Multitier Intercompany Operations

Manage complex intercompany operations, such as funds transfers and expense or revenue sharing between provider and receiver organizations, through multiple clearing organizations. The multitier operations automate the generation of intercompany transactions between the organizations involved in the financial route when you transfer funds. This streamlines the ability to transact, settle, account for, and track transfers between organizations. This feature also enables the settlement of funds in a currency different from the currency in which the transfer was initiated. Automating the multitier operations will benefit enterprises that run global operations by improving operational efficiency, optimizing taxes, and managing currency exposure.

The new multitier functionality can be used in addition to the current intercompany capabilities. Multi-tier will provide value in the following scenarios:

- When there are frequent fund transfers between entities to meet working capital requirements and address internal financing needs. These treasury fund transfers instances of internal lending and borrowing often require bilateral agreements between involved parties. To formalize and streamline these arrangements, organizations can establish multitier intercompany agreements, serving as living documents authorizing fund transfers for a financial route. Each occurrence of transfer occurrence can be managed and documented as Intercompany Transfer Authorization.

- Routing of such intercompany transfers may also be performed through clearing organizations for achieving tax goals or to manage currency exposure. Using a clearing company has the following benefits:

- Automates intercompany operations from transfers to settlement

- Implement different operating models

- Trading Hubs: Execute on transfers of services and non-goods with fully automated and transparent transaction flow

- Internal Clearing House: Save on currency fluctuations with expedited settlement

- Internal Financing Hubs: Optimize cost of capital via internal lending and borrowing

A multitier intercompany transaction is structured as follows:

Intercompany Agreement is the main parent document that authorizes the transfer via a specific Financial Route. This can be a living document until the identified Financial Route and purpose is no longer active. For example, this can be the annual line of credit released by treasury department to its one of LOB entities.

Intercompany Transfer Authorization is the specific instance of intercompany transfer that needs to be executed following the Financial Route specified in the Agreement. Each Transfer Authorization can represent a new forward transaction such as a new loan or interest on loan. It can represent a negative transaction such as a repayment of loan or a cancellation of a loan or interest. There can be multiple Transfer Authorizations within a Agreement.

Intercompany transaction represents the detailed transfers between the entities involved. At the minimum, there will be one intercompany transaction between provider and the receiver (when no Clearing Organization is involved in the Financial Route). When one Clearing Organization is involved in the flow, there will be an intercompany transaction between Provider and Clearing Organization and another between Clearing Organization and Receiver.

Intercompany Invoices represents the accounts receivable (AR) and accounts payable (AP) invoices created from the intercompany transactions. This method of accounting and settlement is chosen when there are regulatory and accounting requirements to produce the backing documents behind the intercompany transfers. Typically this is required for cross border activities. This is optional and can be turned off to simply generate general ledger journal entries.

The following screenshots describe the process of Multitier intercompany flow:

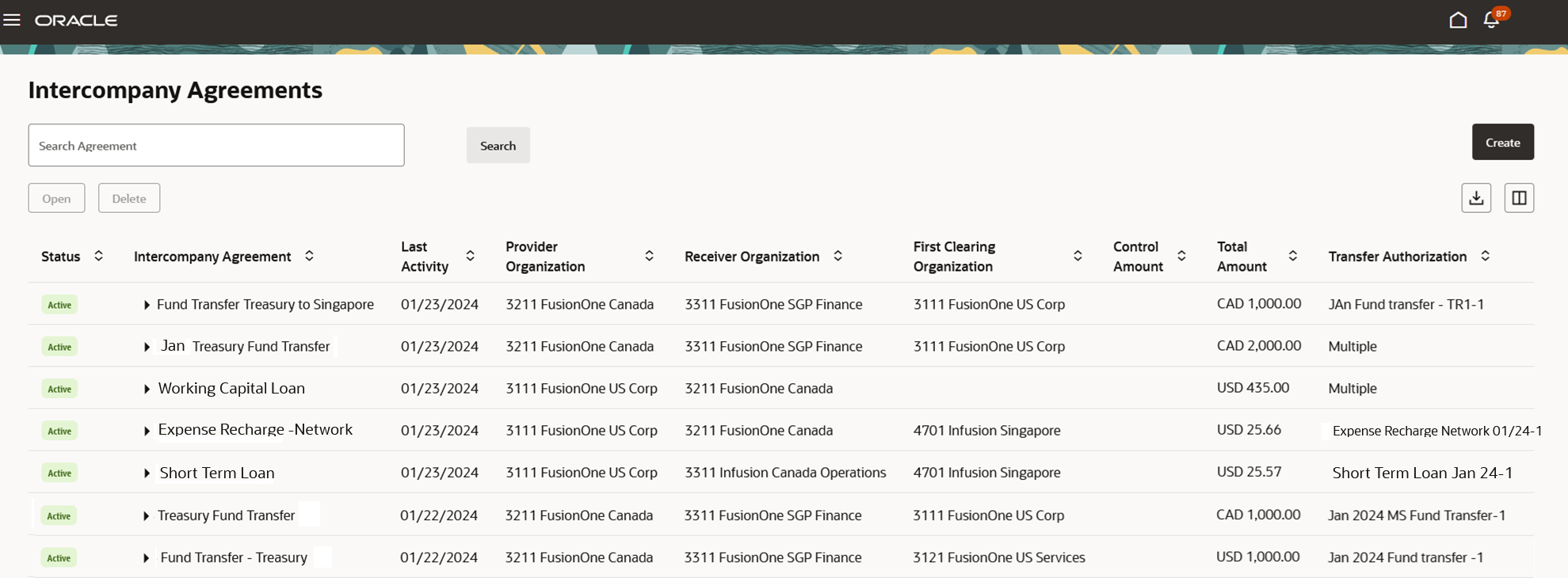

Use the Intercompany Agreement landing page to manage all intercompany agreements.

Multitier Intercompany Operations Landing Page

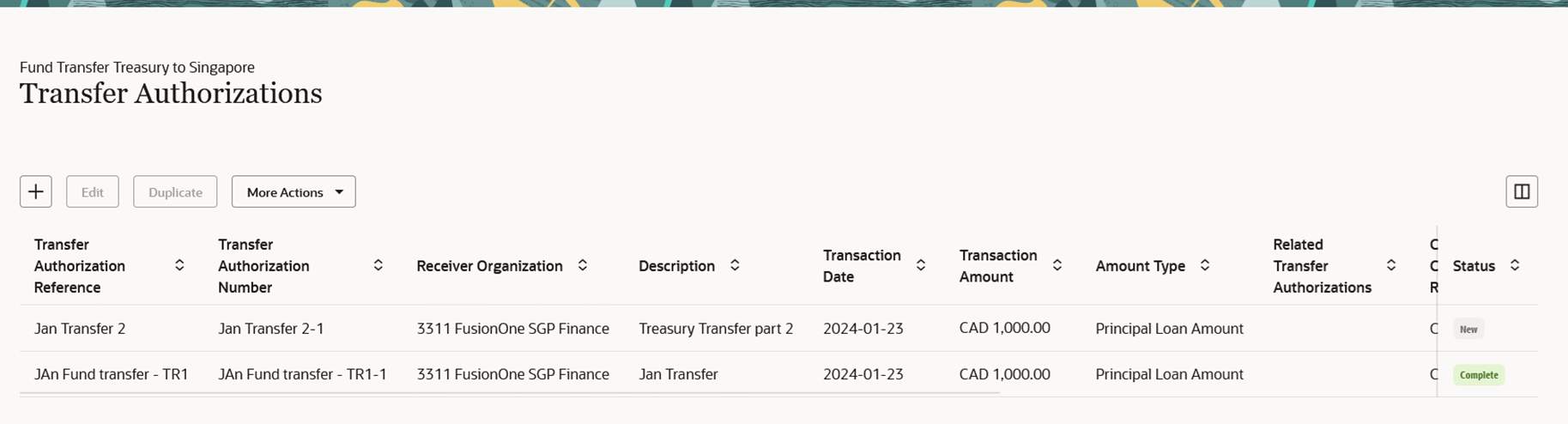

A transfer authorization is a specific instance of fund transfer between the organizations. In the below example, the authorization is for initiating transfer of funds for treasury purpose.

Transfer Authorization to initiate the fund transfer

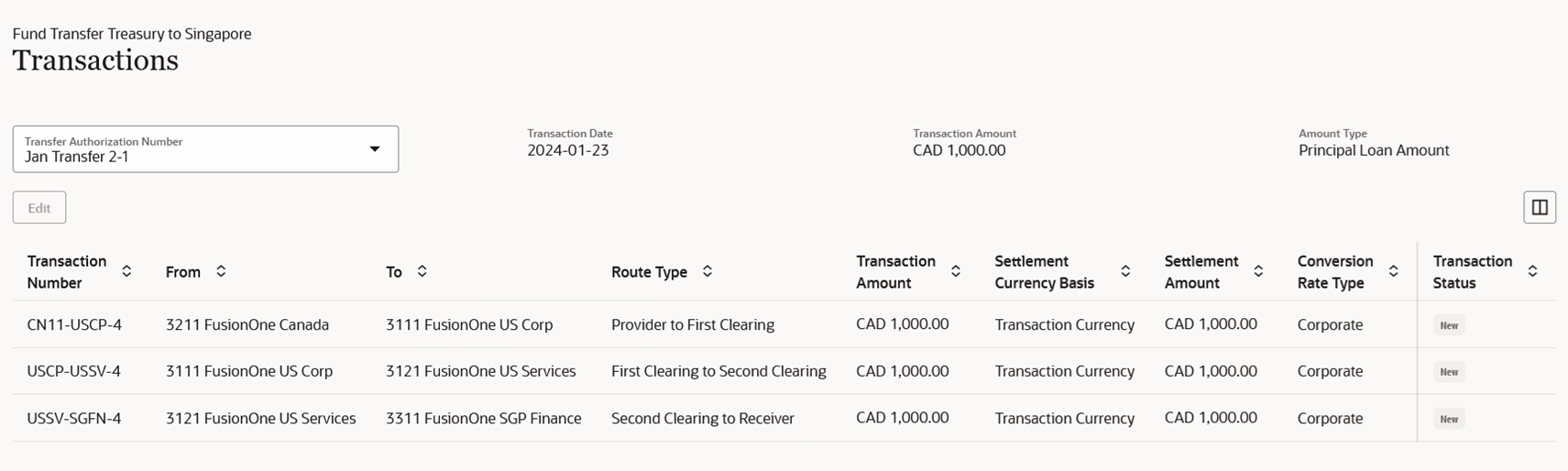

In the below example, three transactions result from the authorization, starting from provider to receiver through two clearing organizations.

Transactions generated by the system based on the financial route

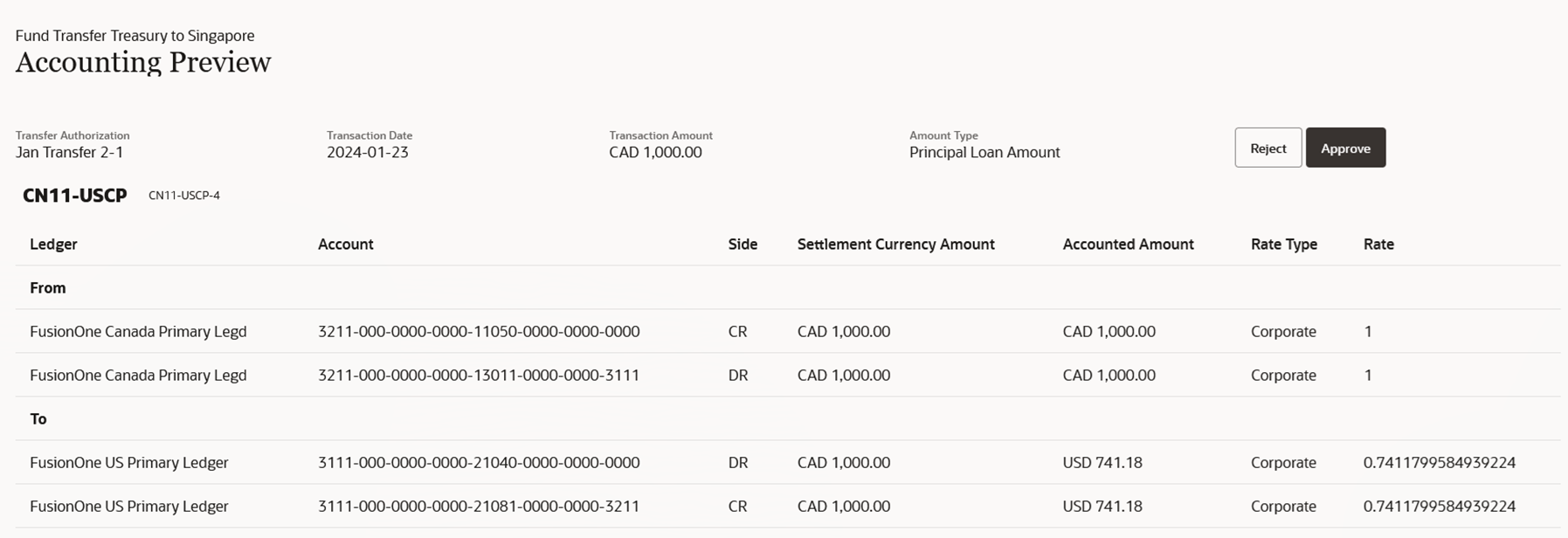

The early preview of the accounting is generated for each transaction.

Preview of Accounting for a Transaction

Business benefits include:

- Brings operational efficiency by automating the generation of intercompany transactions between the organizations involved in the financial route.

- Settlement of transactions in different currencies enables global enterprises to save currency conversion costs by planning financial routes accordingly.

- Streamlines the ability to define and record intercompany transactions having financial route through the intermediaries to meet organization's tax planning goals.

Steps to Enable

The following set ups are must for using multitier flow:

Association of Intercompany Organization with unique combination of balancing segments

An intercompany organization is the most granular and operational management unit that will record and report inter/intra company transfer. You must associate an intercompany organization to a specific primary balancing segment value or one unique combination of balancing segment values if secondary and/or tertiary balancing segments are also enabled for use in multitier flow.

Transaction Type

Intercompany transaction type defines the intent or purpose of the transaction flow and determine the onward processing of intercompany transactions. The transaction type must be enabled for use in multitier flow.

Intercompany Agreement

Intercompany agreement is the main parent document that authorizes the transfer via a specific financial route. You must define an active agreement that specifies the financial route consisting of provider, receiver and optionally, upto 2 clearing organizations along with other attributes.

Key Resources

- Introduction to Multitier Intercompany Operations

- How Multitier Intercompany Operations Process Intercompany Transactions

- Create Multitier Flow

- Define Transaction Type for Multitier Flow

- Data Security for Multitier Intercompany Operations

- Review the topical essay on Multitier Intercompany Operations to learn more about the rationale for different types of inter-company transactions and the management of those activities using inter-company accounting. The essay can also be referred to for additional guidance on organizational structures. The topical essay will be available at a later date on the Financial Management Resources Center.

Access Requirements

The following new duty roles are added and are associated with Intercompany Accountant role:

- Intercompany Agreement Processing

- Intercompany Agreement Management

- Intercompany Agreement Inquiry

In addition, create and enable this profile option to access the Multitier Intercompany Operations menu from within the Intercompany Accounting work area.

- FUN_ENABLE_INTERCO_MULTITIER