Escheatment of Unclaimed Checks

Escheatment of Unclaimed Checks

Identify and escheat unclaimed checks issued for payments to suppliers, or issued to employees for expense payments, that haven't been presented for clearing during a specific period of time, and transfer the amount to the appropriate local authority. You can also generate a report with a list of payments that are escheated or initiated for escheatment.

Escheatment Process Steps:

- Identify the stale dated check payments in Manage Payments page using payment date criteria. Checks that aren’t cleared for more than or equal to the minimum number of days for escheatment are considered as stale dated check payments.

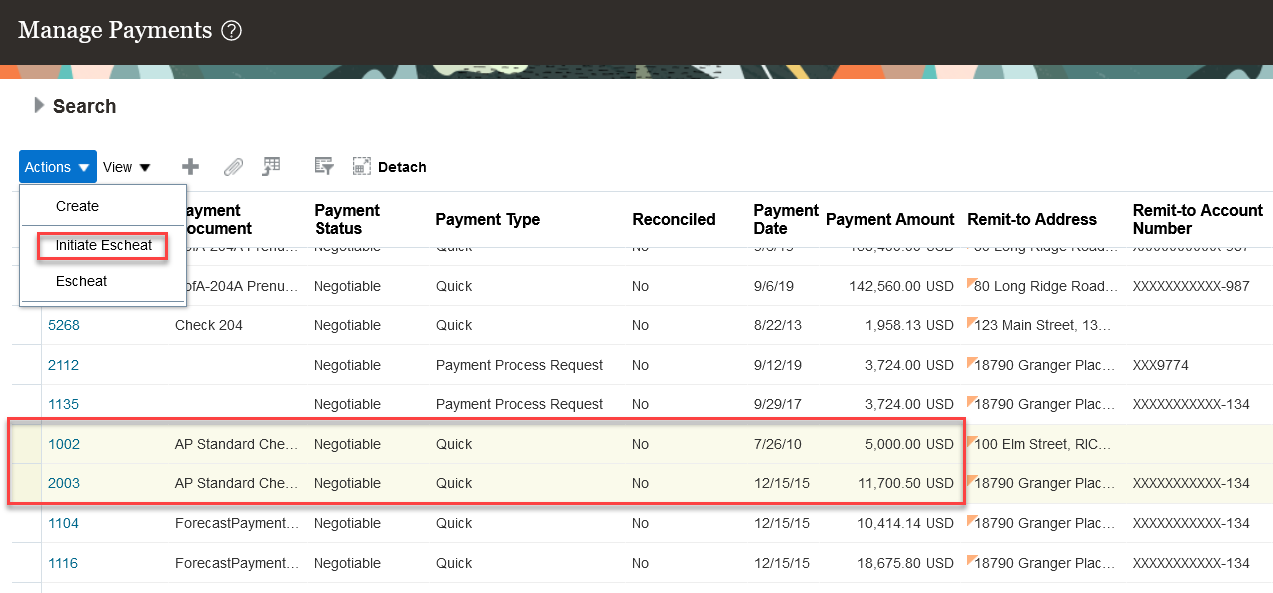

Identify the Stale Dated Payments in Manage Payments Page

- Select "Initiate Escheat" action on a single payment or selected multiple payments identified as stale dated check payments. After payment is Initiated for escheatment, the payment status will be changed to Escheatment Initiated.

Initiate Escheatment from Manage Payments Page

- Send stop payment instructions to the corresponding banks for all payments in the Escheatment Initiated status.

