Automating Tax Location

When using input tax on expenses, one expense item could be taxed using several different tax locations depending on where the expense was incurred. For example, an expense item of “Meals” may be taxed at 10% in Germany, 15% in France and 20% in the UK. Expecting an employee to select the correct tax location for every expense item is unreasonable. Furthermore the list of tax locations from which to pick in enterprise international accounts can become very long and with no filtering or defaulting by employee extremely cumbersome to use.

To ease expense entry and minimize user error, OpenAir can default a tax location for a receipt based on:

-

The expense item

-

The geographical location in which the expense was incurred (defaults to the user's home location)

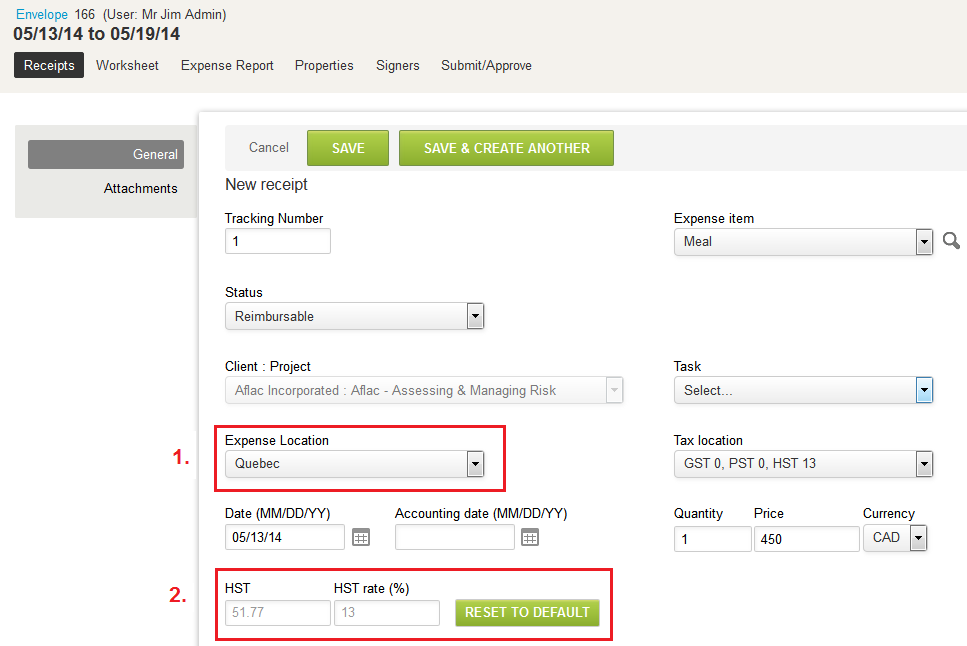

With this feature enabled, a user can (1) mark where a specified expense was incurred and (2) OpenAir can then automatically calculate the correct taxes based on the home location of user. The user can override this calculation if necessary.

The calculation fields are highlighted if the user overrides the calculation. The user can reset back to the calculated values by clicking the RESET TO DEFAULT button.

To setup this feature your administrator needs to:

-

Administration > Application Settings > Tax Locations - Create the required tax settings.

Note:It is recommended to use this for tax settings and not for tax locations.

-

Administration > Application Settings > User Locations - Create the required user locations.

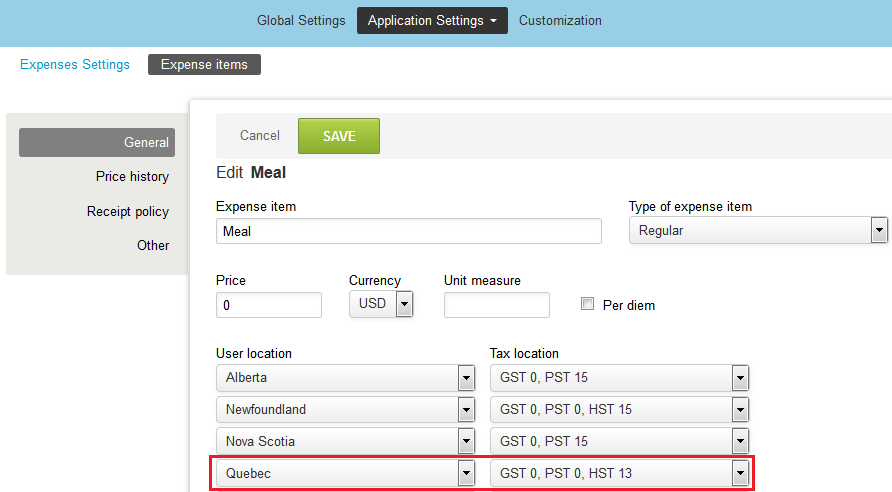

Administration > Application Settings > Expenses > Expense item - Fill out the new grid to match User location to Tax location combinations for the expense item.

To enable this feature, contact OpenAir Customer Support.