Nexus Determination Lookup Logic in SuiteTax

For each sale or purchase transaction, NetSuite determines which nexus to use, and triggers the appropriate tax engine to calculate the tax amounts.

A nexus that is marked as tax-exempt does not have an assigned tax engine. Tax calculation won't be triggered.

The following diagrams describe the nexus determination lookup logic for sales and purchase transactions.

For information about setting up subsidiary tax registrations, see Assigning Tax Registrations to a Subsidiary in SuiteTax.

When matching an address to a nexus during nexus determination for sales and purchase transactions, the value in the State/Province/County field of the address is checked to determine the correct nexus. If you enable the Allow Free-Form States in Addresses preference, you must enter the two-letter abbreviation for the state or province for the system to properly determine the transaction nexus. If you use the full name of the state or province, the system might not be able to determine the correct transaction nexus. For more information about this preference, see Setting General Account Preferences.

Nexus Determination on Sales Transactions

The following diagram provides an overview of the nexus determination lookup logic on sales transactions.

If you enable the location at the line level on the sales transaction form, NetSuite uses it in its nexus determination.

The Ship FROM country is determined by one of these:

-

The line-level location, if available.

-

The header-level location if the line-level location isn't available.

-

The transaction subsidiary shipping address if the header-level location isn't available.

-

The transaction subsidiary main address if the transaction subsidiary shipping address isn't available.

All countries except for the U.S. and Canada are considered to be Ship FROM countries. For the full list of the Ship FROM countries, see List of Countries Based on Ship FROM Address.

If you enable the Multiple Shipping Routes feature, and the Enable Item Line Shipping box is checked on your transaction, the line level shipping address is used in the nexus determination on sales transactions. For more information about Multiple Shipping Routes, see Multiple Shipping Routes.

You are tax registered if your tax registration number is filled on the respective transaction. It isn't sufficient to have this data on your customer record only.

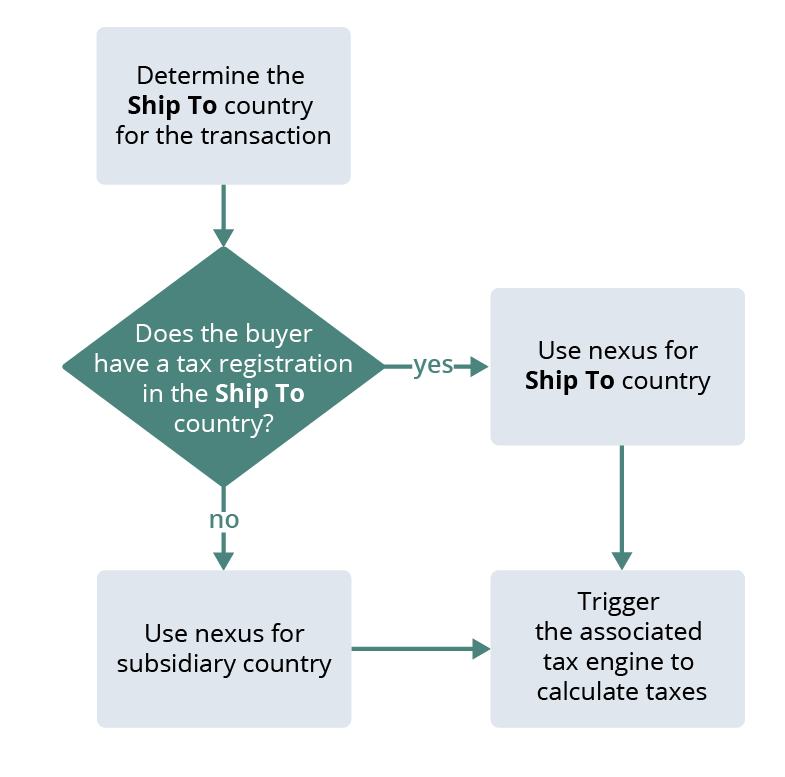

Nexus Determination on Purchase Transactions

The following diagram provides an overview of the nexus determination lookup logic on purchase transactions.

If you enable the location at the line level on the purchase transaction form, NetSuite uses it in its nexus determination.

The Ship TO country is determined by one of these:

-

The line-level location, if available.

-

The header-level location if the line-level location isn't available.

-

The transaction subsidiary shipping address if the header-level location isn't available.

-

The transaction subsidiary main address if the transaction subsidiary shipping address isn't available.