Enhanced Tax Rapid Implementation

Enhanced Tax Rapid Implementation

Use the additional columns in Tax Rapid Implementation to enter information related to tax rate controls and offset tax and recovery rates.

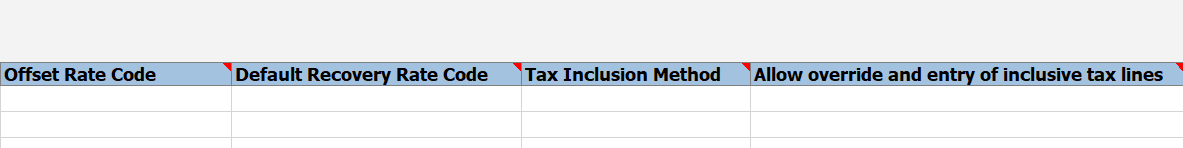

The following fields are included in the Manage Rates worksheet of the tax configuration workbook and the tax rates template spreadsheet.

- Offset Rate Code

- Default Recovery Rate Code

- Tax Inclusion Method

- Allow override and entry of inclusive tax lines

Business Benefits:

- Reduces the manual effort in updating offset and recovery tax rates, and tax-related options, using Tax Rapid Implementation. Tax Rapid Implementation is used for initial configuration of tax and ongoing maintenance when business or tax regulations change. The new fields introduced are commonly used by many customers and require a significant amount of manual effort to update, when the number of tax rates uploaded is high. It offers an option to provide the values for these fields when creating tax rates using Tax Rapid Implementation.

- Helps fulfill tax requirements of organizations with strict configuration access policies.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The offset rates and the recovery rates referenced in these columns must already be created prior to uploading the spreadsheet.

- The recovery rate can be created using the Manage Tax Recovery Rates worksheet along with the tax rate in the same tax configuration workbook.

Key Resources

- Overview of Define Taxes for Rapid Implementation

- Can I only use the rapid implementation task list to create my tax configuration?

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 704310