Invoice Statuses for Israeli Invoices

For customers in Israel there are several regulations supported by the Localization SuiteApp.

Ensure that the IL Invoice form is used.

Do not delete invoices for the Israeli subsidiary, as audit will examine the invoice numbering. The Israeli Localization role created by the localization is set up to prevent the deletion of transactions. To cancel a transaction, a credit memo should be applied.

The Israeli Invoice has three printing statuses:

-

Draft - when changes can still be made. This can be shared with the customer, and will be labeled as Draft.

-

Original - only one original invoice can be created. The original invoice can be updated, but not printed again. The Edit and Print Invoice buttons will not be available after the original invoice is created. Information fields which do not affect the GL impact of the document can still be amended.

-

Copy - subsequent prints of the invoice will be marked as Copy.

Mass Document E-mail Capability

The Israel Localization SuiteApp includes the Mass Document E-mail Capability.

To send the invoices through e-mail:

-

Go to Transactions > Bank > Israeli Print Checks.

-

Use filters to select the date parameters and whether you want to print only original invoices or copies.

-

Select the Send E-mail option and Sign Digitally.

-

Select Print All Records to e-mail all invoices.

You can also print your invoices.

Israeli Receipts

If you want to create or print Israeli Receipts, see the following procedure:

To create Israeli Receipts:

-

Go to Transactions > Customers > Accept Customer Payments.

-

From the Custom Form field, select the IL Customer Payment form.

-

Select the customer.

-

Fill in the required fields.

-

On the IL Custom subtab, check the Override box to edit the IL Exchange Rate.

-

You can click Save or Save & Print, which gives the option to print the original document with a digital signature.

Reporting High Volumes of Small-Amount Invoices for Accounts Receivable in IL VAT Reports

When you report high volumes of small-amount invoices, do not use any IL VAT tax codes. Instead, use one of the tax codes provided in the following examples.

Organizations that issue a high number of invoices to customers (more than 100,000 invoices) should use a dedicated VAT code in small-amount invoices (less than 5,000 ILS), which is not collected in the PCN file. This entry will aggregate all the sales less than 5,000 NIS (for example, all cash registers in a given month).

To include these VAT amounts in the Israeli VAT Summary Report and the PCN File, create a Journal Entry at the end of the month.

To define correct VAT codes for reporting high volumes of small-amount invoices:

-

Go to Setup > Accounting > Tax Codes > New.

-

Select the country.

-

Fill in the required fields.

Ensure you have the following tax codes added:

Tax Code

Rate

Tax Agency

Tax Type

Available On

ILL - מע"מ עסקאות חייבות לא מזוהות VAT on Small Amounts Sales

17%

Default Tax Agency IL

ILAR

Sales Transactions

ILLE - מע"מ עסקאות פטורות לא מזוהות Zero percentage VAT on Small Amounts Sales

0%

Default Tax Agency IL

ILAR

Sales Transactions

מעמ עסקאות לא לדיווח VAT on Sales not for Reporting

17%

Default Tax Agency IL

ILAR

Sales Transactions

For invoices with small amounts, use tax code מעמ עסקאות לא לדיווח - VAT on Sales not for Reporting. Invoices with small amounts are invoices of less than 5,000 ILS.

For more information about tax codes, see Tax Code Properties and Creating Tax Codes.

To create a journal entry for reporting high volumes of small-amount invoices:

-

Go to Transactions > Financial > Make Journal Entries.

-

From the Custom Form list, select IL Journal Entry.

-

Fill in the required fields.

-

On the Lines subtab, on the first line, select or enter the following:

-

From the Account list, select 1100 Accounts Receivable.

-

In the Debit field, enter the total income amount of all small amount invoices excluding VAT for the applicable reporting period.

-

From the Tax Code list, select מעמ עסקאות לא לדיווח VAT on Sales not for Reporting.

-

From the Tax Account list, select VAT on Sales IL.

-

-

On the Lines subtab, click Add to add the second line. Select or enter the following:

-

From the Account list, select 1100 Accounts Receivable.

-

In the Credit field, enter the total income amount of all small amount invoices, excluding VAT, for the applicable reporting period. This should be the same amount as on the first line.

