Automatic Preparation for Large Volume Transactions

Automatically partition a single Accounting Hub transaction consisting of hundreds of thousands of lines into smaller transactions during the import process. Create Accounting can then process the smaller transactions in parallel to achieve faster completion time.

Upon enabling this feature, large Accounting Hub transactions that exceed 100,000 lines per transaction are automatically split into smaller transactions consisting of 300 lines or fewer based on a configurable grouping criteria. These small transactions are then independently processed by the Create Accounting process using the suspense account assigned to the ledger to generate a balanced accounting entry. An alternative clearing account may also be configured by users if suspense is not enabled or if there is a requirement to use a different account instead of the default suspense account. If the large transaction results in a balanced accounting entry, the suspense or clearing account will net to zero after all the small transactions are accounted successfully.

By default, transaction lines with different values in the 'Default Currency' column of the transaction data file won't be grouped into the same small transaction. You can configure additional line level sources as group by attributes so that the transaction lines with different values for such sources aren't grouped together.

Assuming there are 200,000 lines in a transaction and all these lines have the same currency and balancing segment value and suspense is enabled, this feature will create 667 small transactions with 300 lines or fewer. The accounting entry for each small transaction will be balanced by the suspense account and the suspense amount across the 677 transactions will net to zero assuming the large transaction contains balance data. If suspense is not enabled or you wish to use a different account, you can configure a custom account rule to derive the clearing account.

Refer to the 'How to enable' section below for detailed steps to configure the clearing account and assign additional group by attributes.

This feature is beneficial in scenarios where the external source system generates accounted data that is brought into Accounting Hub and the transaction to lines ratio is very high.

Steps to Enable

Use the following steps to enable this feature.

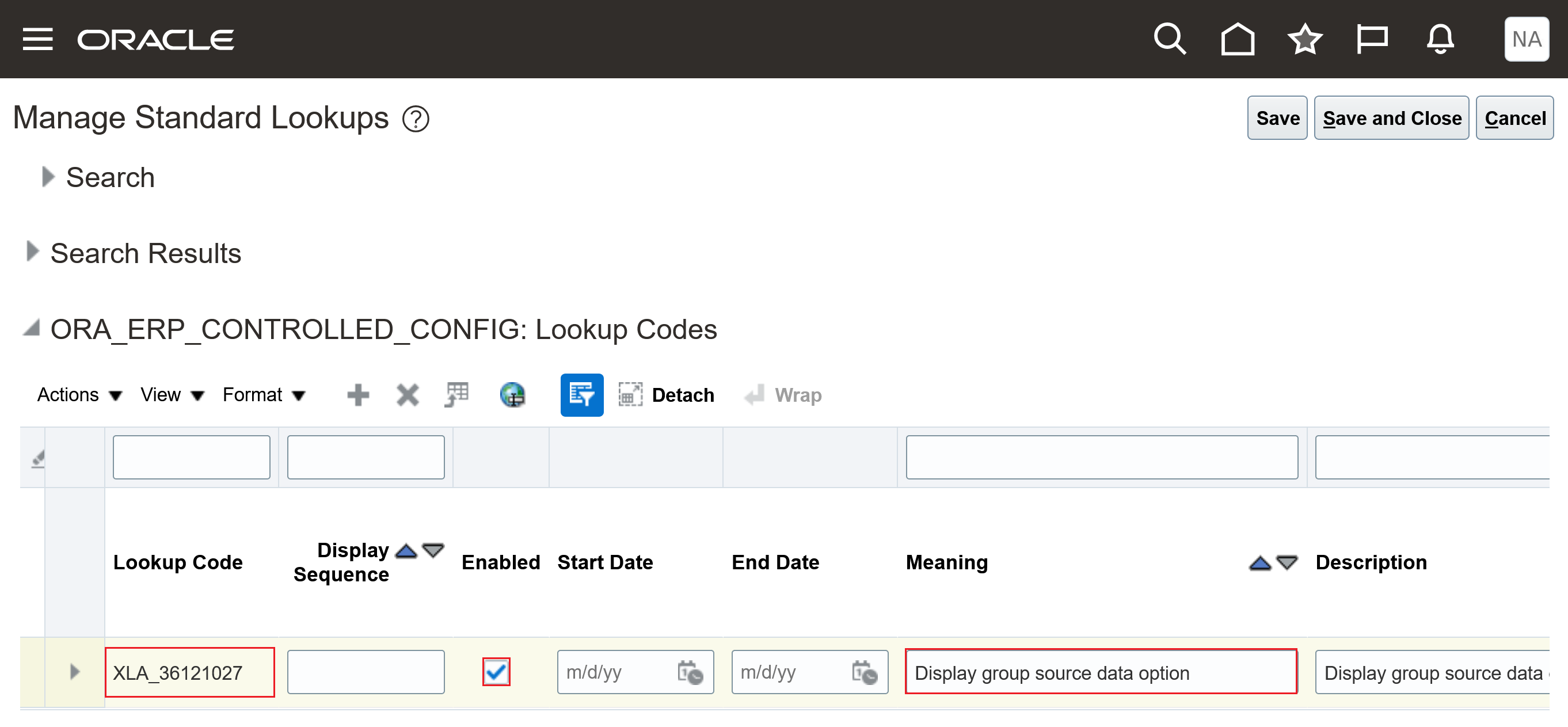

- Add a promotional option code to display the group source data option for the event class.

- Navigate to Setup and Maintenance.

- Search and navigate to the Setup Task: Manage Standard Lookups.

- Search for the Lookup Type: ORA_ERP_CONTROLLED_CONFIG.

- Lookup Code: XLA_36121027

- Enabled: <Checked>

- Meaning: Display Group source data option in UI

- Save the changes.

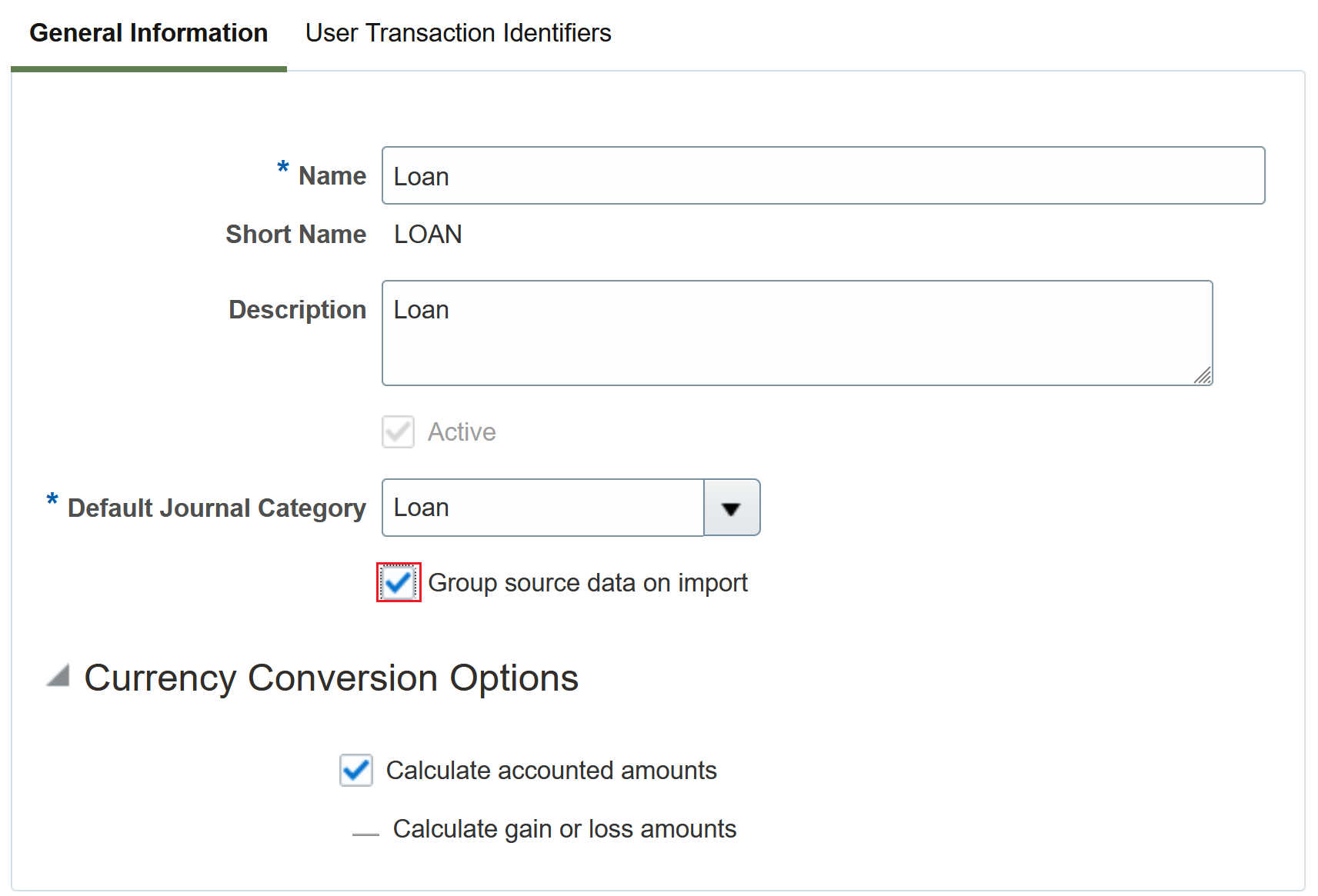

- Enable the group source data on import in the Manage Subledger Applications task.

- Navigate to Setup and Maintenance.

- Select the Setup Offering: Fusion Accounting Hub.

- Click on the Functional Area: Accounting Transformation.

- Click on the Setup Task: Manage Subledger Applications with scope set for your accounting hub subledger.

- Select event class in the event model hierarchy.

- Select the 'Group source data on import' option.

- Save the changes.

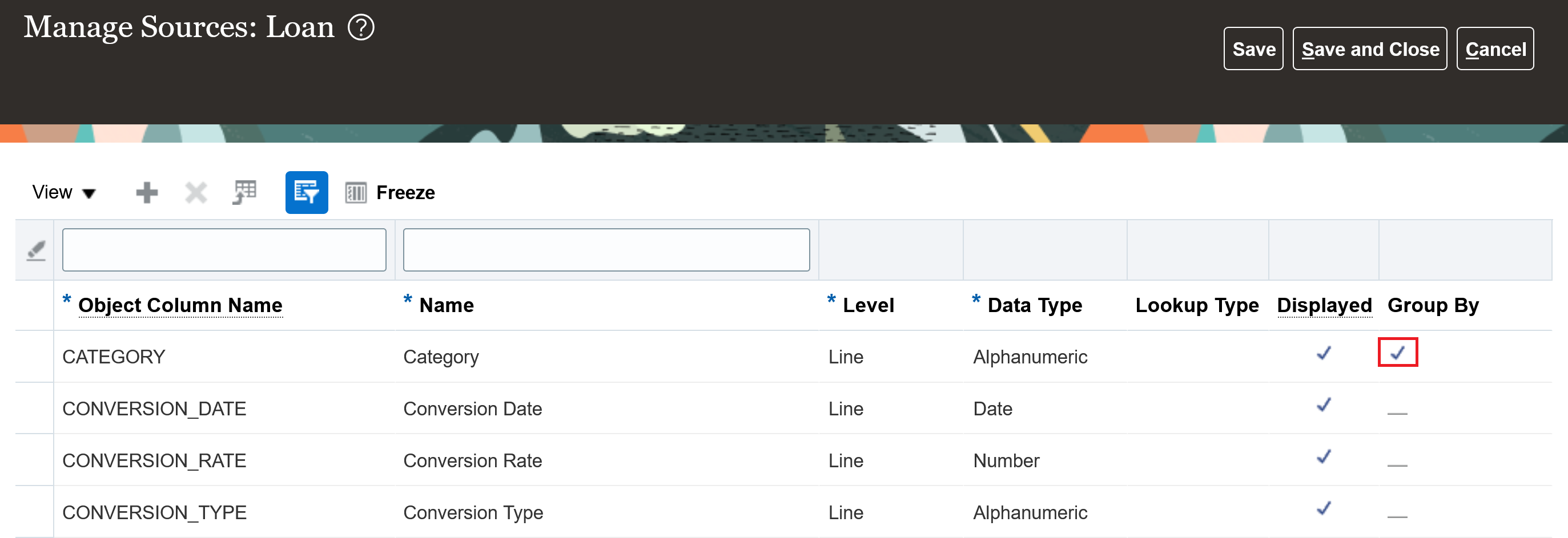

Configuring Additional Sources as Grouping Attributes

Assign additional sources as grouping attributes if applicable. You can assign any line level source as grouping attribute so that transaction line with different value in default currency and grouping attributes won't be grouped into the same event.

- Navigate to Setup and Maintenance.

- Select the Setup Offering: Fusion Accounting Hub.

- Click on the Functional Area: Accounting Transformation.

- Click on the Setup Task: Manage Sources with scope set for your accounting hub subledger.

- Check the 'Group By' attribute for the source.

- Save the changes.

