Understanding Nexuses in SuiteTax

NetSuite uses the term nexus to describe a tax jurisdiction or geographic area where you do business and which has its own tax regulations. For example, a nexus can be a country, municipality, city, state, province, county, or economic zone.

To determine the correct tax jurisdiction and tax rate, NetSuite needs to know where you are registered for tax purposes, and which tax engine has been assigned to that nexus.

In most situations, the nexus is a country because most countries charge tax only at the national level. But you may have countries, such as the U.S., Canada, and Brazil, that levy taxes at different levels and also have independent tax authorities.

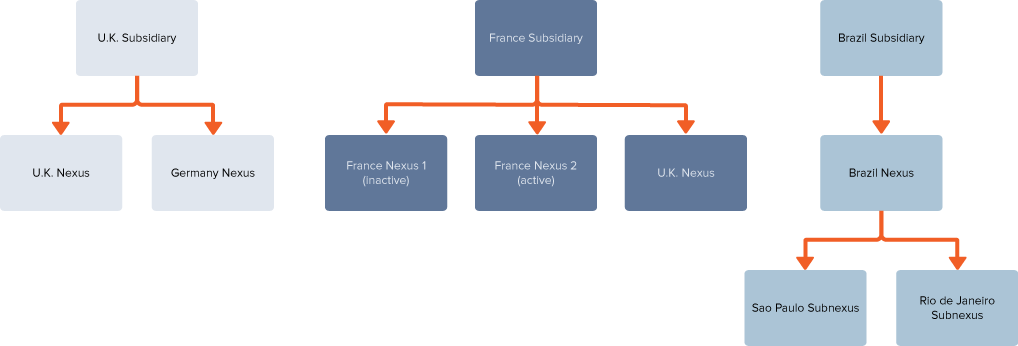

With the SuiteTax feature enabled, you can create a hierarchy of nexuses. A country can have one national-level nexus, and a nexus can have multiple subnexuses. A nexus must be assigned to a subsidiary.

For information about subnexuses, see Understanding Subnexuses in SuiteTax.

To create nexuses and subnexuses, see Setting Up Nexuses in SuiteTax.

Examples of nexus structures: