Residual Balance Clearing for Transaction Currency Revenue Recognition

Write off residual balances due to terminations, full satisfaction and foreign currency gains and losses addressed by General Ledger Revaluation. Use this process to eliminate small balances for end-of-life contracts by setting the contract's balance sheet accounts to zero.

Organizations engaged in commerce in currencies other than their local currency can model their revenue contracts using the transaction currency as the contract currency. The transaction currency consideration value is used as the basis for the revenue allocation and recognition of both ledger and nonledger currency-denominated revenue contract performance obligations. When using this approach, the native Oracle General Ledger revaluation functionality is used to derive and record unrealized foreign currency gains and losses by truing up the balance sheet to current rates.

As the results from the true-up are not reflected in the revenue contract within Oracle Revenue Management, residual balances in the contract balance sheet accounts within Revenue Management and its subledger may exist.

This feature provides the ability to clear out the currency-related residual balances using the enhanced Residual Account Balance Write-Off process.

This process:

- Identifies residual balances in the contract balance sheet accounts due to foreign exchange currency rates. It offsets the balances to a user-defined currency revaluation offset account without impacting existing balances in the contract balance sheet account balances within General Ledger.

- Clears out residual balances in Revenue Management due to foreign currency unrealized gains and losses managed by the Oracle General Ledger Revaluation process.

- Generates Revenue Management offsetting entries and withholds the entries from being posted to General Ledger.

- Tracks eligibility and adjustment status with the new Currency Revaluation Adjustment Status.

- Applies to foreign currency revenue contracts modeled in either the Entered or Accounted allocation currency basis.

