About Forecast Methods

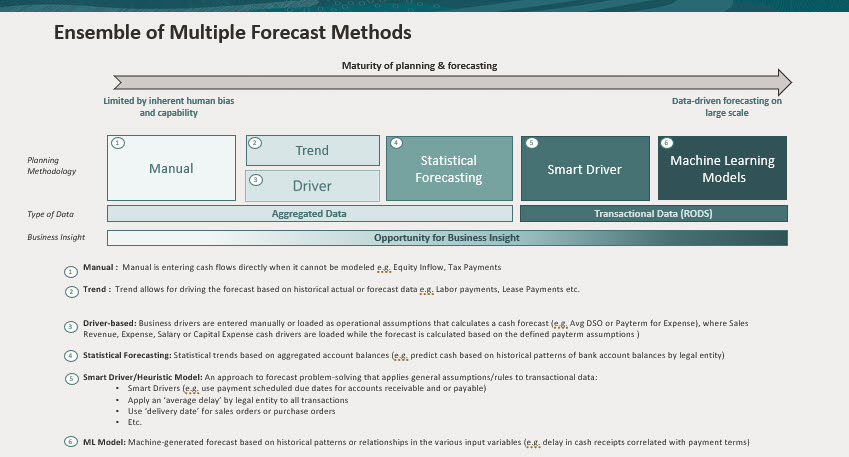

Forecast methods are different approaches to arriving at cash forecasts.

Predictive Cash Forecasting supports various forecast methods for each cash line item, providing you with the flexibility to choose the appropriate method.

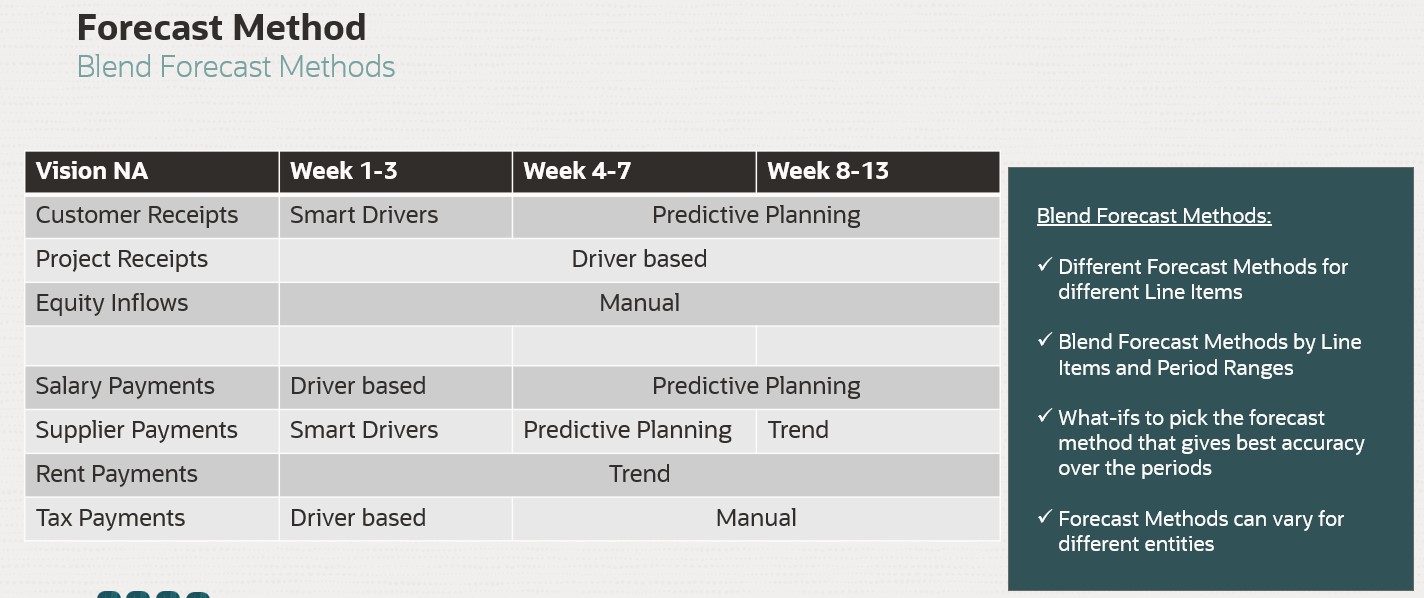

You can define the default forecast methods to use for each line item and entity combination based on the data source available, the maturity of planning and forecasting, and the time horizons for the forecast. You can also define period-based forecast methods where you can use different forecast methods for different time frames.