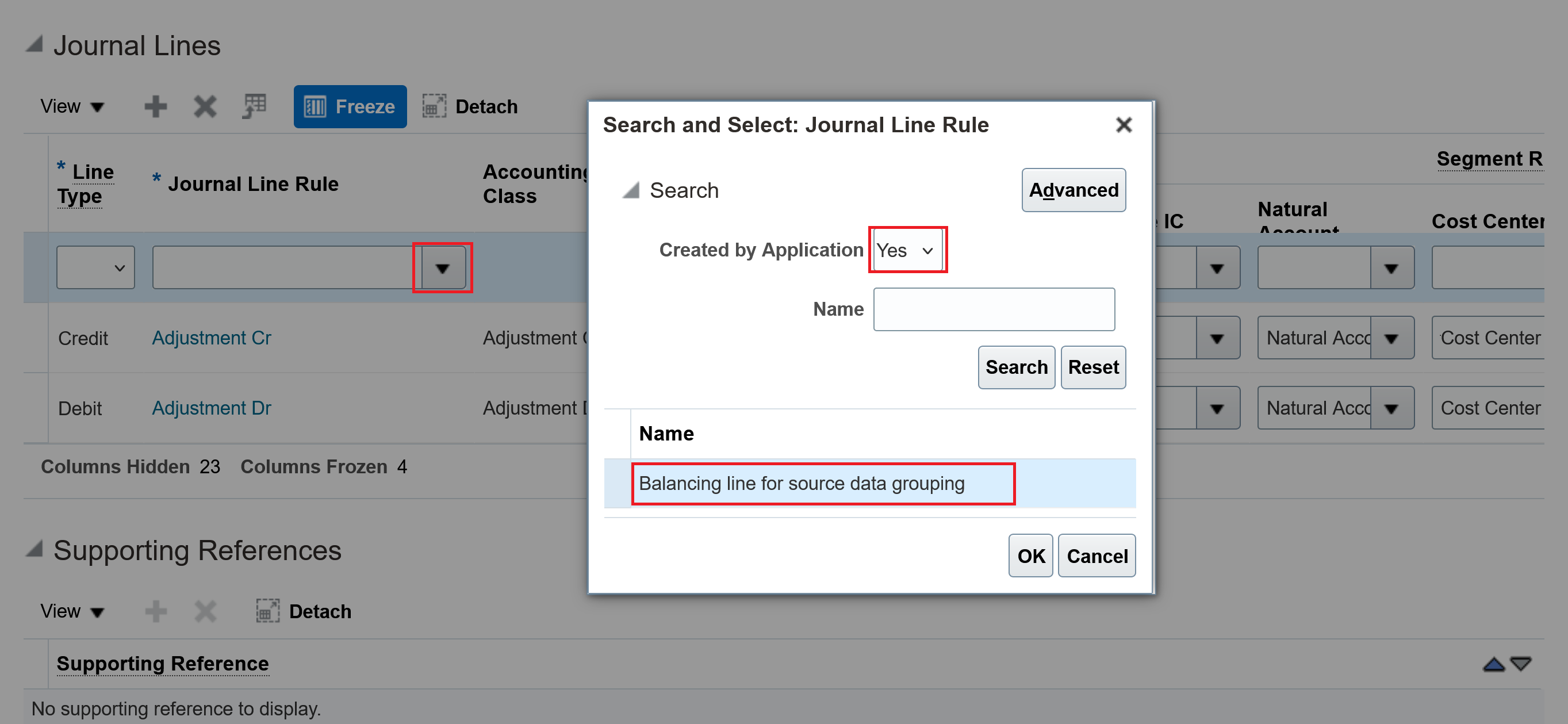

Configuring a Clearing Account other than the Default Suspense Account

If suspense is not enabled or you wish to use a different clearing account, then perform the following steps to configure the clearing account.

- Define account rule to derive the clearing account to be used to balance individual subledger accounting entries for a large transaction.

