Invoice Creation for Remitting Escheated Payments to the Escheatment Authority

Invoice Creation for Remitting Escheated Payments to the Escheatment Authority

Use the escheatment process in Payables to transfer the payment amounts of unclaimed checks issued to suppliers and employees to the appropriate local authority. The escheatment process includes all checks issued to suppliers and employees that were not cleared within a specified time period. The previous release supports the identification and selection of stale payments, initiating the escheatment processes, escheating the stale payment, and creating the related accounting transactions. This release automates the invoice creation and transfer to the escheatment authority. '

Escheatment Process and Invoice Creation Steps:

- In Manage Payments page, identify the stale check payments using the configured payment date criteria. Stale payments are any checks that weren't cleared after the minimum number of days before they become eligible for escheatment..

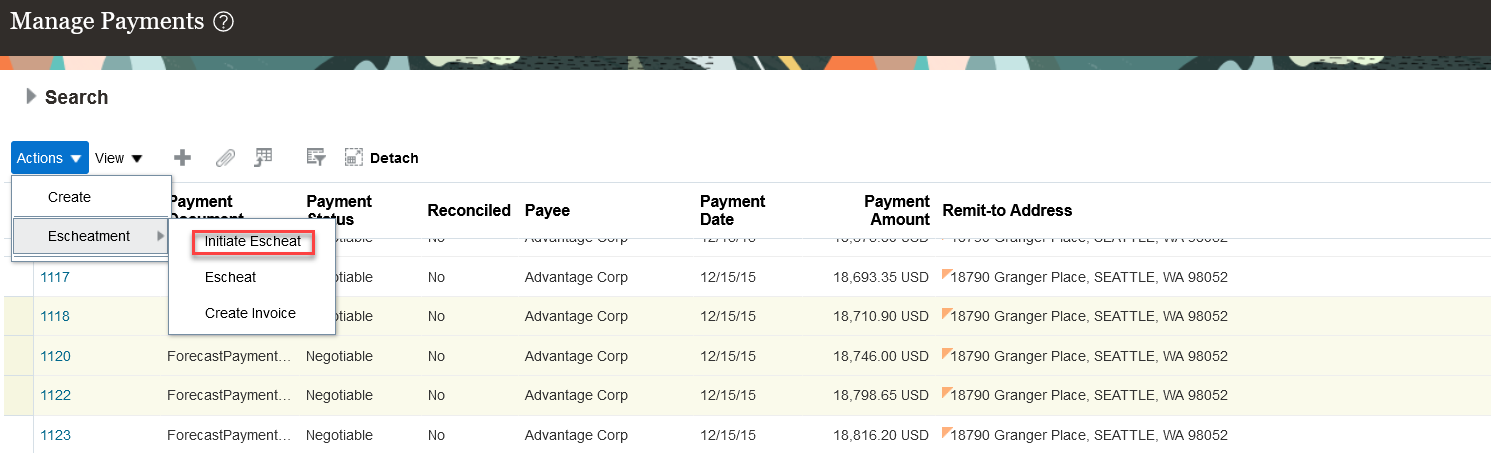

- Select one or more stale payments, then select the Initiate Escheat action. After payment is Initiated for escheatment, the payment status will be changed to Escheatment Initiated.

Initiate Escheatment from Manage Payments Page

- Send stop payment instructions manually to the corresponding banks for all payments in the Escheatment Initiated status.

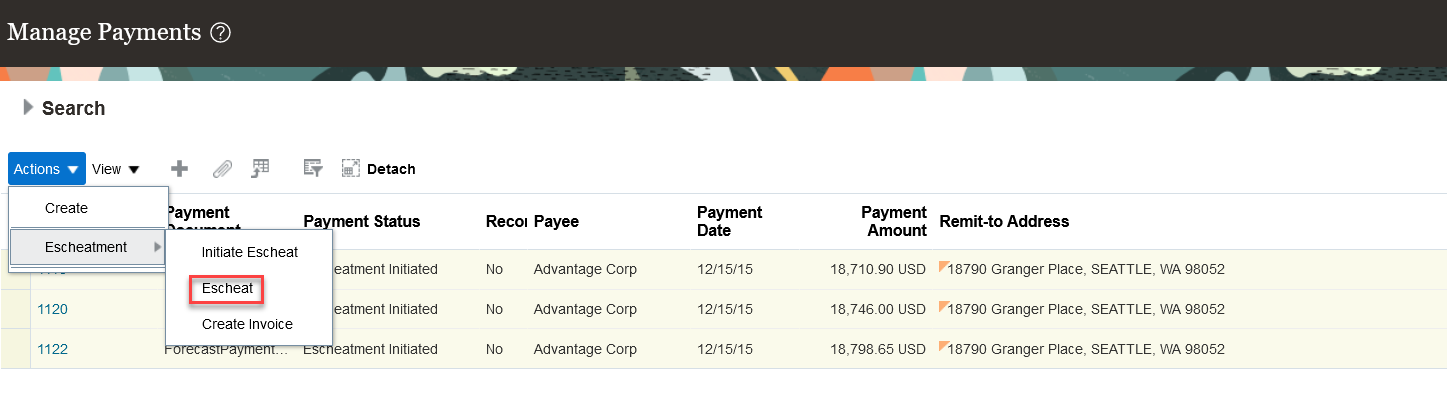

- After performing due diligence on all stale dated payments, use the Manage Payments page to search for and select payments in the Escheatment Initiated status and submit the Escheat action.

Escheat Payments Which Are in Escheatment Initiated Status

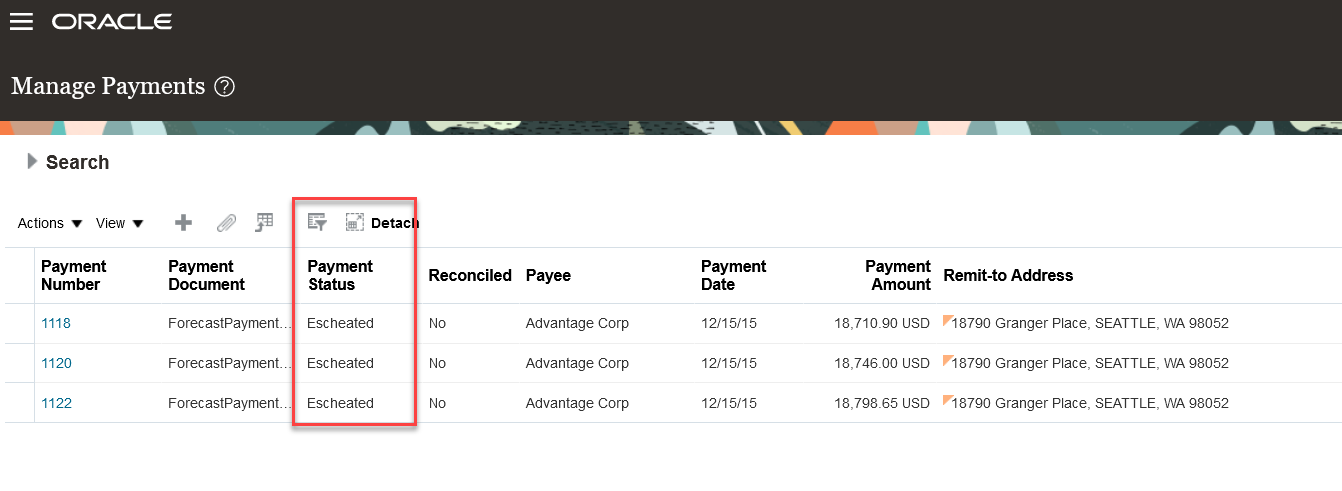

- The payments status changes to Escheated. There is no further activity on escheated payments.