-

From the Tax Code list, select either ILL - מע"מ עסקאות חייבות לא מזוהות VAT on Small Amounts Sales or ILLE - מע"מ עסקאות פטורות לא מזוהות Zero percentage VAT on Small Amounts Sales.

-

From the Tax Account list, select VAT on Sales IL.

-

-

Click Save.

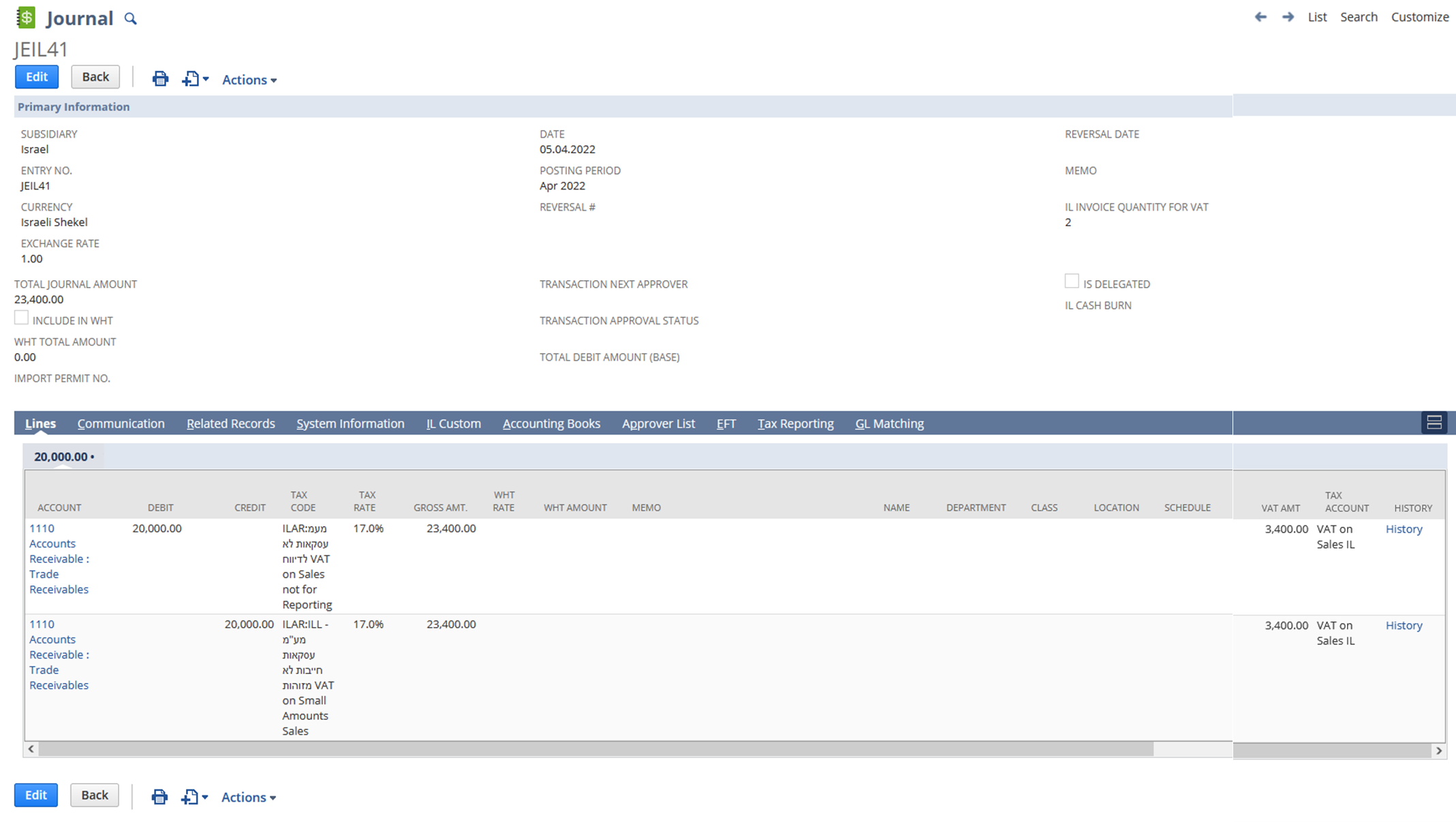

For an example of a completed journal entry form, see the following screenshot: