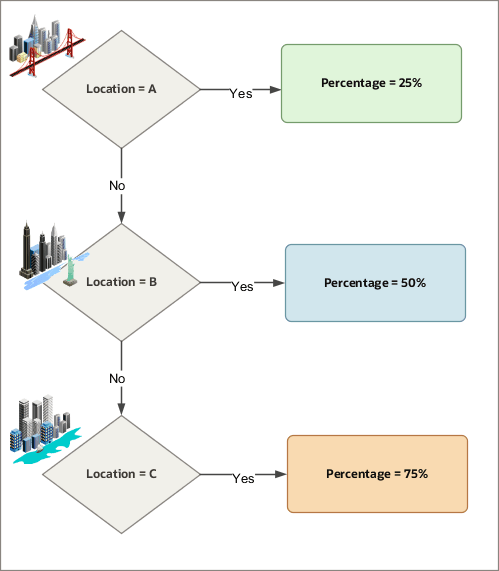

Here are some criteria that you could use:

-

For workers at location A, apply a percentage of 25% (0.25)

-

For workers at the location B, apply a percentage of 50% (0.50)

-

For workers at the location C, apply a percentage of 75% (0.75)

Note: You must set the default calculation type as Number.

This figure shows the criteria that you can use to calculate the percentage rate.

This ValuesDefinedByCriteria.dat file loads the conditions and allowance

values. The Allowance value definition group must be already available in the

application.

METADATA|ValuesDefinedByCriteria|ValuesDefinedByCriteriaCode|EffectiveStartDate|EffectiveEndDate|LegislativeDataGroupName|ValueDefinitionGroupCode|ValuesDefinedByCriteriaName|DefaultCalculationTypeCode|PeriodOrUnit|RetrievalDateType

METADATA|Criteria|CriteriaCode|EffectiveStartDate|EffectiveEndDate|CriteriaName|RetrievalDateType|DisplayName|Operand|Sequence|ValueSetCode|LegislativeDataGroupName|ValueDefinitionGroupCode|DatabaseItemCode|DefaultCriteriaFlag|ParentCriteriaCode|ValuesDefinedByCriteriaCode

METADATA|LiteralValuesForCriteria|EffectiveStartDate|EffectiveEndDate|LiteralValue|LegislativeDataGroupName|CriteriaCode

METADATA|ValueDetails|ValueCode|EffectiveStartDate|EffectiveEndDate|ValueName|ValueIdentifier|RetrievalDateType|Uom|Currency|CriteriaCode|ValueDefinitionGroupCode|CalculationTypeCode|LegislativeDataGroupName|MultiplierOrCondition|Periodicity|ValuesDefinedByCriteriaCode

METADATA|CalculationValues|EffectiveStartDate|EffectiveEndDate|OverrideCalculationTypeCode|FlatAmountValue|FlatCalculationValueDefnCode|FlatRateValue|IncrementalRateValue|NumberValue|TextValue|RateDefinitionCode|ValueIdentifier|LegislativeDataGroupName|ValueCode|FromValue|ToValue

MERGE|ValuesDefinedByCriteria|VBC_Percent_Salary|2020/01/01|4712/12/31|CRFL RRF LDG US1|Salary|VBC_Percent_Salary|Number||E

MERGE|Criteria|VBC_Location A|2020/01/01|4712/12/31|VBC_Location A|E||=|1||CRFL RRF LDG US1|Salary|PER_ASG_LOCATION_NAME|N|VBC_Percent_Salary|VBC_Percent_Salary

MERGE|Criteria|VBC_Location B|2020/01/01|4712/12/31|VBC_Location B|E||=|2||CRFL RRF LDG US1|Salary|PER_ASG_LOCATION_NAME|N|VBC_Percent_Salary|VBC_Percent_Salary

MERGE|Criteria|VBC_Location C|2020/01/01|4712/12/31|VBC_Location C|E||=|3||CRFL RRF LDG US1|Salary|PER_ASG_LOCATION_NAME|N|VBC_Percent_Salary|VBC_Percent_Salary

MERGE|LiteralValuesForCriteria|2020/01/01|4712/12/31|A|CRFL RRF LDG US1|VBC_Location A

MERGE|LiteralValuesForCriteria|2020/01/01|4712/12/31|B|CRFL RRF LDG US1|VBC_Location B

MERGE|LiteralValuesForCriteria|2020/01/01|4712/12/31|C|CRFL RRF LDG US1|VBC_Location C

MERGE|ValueDetails|Location A Percentage|2020/01/01|4712/12/31|Location A Percentage||E|N||VBC_Location A|Salary|Number|CRFL RRF LDG US1||Year|VBC_Percent_Salary

MERGE|ValueDetails|Location B Percentage|2020/01/01|4712/12/31|Location B Percentage||E|N||VBC_Location B|Salary|Number|CRFL RRF LDG US1||Year|VBC_Percent_Salary

MERGE|ValueDetails|Location C Percentage|2020/01/01|4712/12/31|Location C Percentage||E|N||VBC_Location C|Salary|Number|CRFL RRF LDG US1||Year|VBC_Percent_Salary

MERGE|CalculationValues|2020/01/01|4712/12/31||||||0.25||||CRFL RRF LDG US1|Location A Percentage|0|999999999999

MERGE|CalculationValues|2020/01/01|4712/12/31||||||0.5||||CRFL RRF LDG US1|Location B Percentage|0|999999999999

MERGE|CalculationValues|2020/01/01|4712/12/31||||||0.75||||CRFL RRF LDG US1|Location C Percentage|0|999999999999