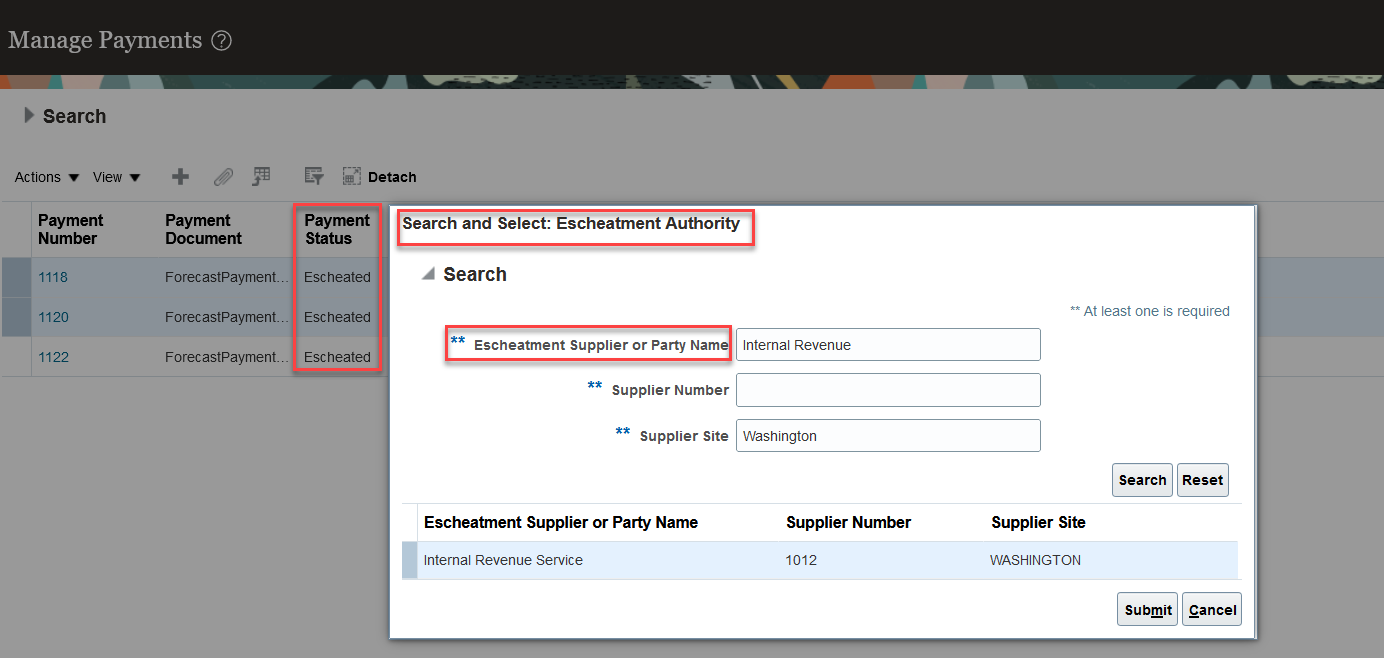

Escheated Payments

- Run the Create Accounting process on the escheated payments to transfer the amounts from the Cash or Cash Clearing account, to the Unclaimed Fund account.

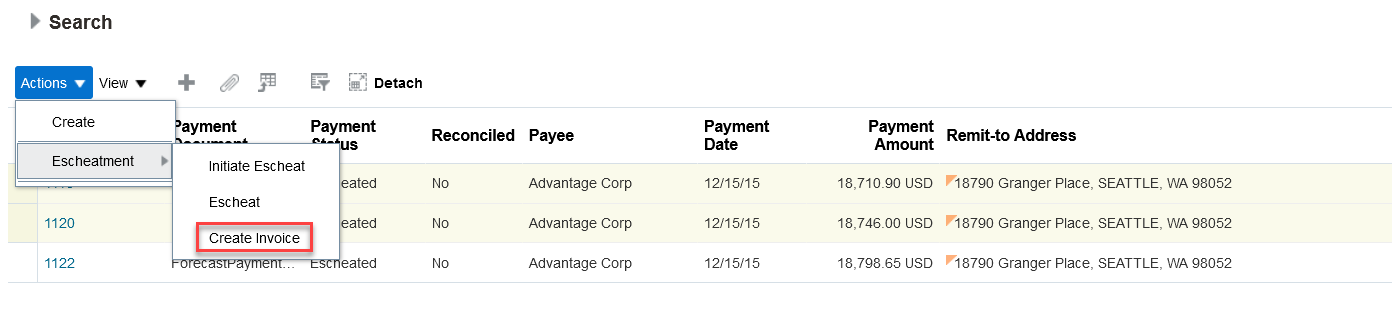

- Select the escheated payments for the applicable escheatment authority, then select the Create Invoice action to an create an invoice.