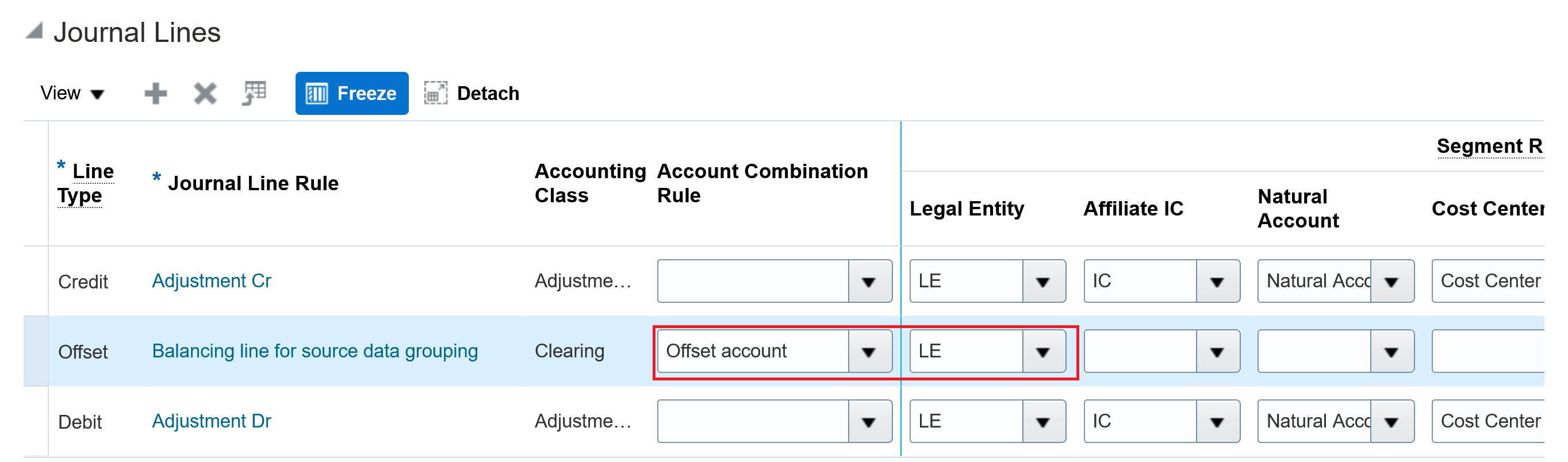

- Assign the pre-defined journal line rule 'Balancing line for source data grouping' to your journal entry rule set.

- Navigate to Setup and Maintenance.

- Select the Setup Offering: Fusion Accounting Hub.

- Click on the Functional Area: Accounting Transformation.

- Click on the Setup Task: Manage Journal Entry Rule Set with scope set for your accounting hub subledger.

- Edit the journal entry rule set associated with the large transaction's event type.

- Add a row in the journal line region.

- Search for the pre-defined journal line rule 'Balancing line for source data grouping' and assign to the rule set.

- Assign account rule(s) to the 'Balancing line for source data group'.

- Save the changes.

- Activate the subledger journal entry rule set assignments.

Tips And Considerations

Here are a few important tips to note while using this feature –

-

This feature doesn't support any of the following configurations:

- When the 'Flexible Configuration of Accounting Hub Cloud Service End-to-End Flow' feature is not enabled.

- When Transfer to EBS General Ledger is enabled.

- When Transfer to Peoplesoft General Ledger is enabled.

-

Transaction lines in a large transaction with the same value in the Default Currency source and other sources designated as group by attribute will be grouped into the same accounting entry. If the large transaction results in an accounting entry with multiple balancing segment values, it's recommended to assign any sources used to derive the balancing segment as group by attribute to minimize the number of balancing lines created for each individual accounting entry in the large transaction. For example, if the 'Category' source is used to derive the GL account balancing segment value, then assign it as the grouping attribute. If you want to assign a supporting reference to the clearing line, then it's also recommended to assign the supporting reference source as group by attribute. However, too many group by attributes may hinder performance and increase the number of accounting entries.

-

If a source other than Default Currency is used to derive the entered currency of the accounting entry, assign that source as a group by attribute to minimize the number of clearing lines.

-

If the large transaction is not balance by balancing segments, the intercompany balancing amount will be posted to the suspense or clearing account.

-

If the large transaction has multiple currencies and is not balanced by currency, the currency balancing amount will be posted to the suspense or clearing account.

-

If the large transaction has exchange gain or loss in subledger level reporting currency or secondary ledger, the exchange gain or loss may be posted to the clearing account.

-

In case an invalid accounting entry is created for any of the small transactions, the valid accounting entries belong to the same large transaction will be accounted with a final status and will be eligible for transfer and posting in the General Ledger. You can use one of the following methods to correct the invalid entry.

-

If transaction reversal is enabled,

- Reverse the transaction to negate the accounting impact of the posted journal related to the original large transaction.

- Submit the Accounting Hub Maintenance process with the Purge invalid transaction mode to delete the invalid small transaction and its reversal.

- Re-import the transaction with new transaction numbers after the data or configuration has been modified to resolve the original accounting exception.

-

If transaction reversal is not enabled,

- Re-import the large transaction with negative amounts to negate the accounting impact of the posted journal related to the original large transaction.

- Submit the Accounting Hub Maintenance process with the Purge invalid transaction mode to delete the invalid small transactions.

- Re-import the transaction with new transaction numbers after modifying the data or configuration to resolve the original accounting exception.

-