Segregate Offsetting Balances

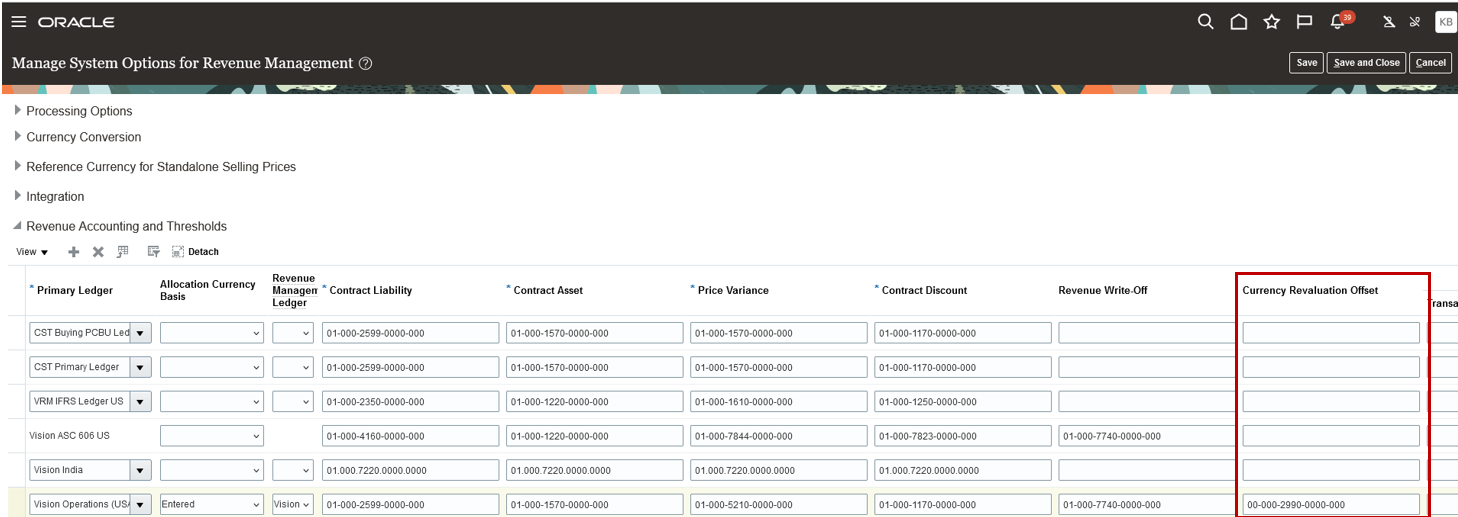

Use the newly added Currency Revaluation Offset account in the Revenue Accounting and Thresholds section in the Manage System Options for Revenue Management to designate a dummy account to record the currency-related offset balances for your processing ledger. When the process encounters end-of-life currency-related residual balances, Revenue Management offsets accounting entries are created. The entries negate any currency-related residual balances in the contract balance sheet accounts and moves them to the Currency Revaluation Offset account. As the entries are subledger only, they are not posted and do not impact the corresponding contract account balances within General Ledger.

Manage System Options for Revenue Management - Currency Revaluation Offset

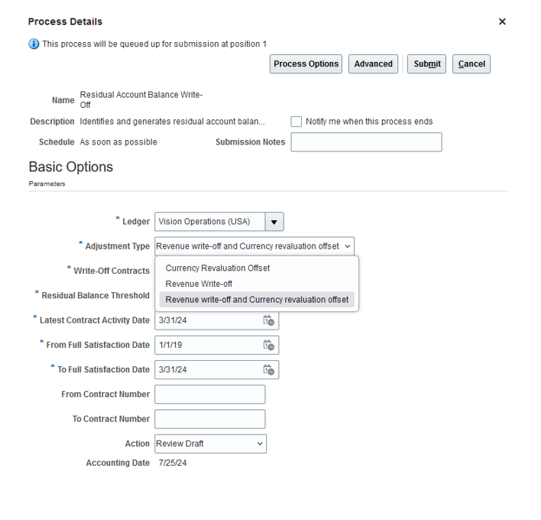

Residual Account Balance Write-off – Adjustment Type

Residual Account Balance Write-off - Adjustment Type

The Residual Account Balance Write-off process now supports clearing of residual balances to revenue and currency revaluation offsets for fully satisfied contracts and contracts terminated with immaterial changes.

The Process Details window for the Residual Account Balance Write off process now provides multifunctional processing by introducing a new Adjustment Type parameter.

Use this parameter to indicate which process you want to perform, write off revenue only, offset currency revaluation balances only, or both.

When you select, Adjustment Type, Revenue Write-off, the process identifies the eligible revenue contracts as selected based on the defined process parameters where revenue related contract residual balances exist for balance sheet accounts.The Contract Residual Account Balance Write-Off report displays the residual balances and the adjustment balances by contract balance sheet account.

When you select Adjustment Type, Currency Revaluation Offset, the process identifies the eligible foreign currency revenue contracts based on the defined process parameters where there are no revenue-related residual balance sheet amounts, but currency-related residual balances remain. The Contract Residual Account Balance Write-Off report displays the residual balances and the adjustment balances by contract balance sheet account.

When you select Adjustment Type Revenue write-off and Currency revaluation offset, the process selects the eligible foreign currency and nonforeign currency revenue contracts as selected based on the defined process parameters, where there are revenue-related residual balance sheet amounts remaining, in addition to the remaining currency-related residual balances. The process first writes off the revenue-related items and then offsets the remaining currency-related balances. In the Contract Residual Account Balance Write-Off report, the process displays the residual balances and the adjustment balances by contract balance sheet account for both the entered and accounted currencies.

Updated Residual Balance Threshold Logic

The Residual Balance Threshold parameter rule logic has been improved and the threshold is now evaluated against all the contract balance sheet accounts. Now contracts are selected where the residual balance in all the contract balance sheet accounts for the revenue contract are within the plus or minus range of the defined threshold amount. Previously, the contract was selected when only one of the contract balance sheet account’s residual balances met the threshold. This ensures that contracts are not prematurely written off, because once a contract is in Final adjusted status, no further application of billing or revisioning is allowed.