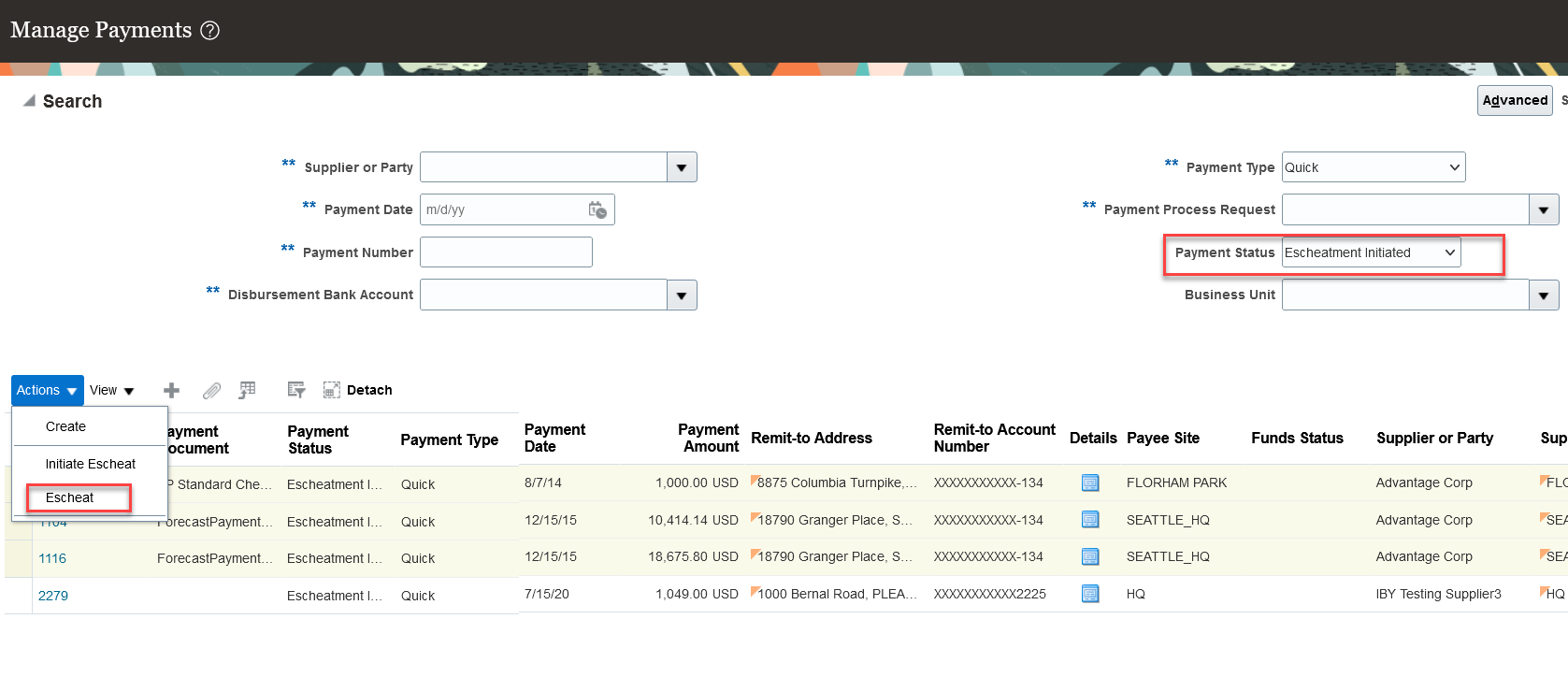

- After performing due diligence on all stale dated payments, use the Manage Payments page to search for and select payments in the Escheatment Initiated status in and submit the Escheat action.

Escheat Payments Which Are in Escheatment Initiated Status

- The payments status changes to Escheated. There is no further activity on escheated payments.

