National Service Fiscal Documents for Brazil

Work with the recently introduced national system for service fiscal documents in Brazil. This feature provides an option to users who want to use the new national system.

The national tax authority processes the national service fiscal document centrally compared to the current service fiscal document where each city has its own processing and document layout.

To use this option, you must create a new city inscription tax registration using a new Tax Registration Status:

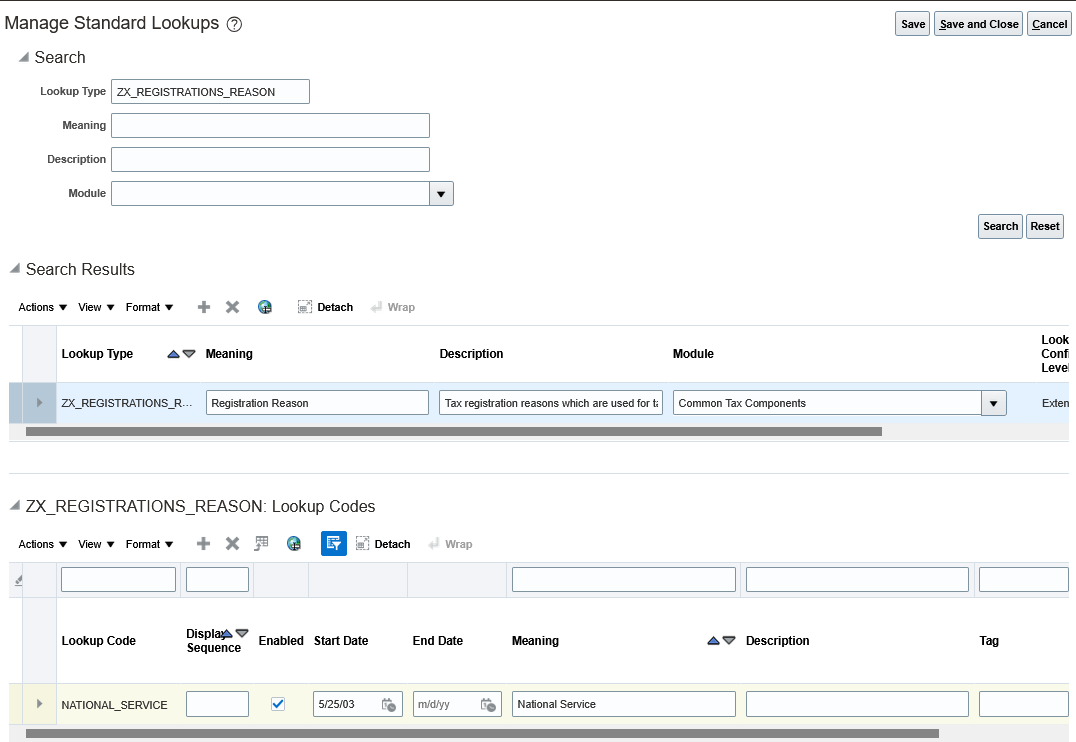

- Navigate to Manage Standard Lookups and search for the Lookup Type ZX_REGISTRATIONS_REASON.

- Add a new Lookup Code NATIONAL_SERVICE.

- Save and Close.