Track Contract Eligibility and Adjustments

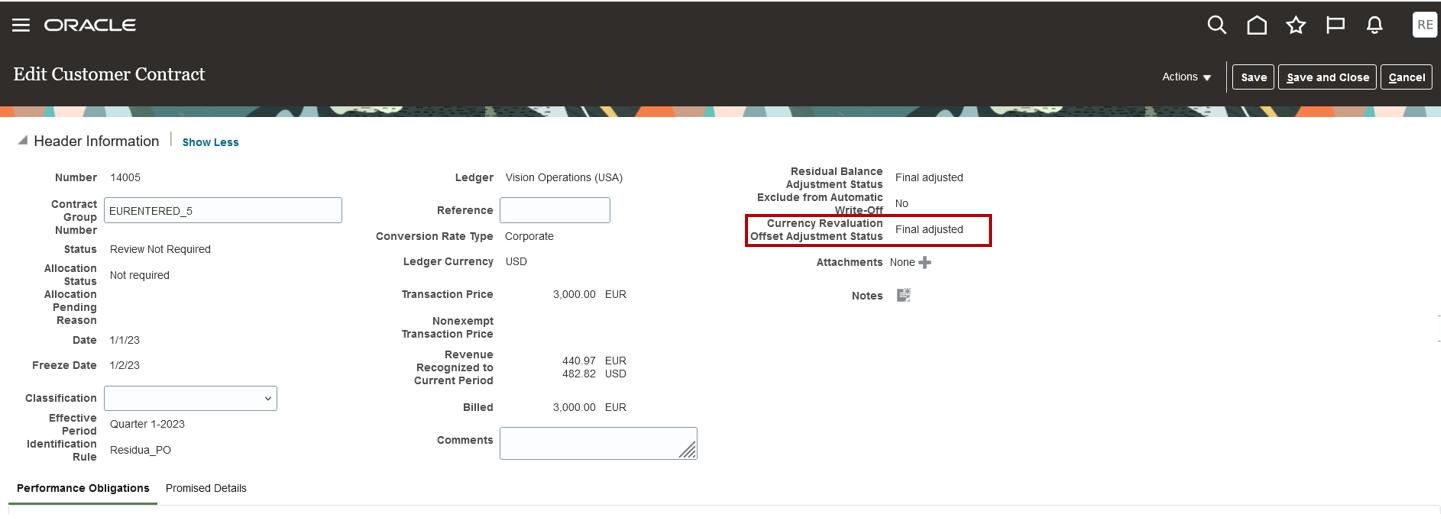

In addition to the Residual Balance Adjustment Status, a new status is added to the Edit Customer Contract’s Header Information region.

Edit Customer Contract - Currency Revaluation Offset Adjustment Status

Use the new Currency Revaluation Offset Adjustment Status field to track the eligibility and adjustment status for your foreign currency contracts as they move through the Currency Revaluation Offset eligibility and processing cycle.

Once a foreign currency contract status is set to Final adjusted by the Residual Account Balance Write-off process using Adjustment Type of Revenue Write-Off process, the contract is no longer eligible for future processing for billing or revisioning. Any subsequent source document lines or billing lines imported for the revenue contract are tagged as rejected by the Validate Customer Contracts process. However, the contract is still eligible for processing by the Residual Account Balance Write Off process using, Adjustment Type of Currency Revaluation Offset.

When creating the accounting distributions for the contract, the process verifies and updates the status accordingly. The first time you run the process, the application evaluates the contract’s position against the new logic. It then determines if any legacy foreign currency contracts with residual balances are eligible for currency revaluation offset processing.