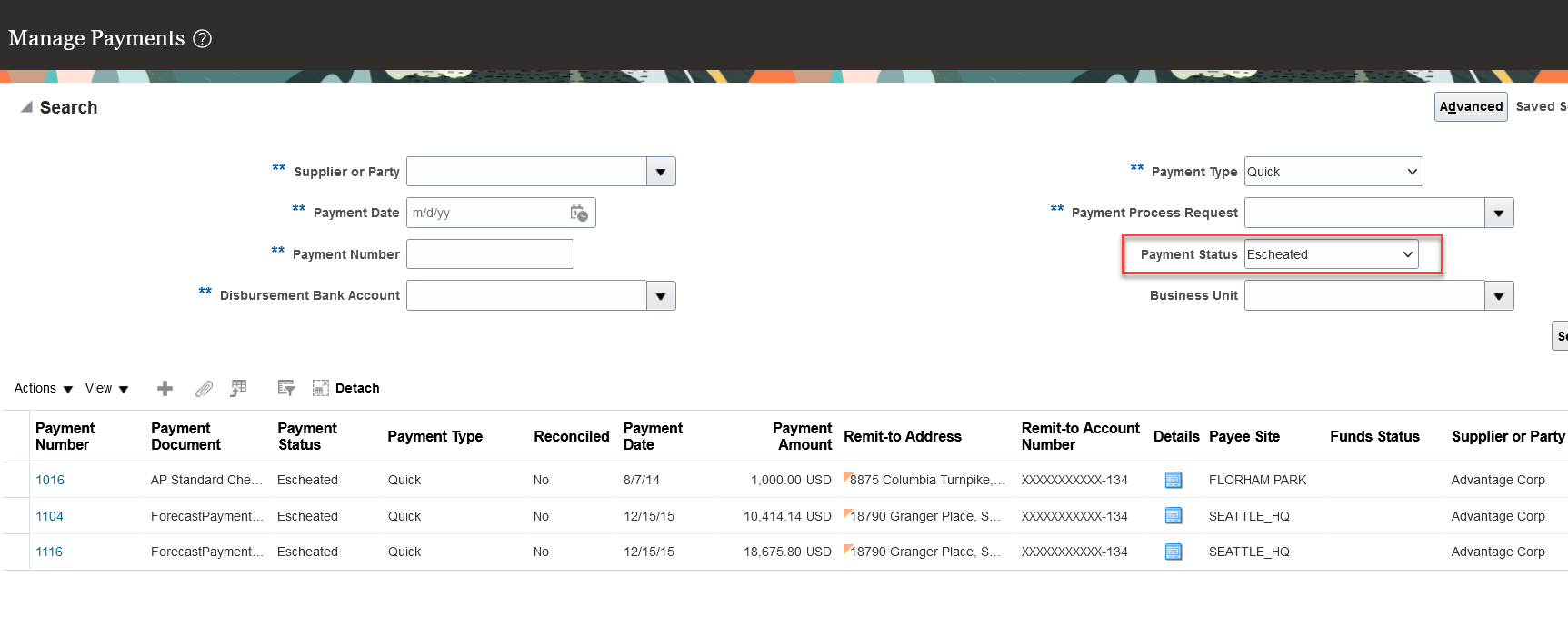

Escheated Payments

- Run accounting process for the escheated payments to transfer the amount from Cash or Cash clearing account, to Unclaimed Fund account.

- Create a Payables invoice for payment to the escheatment authority.

Accounting Entries for the Payment and Escheated Payment when Offset Segments option is set to None and Account for Payment option is set to at Payment Issue and Clearing.

When payment is accounted:

Dr Supplier Liability Account

Cr Cash/Cash Clearing Account

When payment is escheated:

Dr Cash/Cash Clearing Account

Cr Unclaimed Fund Account

Create invoice manually on Escheatment Authority:

Dr Unclaimed Fund Account

Cr Escheatment Authority Liability Account

Generation of accounting entries for the escheated payment will be different based on Offset Segments and when to account payment options.

Report:

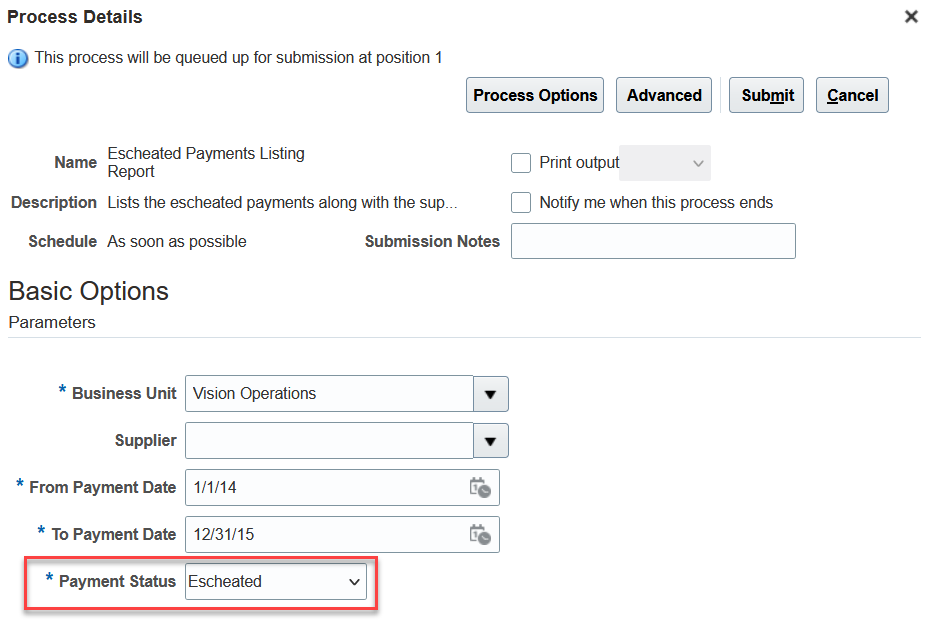

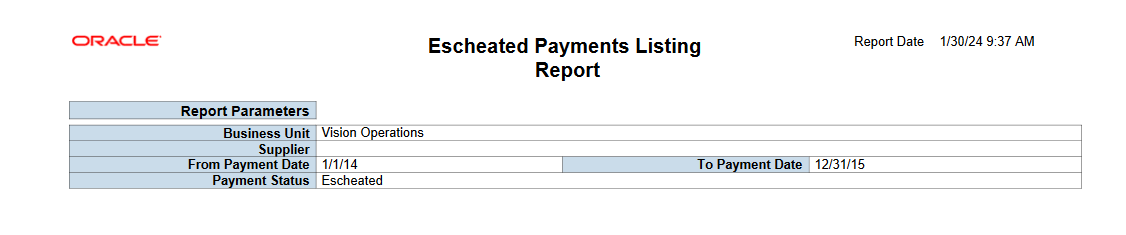

Run the Escheated Payments Listing Report for a list of Escheated and Initiated for Escheatment payments.

Escheated Payments Listing Report

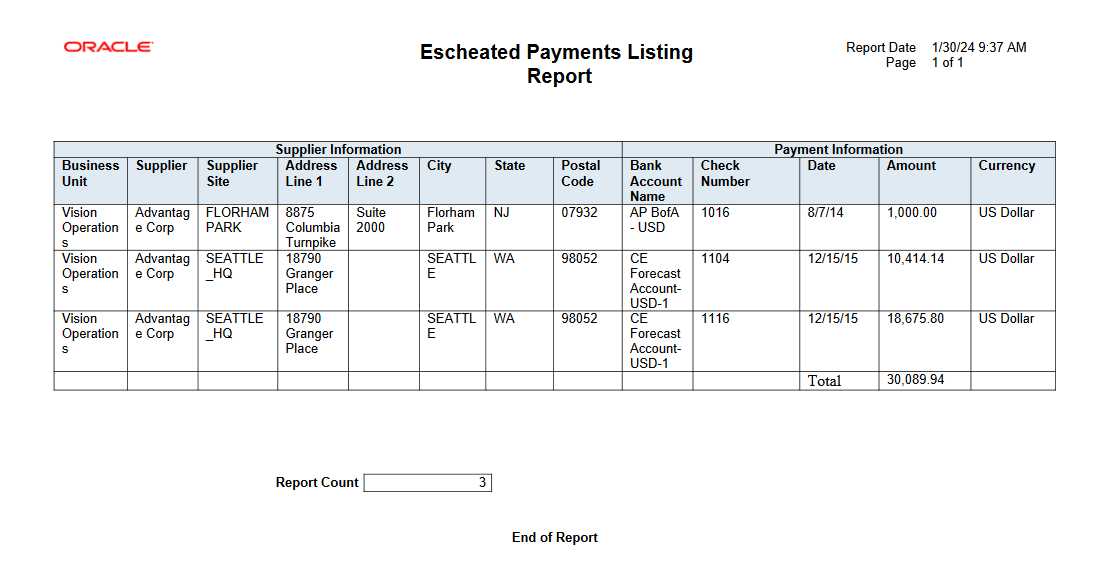

Report Output:

Report Output

Business benefit:

Improves compliance with legal regulations by transferring unclaimed payments over to the appropriate authority.