Create Invoice from Manage Payments page

- Search for and select the Escheatment authority supplier to create the invoice for this authority.

Choose Escheatment Supplier to create an invoice

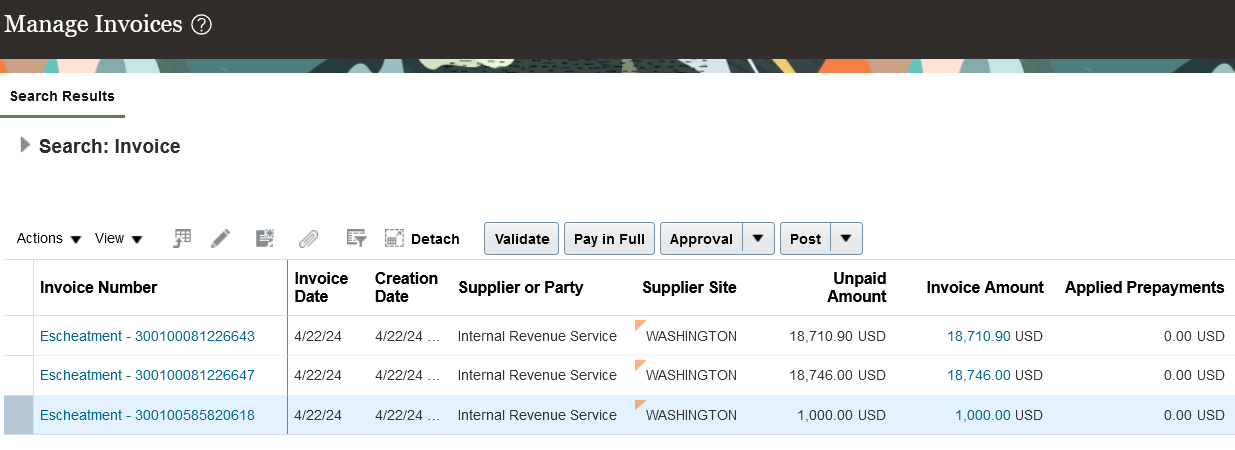

- Review Escheatment Invoice from Manage Invoice page.