The Currency Revaluation Offset Adjustment Status consists of the following four status values:

Currency Revaluation Offset Adjustment Values

| Status | Description |

|---|---|

|

Not eligible for offset |

Status that indicates the contract is not yet available for currency revaluation offset processing. |

|

Eligible for offset |

Status that indicates the contract requires currency revaluation offset processing. |

|

No offset required |

Status that indicates the contract does not require residual currency revaluation account balances offsetting. |

|

Final adjusted |

Status that indicates the contract's currency revaluation offset entries are created and the contract is closed from any further processing. |

Expanded Reporting

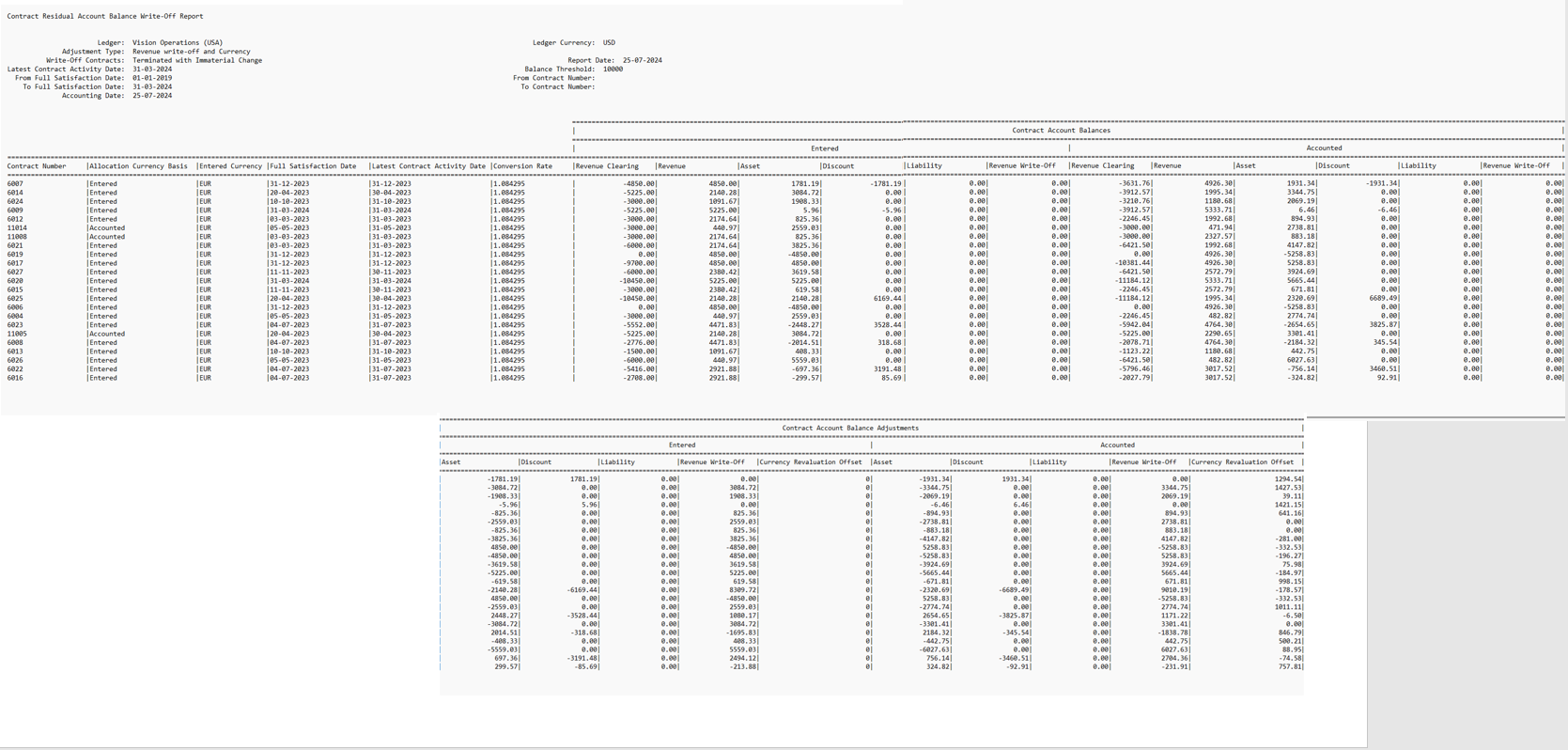

Contract Residual Account Balance Write-Off Report

Contract Residual Account Balance Write-off Report

The Contract Residual Account Balance Write-off report generated by the Residual Account Balance Write-off process is modified to include currency revaluation offset details.