Administrators typically define the forecast methods to use, although cash managers can make changes for their entity any time if needed. For information about how to set the default forecast method for line items, see Setting Assumptions for Forecast Methods.

Predictive Cash Forecasting supports the following forecast methods, which administrators can enable for the application:

- Cash drivers—A calculated method where different drivers are used to drive cash forecast for specific line items. Predictive Cash Forecasting provides 11 different driver-based methods that can be used for different cash inflows and outflows. Business drivers are entered manually or loaded as operational assumptions that calculate a cash forecast (for example, Avg DSO or Payterm for Expense), where Sales Revenue, Expense, Salary or Capital Expense cash drivers are loaded and then the forecast is calculated based on the defined pay term assumptions. For more information about cash drivers, see About Driver-Based Forecasting Methods.

- Smart Drivers—For data you expect to come from ERP. Useful in a daily model. In a

periodic model, you might use Smart Drivers for early periods, and other methods for

later input.

Smart Drivers is an approach to forecast problem-solving that applies general assumptions or rules to transactional data. For example:

- Smart Drivers to use payment scheduled due dates for accounts receivable and or payable.

- Apply an average delay by legal entity to all transactions.

- Use delivery date for sales orders or purchase orders.

Fusion ERP Cloud integration will be available in a future release. Predictive Cash Forecasting will include seeded integrations from Fusion ERP Accounts Receivable, Payable and Cash Management. In the interim, you can load subledger summarized data from other data sources, such as Oracle EBS, Peoplesoft, or SAP.

- Statistical Prediction—You can use Predictive Planning to forecast cash based on the historical

data for the line item using time-series forecasting techniques.

Predictive Planning selects the best prediction method to

use, selecting the method that gives the most accurate results based on the data

available. For example, use statistical trends based on aggregated account balances

to predict cash based on historical patterns of bank account balances by legal

entity. For more information about the statistical forecasting methods, see Predictive

Planning Forecasting and Statistical Descriptions in Working with Planning.

Note:

For Interactive Predictive Planning, Receivable Invoices, Overdue Invoices, Payable Invoices, Payable Overdue Invoices will not provide any results as there is no historical data in these lines. However you can use AutoPredict, because it allows you to reference a different line item for predicting.

- Machine Learning— Machine Learning Models are integrated in Predictive Cash Forecasting to

accurately predict the cash inflows from Accounts Receivable data.

Machine learning as a prediction model is best suited to

customers who have a due date-based payment approach. For example, create a

machine-generated forecast based on historical patterns or relationships in the

various input variables such as a delay in cash receipts correlated with payment

terms.

Note:

Machine Learning will be supported in a future update. - Manual Input—The most basic method, for line items where it is difficult to apply specific logic; instead you can manually enter the cash forecast numbers. For example, Equity Inflow or Tax Payments.

- Trend—You can use trend-based methods for any line items where the cash forecast can be calculated based on historical trends. Trend-based methods can be used only for Periodic forecasts. For example, Labor Payments or Lease Payments. For more information, see About Trend-Based Forecasting Methods.

Additionally, with Predictive Cash Forecasting, you can blend forecast methods by using different forecast methods for different line items, different forecast methods for different period ranges, or different forecast methods for different entities. You can also perform what-if planning using different forecast methods, and then select the best forecast method to use for a particular line item, entity, or period range.

Video

| Your Goal | Watch This Video |

|---|---|

| This video highlights the Forecast Methods available in Predictive Cash Forecasting. |