Accounting Period Functionality

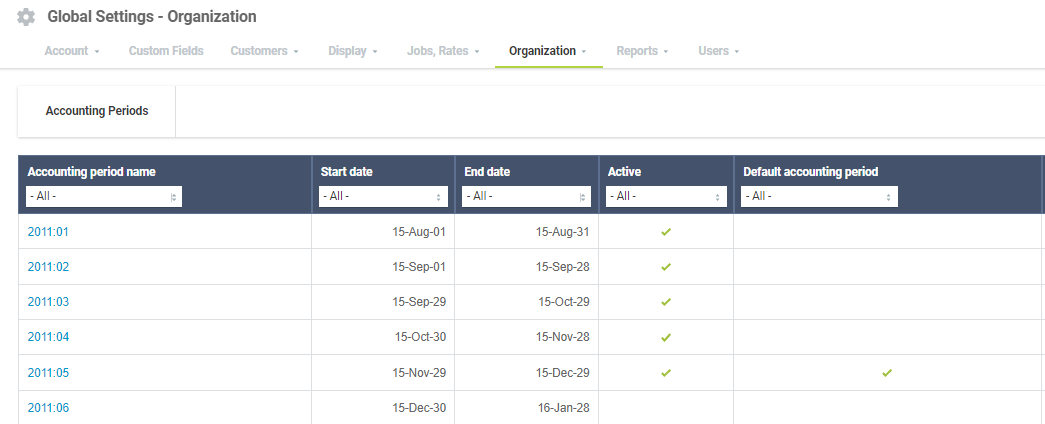

By enabling this feature, separate accounting dates can be associated with most transactions, with reports drawing from these accounting dates. The ability to maintain separate accounting dates can be particularly useful when the original transaction date of an entity must be independent from the date, as signified by a financial report or general ledger application.

For example, the charges on an invoice dated July 5th may need to be associated with the month of June in the general ledger, as the charges were incurred in this month. The invoice transaction date would be 07/05/09, however, the invoice accounting date might be 06/01/09.

In another example, a receipt incurred in March may need to be posted to the financial system in June. In this example, the receipt transaction date might be 03/17/09, while the receipt's accounting date might be 06/01/09. The new accounting period functionality lets users to associate an additional independent accounting date with a transaction. Reports can then be configured to leverage the accounting dates, rather than the original transaction dates.

To enable this feature, contact SuiteProjects Pro Support.