The report includes additional data elements in support of the currency revaluation offset process. For each selected contract, the report displays the contract’s balance sheet current net balances in both the entered and accounted currencies, as well as the adjustment amounts. Use the Review Draft action to generate a draft report of the eligible contracts and contract balances to be cleared or offset. You can use this report together with the Contract Activity Detail Report to reconcile the write-off and offset amounts for individual contracts before generating the final entries.

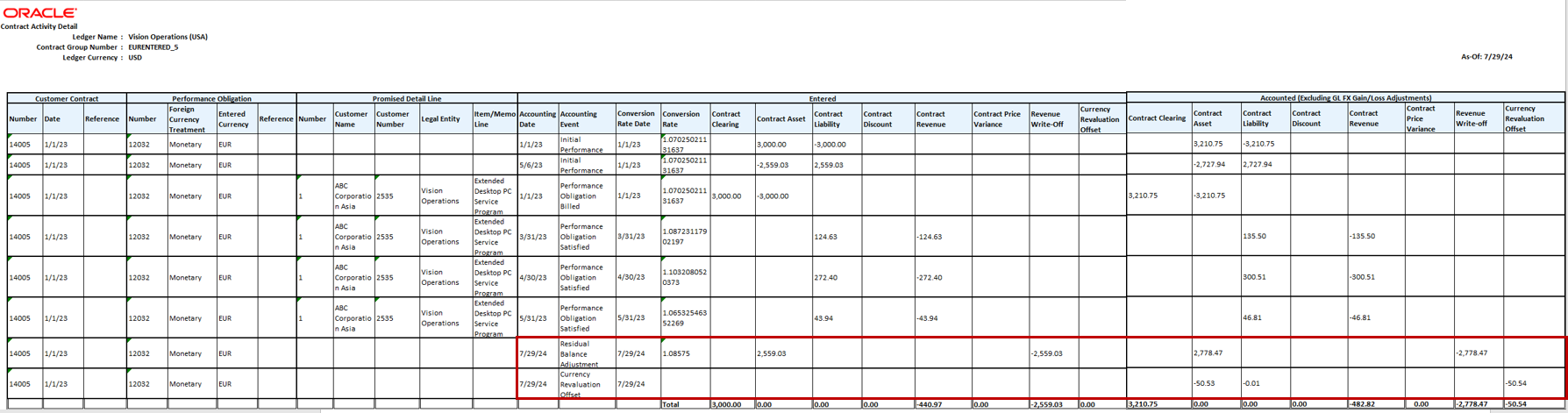

Contract Activity Detail Report – Currency Revaluation Offset

Contract Activities Detail Report

Run the Contract Activity Detail report from the Manage Customer Contracts page. The report includes the currency revaluation offset journal entries. Use this report to view the posted residual revenue write-off and currency revaluation offset entries for each revenue contract. When you execute the Residual Account Balance Write-off process in Final adjusted status, the process generates the applicable accounting entries. The next time you execute the Create Accounting process, the entries are posted and are available for viewing in the report.

Calculation Logic

The Allocation Currency Basis option used to model the revenue contract indicates which contract balance sheet account distributions, Entered or Accounted, are used to drive the calculation for the revenue write-off and currency revaluation offset calculations for processing foreign currency revenue contracts. When selecting eligible contracts for processing, the application first identifies the allocation currency basis, Entered or Accounted, then evaluates whether there are any residual balances in the contract balance sheet accounts for that allocation currency basis. If so, the application clears those balances first by converting the corresponding amount using the exchange rate as of the contract inception date or as of the accounting date parameter selected for the process run.