Steps to Enable

Following setups are mandatory to escheat the payments:

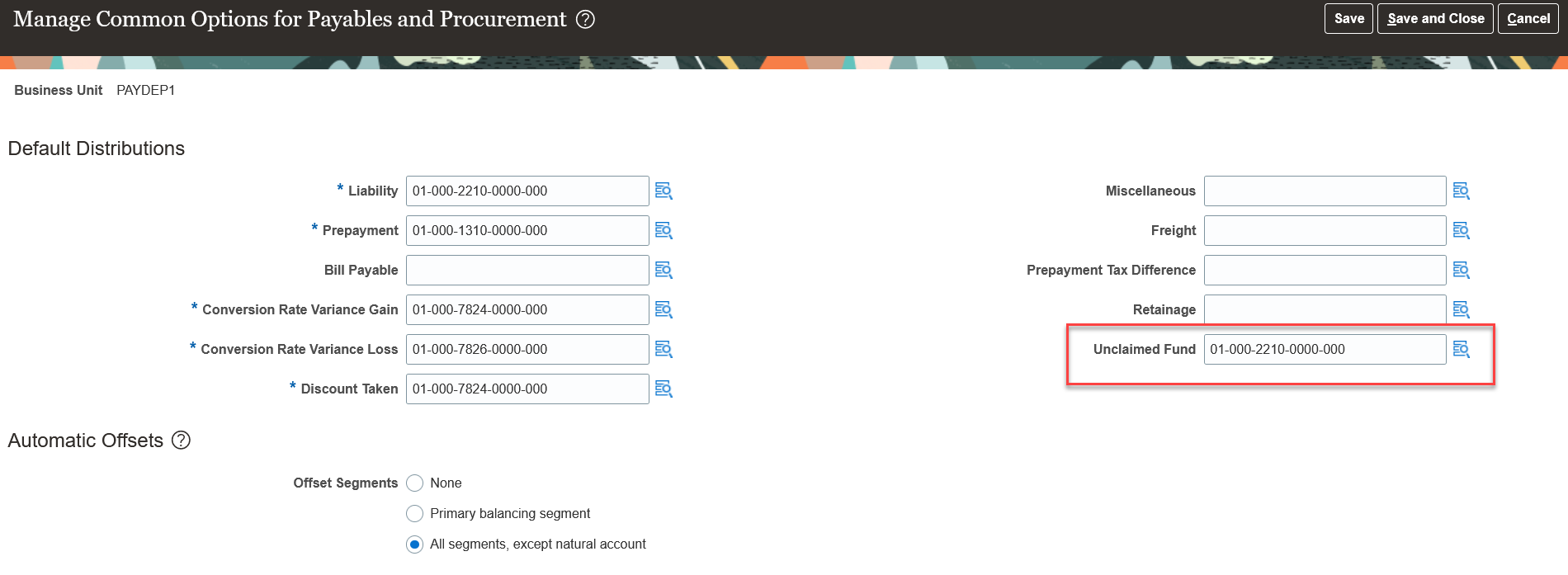

- Enter Unclaimed Fund Account in Manage Common Options for Payables and Procurement page.

