Fair Value and Allocation

The items that your company sells as part of a bundle can have a fair value in addition to a sales price. Fair values are assigned to items that are part of the bundle and that are dependent on each other. Fair values include formulas to calculate the fair value for the items when they're sold. The fair value list for items is created during setup and can be modified as needed. For instructions, see Fair Value Setup.

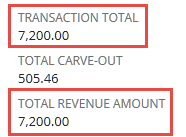

The total revenue amount must equal the transaction total. However, the total of the calculated fair value amounts isn't required to equal any other total. The transaction total is the total discounted sales amount for all revenue elements in the revenue arrangement. The Transaction Total and Total Revenue Amount fields are displayed in the revenue arrangement header. In this screenshot from a revenue arrangement, their values are both 7,200.00.

Each revenue element is allocated a prorated share of the transaction total as the revenue amount for the item. The ratios for the allocation are determined by the calculated fair value amount of each item over the total calculated fair value for the transaction. The ratio is multiplied by the discounted sales amount to derive the revenue amount for the revenue element.

Rounding applied to amounts after the calculation may cause the total calculated revenue to be slightly different from the transaction total. The revenue element with the greatest absolute revenue amount is adjusted to correct rounding errors. The system doesn't include parent kit elements or elements excluded from allocation when evaluating the revenue amounts for rounding.

When the discounted sales amount is greater than the revenue amount, the difference is called the carve-out. When the discounted sales amount is less than the revenue amount, the difference is called the carve-in. The carve-in plus the carve-out equals 0 because the transaction total is always equal to the total revenue amount. The total carve-out is also displayed in the revenue arrangement header. The following table shows the calculations for the previous screenshot.

|

|

Sales Amount |

Disc. Sales Amount |

Calculated Fair Value Amount |

Ratio (Item FV ÷ FV Total) |

Carve-in |

Carve-out |

Revenue Amount (Ratio × Total Disc. Sales Amount) |

|---|---|---|---|---|---|---|---|

|

Item 1 |

6,000 |

6,000 |

6,000 |

0.7800 |

- |

383.78 |

5,616.22 |

|

Item 2 |

1,200 |

1,200 |

1,152 |

0.1498 |

- |

121.68 |

1,078.32 |

|

Item 3 |

0 |

0 |

540 |

0.0702 |

505.46 |

- |

505.46 |

|

Total |

7,200 |

7,200 |

7,692 |

1.00 |

505.46 |

505.46 |

7,200.00 |

Revenue elements that don't permit discount are allocated first in a revenue arrangement. All the revenue elements in the preceding example permit discount.

Carve-out and carve-in ratios are used to allocate billing amounts to revenue elements for partial invoices. The allocation occurs during deferred revenue reclassification. For information, see Reclassification of Deferred Revenue.

The carving ratios are calculated as follows:

-

Carve-out ratio = (discounted sales amount - revenue amount) ÷ discounted sales amount if the discounted sales amount is greater than the revenue amount. If the discounted sales amount is less than the revenue amount, the carve-out ratio is zero. In the example above, the carve-out ratio for Item 1 is 0.068334, and for Item 2 it's 0.112842.

-

Carve-in ratio = gain from the carving on this element ÷ total carving amount if the discounted sales amount is less than the revenue amount. If the discounted sales amount is greater than the revenue amount, the carve-in ratio is zero. For Item 3 above, the carve-in ratio is 1.