For revenue contracts modeled using Accounted as the allocation currency basis, the application converts the contract to the accounted currency using the exchange rate at contract inception. When processing these contracts, clearing amounts for the balance sheet contract accounts are posted to be written off in the accounted currency. The balance is converted back to the contract's entered currency using the inversion rate of the contract at inception date. Then any remaining residual contract balances remaining in the entered currency are eligible for offset to the currency revaluation offset account.

For revenue contracts modeled using Entered as the allocation currency basis, the contract is modeled in its transaction currency with the accounting distributions converted to the accounted currency using the conversion rate as of the transaction date (monetary) or initial performance date (nonmonetary). When processing these contracts, the application writes off the clearing of the balance sheet in the entered currency with the balance converted to the accounted currency using the conversion rate as of the accounting date selected in the process, regardless of whether the contract consists of monetary or nonmonetary contracts. Then any remaining residual contract account balances residing in the accounted currency are eligible to offset to the currency revaluation offset account.

Calculation Drivers

|

Adjustment Type |

Allocation Currency Basis |

Conversion Rate Type |

Conversion Rate Date |

Driving Balance |

|---|---|---|---|---|

|

Revenue Write-off |

Accounted/Blank |

System Options |

Contract Inception (Inversion Rate) |

Accounted |

|

Revenue Write-off |

Entered |

System Options |

Process Accounting Date |

Entered |

|

Currency Revaluation Offset |

Accounted/Blank |

System Options |

No Conversion |

Entered |

|

Currency Revaluation Offset |

Entered |

System Options |

No Conversion |

Accounted |

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Residual revenue write-off applies only to revenue contracts where:

- All performance obligations have been fully satisfied.

- At least one of the contract’s performance obligations is terminated with an immaterial change.

- Contracts with residual contract balance sheet account balances eligible for revenue write-off

- When the contract’s Allocation Currency Basis = Accounted

- Contract balance sheet account balances in the accounted columns <>0

- When the contract’s Allocation Currency Basis = Entered

- Contract balance sheet account balances in the entered columns <>0

- When the contract’s Allocation Currency Basis = Accounted

- Contracts with residual contract balance sheet account balances eligible for currency revaluation offset

- When the contract’s Allocation Currency Basis = Accounted

- Contract balance sheet account balances in the accounted columns = 0

- Contract balance sheet account balances in the entered columns <>0

- When the contract’s Allocation Currency Basis = Entered

- Contract balance sheet account balances in the entered columns = 0

- Contract balance sheet account balances in the accounted columns <>0

- When the contract’s Allocation Currency Basis = Accounted

- Currency Revaluation Offset accounting distributions are not subject to conversion because the entry sets the contract balance sheet accounts balance to zero.

- Residual Balance Threshold

- Applies when the Adjustment Type equals Revenue Write-off or Revenue write-off and Currency revaluation offset

- Contracts with residual contract balance sheet account balances within plus or minus the residual balance threshold in all accounts are selected. Previously, only one account balance within the balance threshold was required.

- When the contract’s allocation currency basis = Accounted or Blank

- Evaluates the residual balance threshold against the contract's accounted contract balance sheet account distributions.

- When the contract’s allocation currency basis = Entered

- Evaluates the residual balance threshold against the contract's entered contract balance sheet accounts distribution.

- You must execute the Create Accounting process in Final or Post status after running the Residual Account Balance Write off process in Final adjusted status to view the entries in the Contract Activity Detail report.

Key Resources

- For more information on Revenue Allocation and Recognition in Transaction Currency, refer to the following:

- Financials What’s New: 24B – Revenue Allocation and Recognition in Transaction Currency for more details.

Access Requirements

No new role access is required to use this feature.