Getting Started with Payroll Solutions

You need to understand the following before you begin work on a payroll integration or payroll SuiteApp using the Paycheck Journal feature:

Enabling the Paycheck Journal Feature

Use the following procedure to enable the Paycheck Journal feature.

To enable the Paycheck Journal feature:

-

Go to Setup > Company > Enable Features.

-

Click the Employees subtab.

-

In the Payroll section, check the Paycheck Journal box.

The Paycheck Journal feature requires the Accounting feature, which is located on the Accounting subtab in the Basic Features section.

-

Click Save.

With this feature enabled, the paycheck journal transaction and payroll item records are available to users with appropriate permissions.

Paycheck Journal Transaction

The paycheck journal transaction works like the paycheck transaction in the Payroll feature, but it doesn't issue a check. Instead, it creates a journal entry to record the accounting impact. This transaction serves as a payroll interface for SOAP web services integrations with external payroll systems and for payroll SuiteApps built with SuiteScript.

The paycheck journal transaction is available at Transactions > Employees > Paycheck Journal. Users must have the Paycheck Journal permission, which is a Transactions type permission.

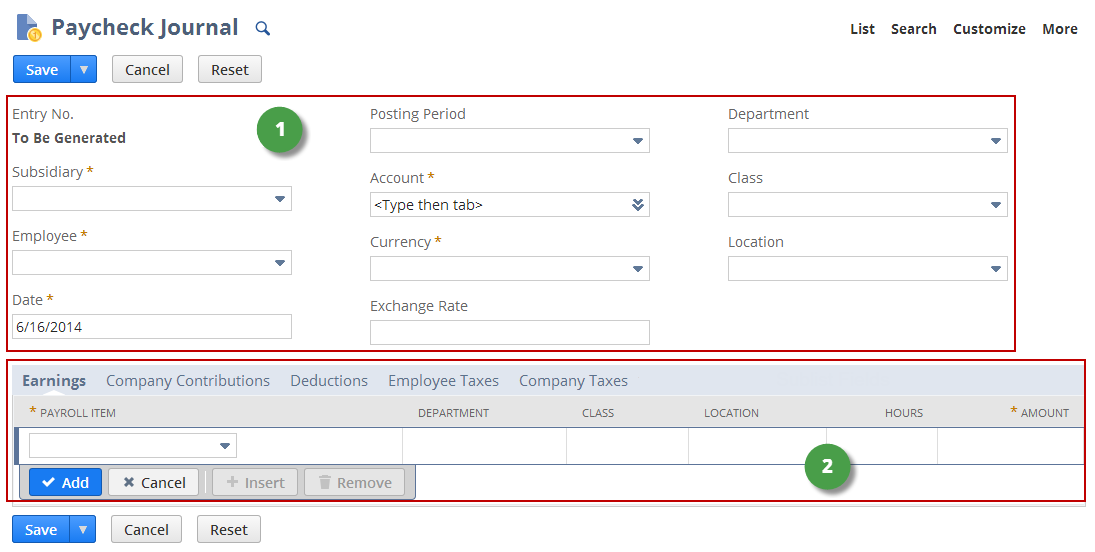

The following screenshot shows the fields supported by the paycheck journal transaction.

NetSuite customers are not expected to use this form without a partner payroll solution. Partner solutions are expected to include custom forms and custom fields that vary from this example.

|

1 |

Body fields |

|

2 |

Sublist fields |

Paycheck journal body fields store basic values used by the transaction. Note the following:

-

Subsidiary is available only in NetSuite OneWorld.

-

Department, Class, and Location are available only in accounts that use these classifications.

-

Currency is available only in accounts with the Multiple Currencies feature enabled.

-

Exchange Rate is not currently in use. Its value, which is set to 1 when a currency is selected, should not be changed.

-

Partners can create custom transaction body fields that display on paycheck journal forms and are accessible to SOAP web services and SuiteScript.

Paycheck journal sublist fields store details about different types of payroll items that can be included in the transaction. Partners can create custom transaction line fields.

Payroll Items and the Paycheck Journal Feature

Similar to transactions related to the Payroll feature, paycheck journal transactions use the payroll item record type to store line item values. The following table outlines some differences in how the two features handle payroll items.

|

Payroll Feature |

Paycheck Journal Feature |

|---|---|

|

|

|

|

Payroll items must be created before any paycheck journal transactions can be entered. The following item types are supported: Deduction, Earning:Addition, Earning:Commission, Earning:Expense, Earning:Salary, Earning:Sick, Earning:Vacation, Earning:Wage, Employer:Contribution, Employer:Expense, and Tax.

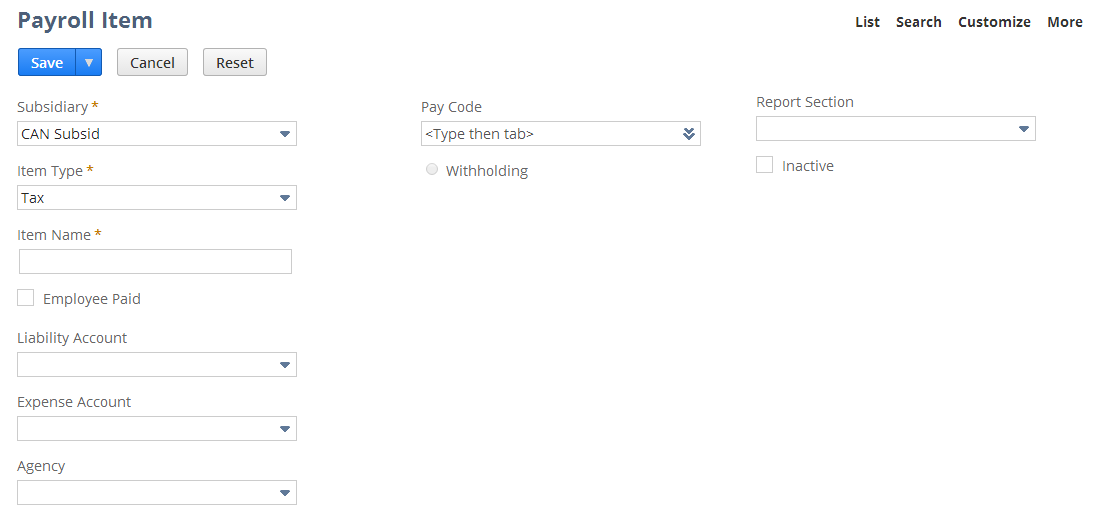

The Payroll Item page is available at Lists > Accounting > Items. Users must have the Payroll Items permission, which is a Lists type permission. The following screenshot shows the fields supported by the payroll item record.

Note the following:

-

Subsidiary is available only in NetSuite OneWorld.

-

Item Type: Tax is available only for non-U.S. subsidiaries.

-

The Employee Paid box is available only when Item Type is set to Tax. When the Employee Paid box is clear, item type is Company Tax. When the Employee Paid box is checked, item type is Employee Tax.

-

Account fields vary according to item type, as shown in the following table:

|

Item Type |

Account Fields for Payroll Items |

|---|---|

|

Deduction |

Liability Account, Vendor (Agency) |

|

Earning |

Expense Account |

|

Employer Contribution |

Liability Account, Expense Account, Vendor (Agency) |

|

Company Tax |

Liability Account, Expense Account, Vendor (Agency) |

|

Employee Tax |

Liability Account, Vendor (Agency) |