Credit and Rebill Functionality for Invoices

The invoicing functionality lets you group multiple charges that should be billed and sent to a customer. Invoices can be sent through an approval process, sent to a customer and subsequently exported to an external accounting system. At times it is necessary to credit and potentially rebill an invoice that has already been approved, sent to a customer, or has been exported. By default, if an invoice and corresponding charges have been approved or exported, a credit would need to be applied manually creating negative offsetting charges. New charges would also need to be created manually if the invoice needed to be rebilled.

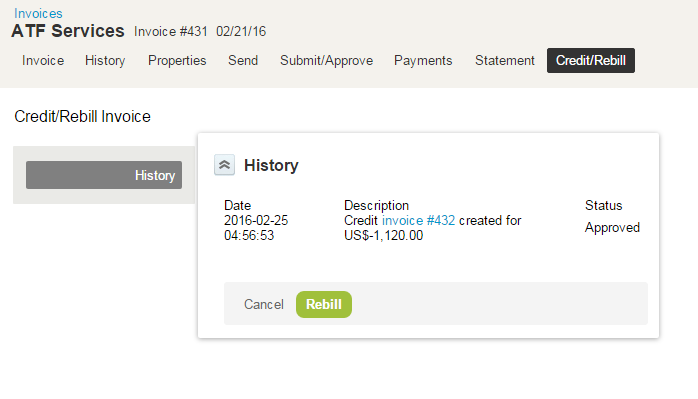

The Credit and Rebill feature streamlines the process of crediting an invoice and rebilling associated charges after a credit has been issued. After you enable this feature, Go to the Credit/Rebill tab on the invoice record to credit, or credit and rebill an invoice. If you credit an invoice, a new invoice will be created that contains offsetting charges of the original invoice. If you then rebill the invoice, the charges from the original invoice will be available to be placed on a new invoice. Both credit and rebill invoices will go through the same approval process as the original invoice. Additionally, the History link in the original invoice will indicate whether the invoice has been credited or rebilled, with the corresponding invoice numbers.

You can enter the invoice date when you create the credit invoice. Account administrators can set the Invoice credit date as either the date from the original invoice or today's date (default). This date is visible on credit invoices, and can be edited until the credit invoice is approved. To set the Credit Invoice Date, go to Administration > Application Settings > Invoices > Other settings.

To enable this feature, contact SuiteProjects Pro Support.