Manage Standard Lookups

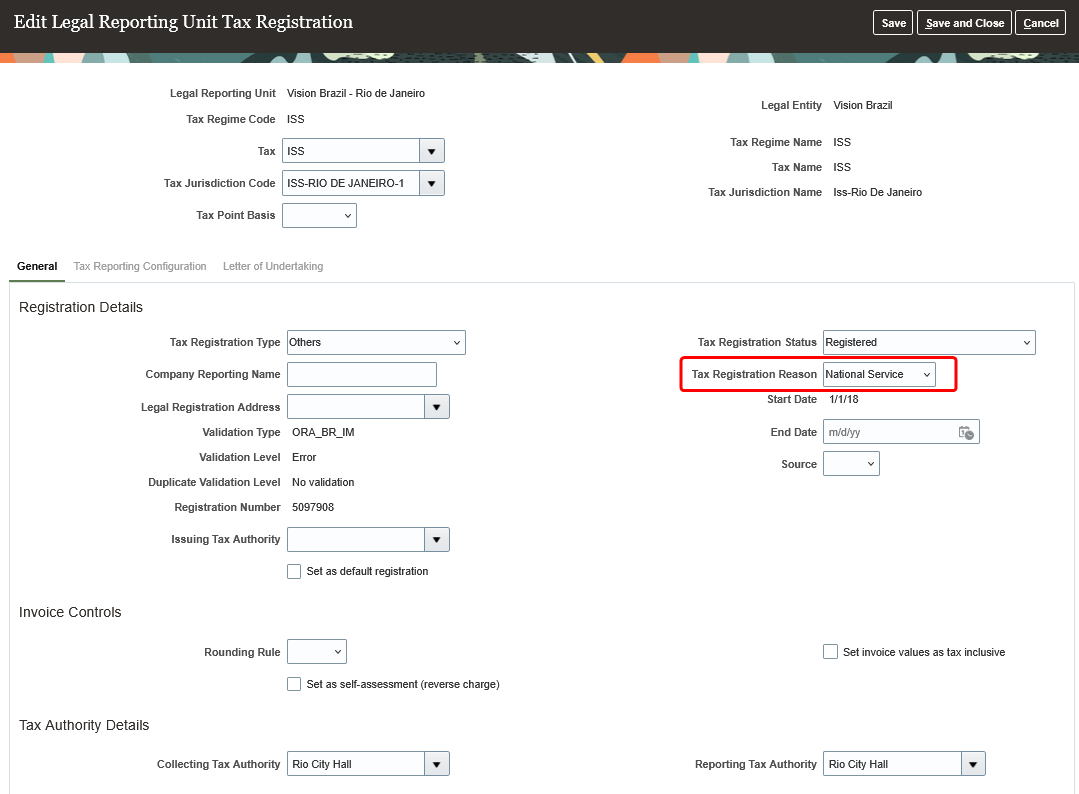

- Navigate to Manage Tax Registrations, Legal Reporting Unit.

- Add a new tax registration for a legal reporting unit.

- Enter the required data and select the Tax Registration Status that you created.

- Save and Close.

Manage Tax Registration - Legal Reporting Unit

NOTE: The regular service fiscal document and the national service fiscal document system do not coexist. You must set the end date for the existing tax registration before you add a new tax registration. If you are already using the regular service fiscal document for the same city, check the migration date with the city tax authority.

You must create a document sequence and fiscal document generation control for the national service fiscal document. For more information about the configuration of document sequence for Brazil fiscal documents, see Define Localization Document Numbering.

The steps to create a national service fiscal document are the same as that of a regular service fiscal document. Here are some processing differences:

- The national service fiscal document has only a single line, hence, all receivables transaction lines will be consolidated into a single line in the fiscal document extract along with respective taxes. By default, the fiscal document line description inherits the first transaction line description. You may provide a more meaningful description at the Update Fiscal Attributes UI or in the Import Outbound Fiscal Attributes FBDI.

- The system will generate a fiscal document key (DPS Key) once the fiscal document is generated.

- The tax authority will return a service fiscal document key with the fiscal document number once the fiscal document is approved.

For more information about the creation and processing of fiscal documents, see Overview of Manage Generation of Fiscal Documents.

The national service fiscal document cancellation also follows the same steps as that of a regular service fiscal document cancellation. For more information about fiscal document cancellation, see Overview of Managing Fiscal Document Variations.

NOTE: Fiscal document substitution is not supported by Cloud ERP currently. You must cancel the fiscal document and create a new one.

Business benefits include:

Create and process a national service fiscal document using the new national system provided by the national tax authority.

Steps to Enable

You don't need to do anything to enable this feature.