Manage Common Options for Payables and Procurement Page

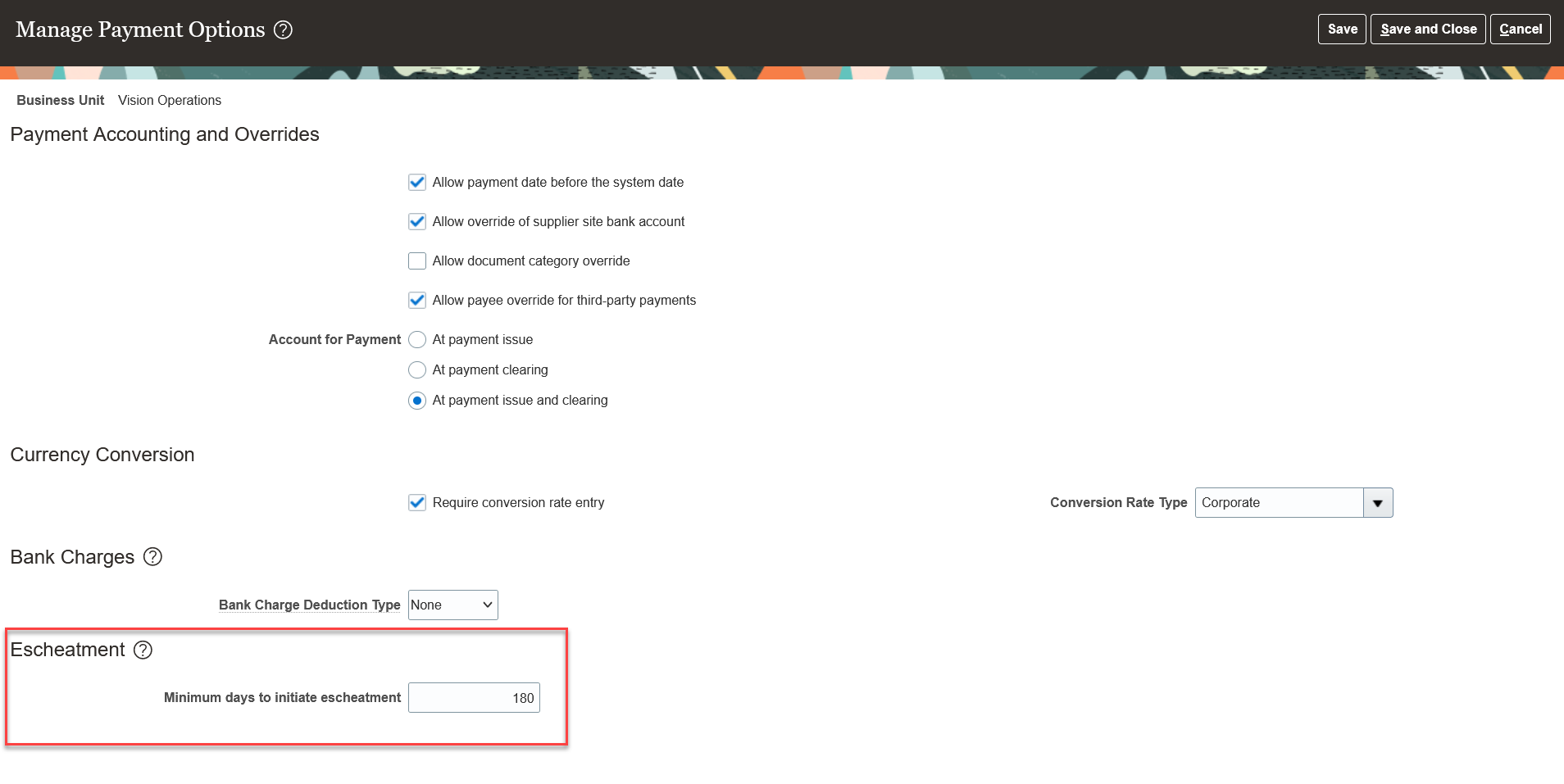

- Enter minimum days to initiate escheatment in Manage Payment Options page.

Manage Payment Options

Updating a Customized Accounting Method:

If you have customized the predefined Subledger Accounting accounting method, you must add the Escheated Payments accounting event class with event type Payment Escheated to your customized accounting method.

To add the Escheated Payments accounting event class, complete these steps:

- Navigate to the Manage Accounting Methods task.

- Select the custom accounting method assigned to the primary and secondary ledgers.

- Select Payables.

- Click the Plus (+) icon.

- Select Event Class = Escheated Payments, Event Type = All, Rule Set = Escheated Payments Accrual Basis.

- Click Activate.

- Submit the ESS Process "Update Subledger Application Option" by selecting the Subledger Application parameter list of value as "Payables".

Tips And Considerations

- You can only escheat check payments in the Negotiable status and in the ledger currency. Payment is eligible for the escheatment only when the payment is done using the Payment Process Profile configured with Processing Type "Printed".

- Payment cannot be initiated for escheatment for the Manual or Refund or Netting and Prepayment payments.

- You can't escheat cross-business-unit payments.

- New accounting event class "Escheated Payments" with event type "Payment Escheated" seeded in Subledger Accounting and assigned to the seeded accounting method.

Key Resources

- Configure Escheatment Options

- How Payments Are Escheated

- Escheated Payments Listing Report

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 481025

Access Requirements

New privilege called "Escheat Unclaimed Payments" predefined to secure the "Initiate Escheat" and "Escheat" actions in Manage Payments page. This new privilege is added to the seeded duty role called "Payables Payment Processing Duty". This duty role assigned to the seeded "Accounts Payable Supervisor" and "Accounts Payable Manager" job role.