Escheatment Invoice

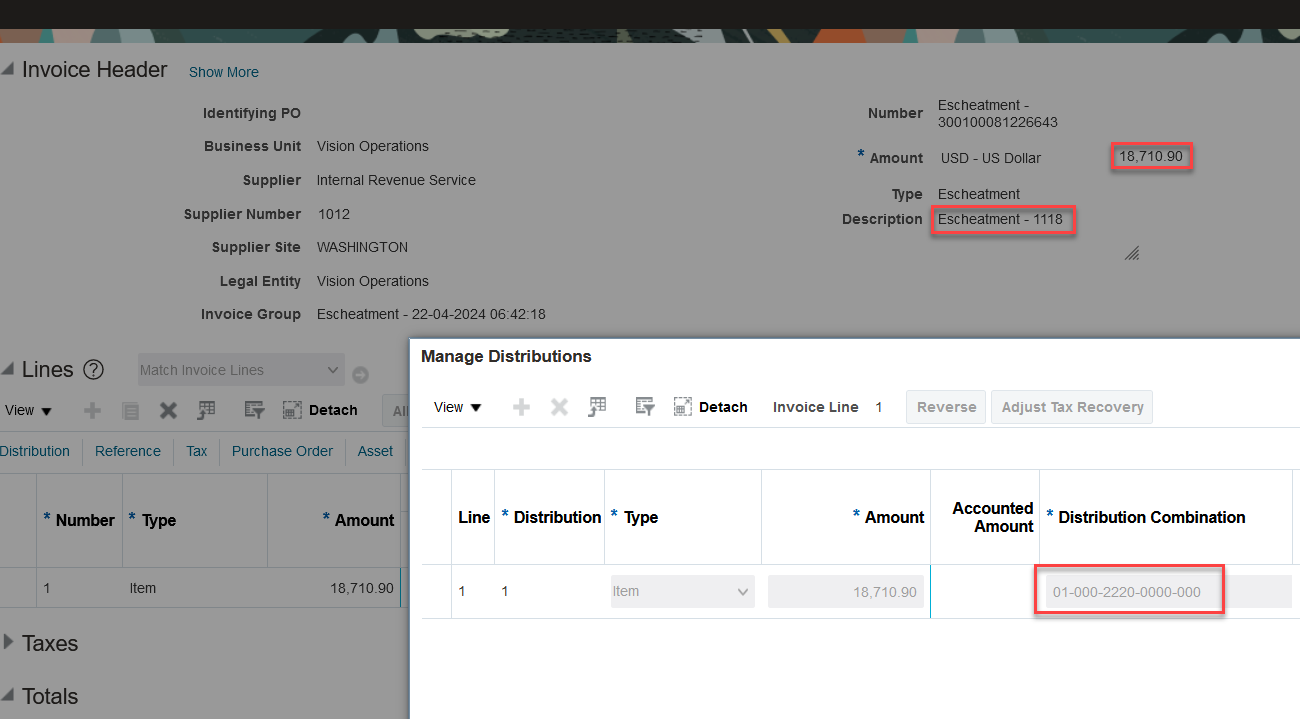

- An Escheatment invoice distribution is created using the Unclaimed Fund account that was credited when the payment was escheated.

Escheatment Invoice Distributions

Accounting Entries for the Payment and Escheated Payment when Offset Segments option is set to None and Account for Payment option is set to at Payment Issue and Clearing.

When payment is accounted:

Dr Supplier Liability Account

Cr Cash/Cash Clearing Account

When payment is escheated:

Dr Cash/Cash Clearing Account

Cr Unclaimed Fund Account

Create invoice on Escheatment Authority:

Dr Unclaimed Fund Account

Cr Escheatment Authority Liability Account

Generation of accounting entries for the escheated payment will be different based on Offset Segments and when to account payment options.

Report:

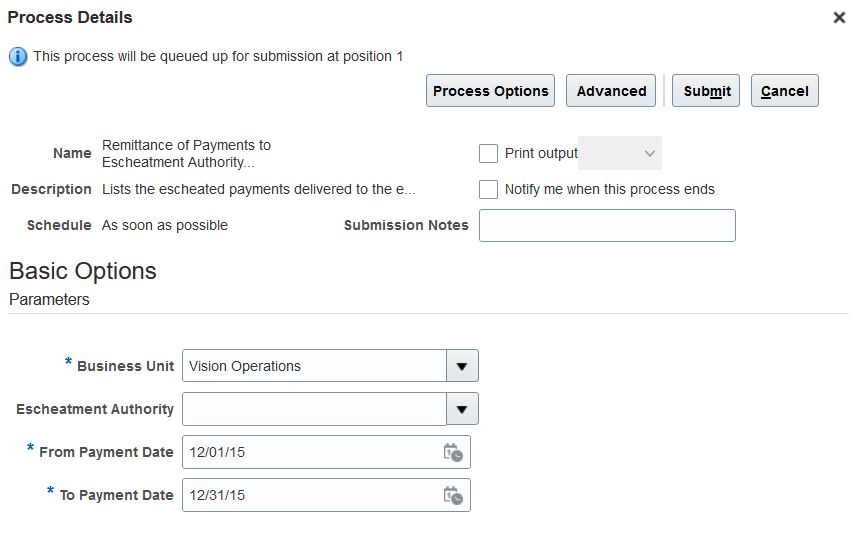

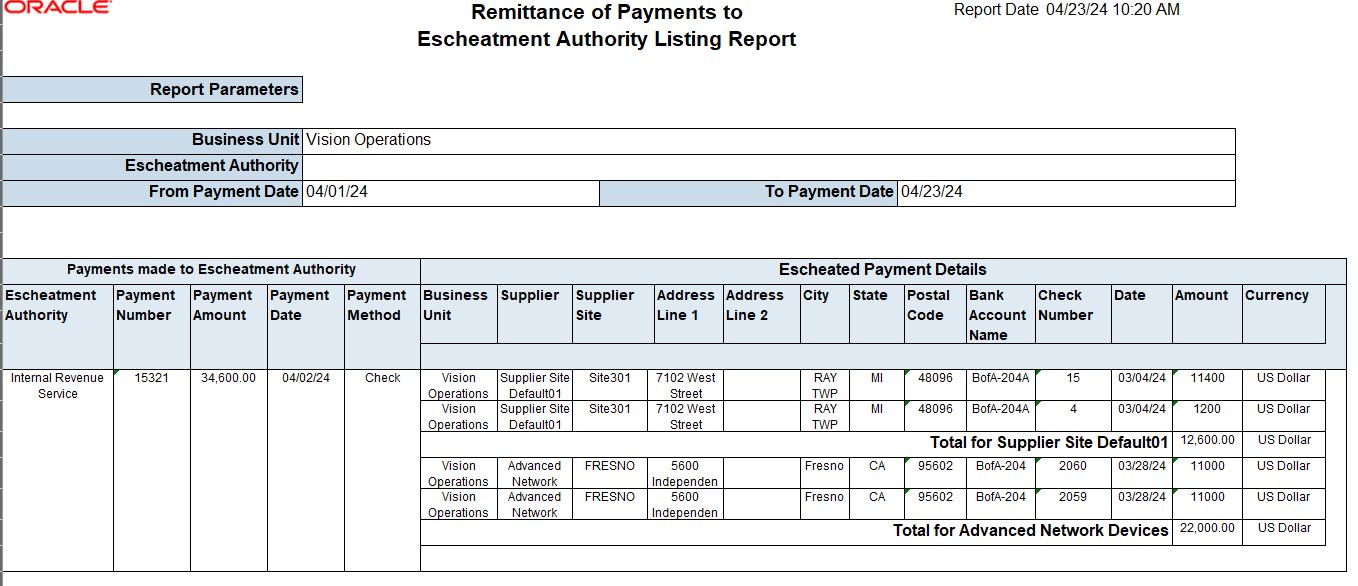

Run the Remittance of Payments to Escheatment Authority Listing Report to review payments remitted to escheatment authority

Remittance of Payments to Escheatment Authority Listing Report

Report Output

Business Benefit:

Escheatment is a legal process in which the government takes control of assets unclaimed for a long time. The state authority holds abandoned properties or dormant accounts for a limited period. It, thus, allows the owner, beneficiary, or legal heir to reclaim them. Proceeds from the sale of these assets go toward state funds. Failure to comply with state unclaimed property laws can allow the state to take legal actions against the holder in addition to charging high penalties. This features improves compliance with legal regulations by reporting unclaimed check payments which are not cashed in a specific time period and transfer such payments to the escheatment authority.

Steps to Enable

Following setups are mandatory to escheat the payments:

- Enter Unclaimed Fund Account in Manage Common Options for Payables and Procurement page.

- Enter minimum days to initiate escheatment in Manage Payment Options page.

Tips And Considerations

- You must account an escheated payment before you create the escheatment invoice.

- You can’t create escheatment invoice for stale payments that settle invoices belonging to different invoicing business units and legal entities.

- You can only create escheatment invoices for the escheatment authority supplier site assigned to the invoicing business unit.

Key Resources

- Transfer Escheated Funds to the Escheatment Authority

- Remittance of Payments to Escheatment Authority Listing Report

- How Payments Are Escheated

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 481025

Access Requirements

The new privilege predefined Escheat Unclaimed Payments is required to secure the Initiate Escheat and Escheat and Create Invoice actions in the Manage Payments page. This new privilege is added to the predefined duty role Payables Payment Processing Duty. This duty role is assigned to the predefined Accounts Payable Supervisor and Accounts Payable Manager job roles.