Configuration Simplification for Payables Withholding Tax Calculation

Simplify the withholding tax configuration to improve efficiency in both withholding tax calculation and payment processing. Configure the withholding tax certificate generation for each tax at the tax or tax rate level to reduce the number of taxes created. Set up tax rule conditions using new operators when Transaction Tax is used, to reduce the number of tax rules needed to determine complex taxable bases for withholding taxes.

Generate the withholding certificate for Argentina at different levels

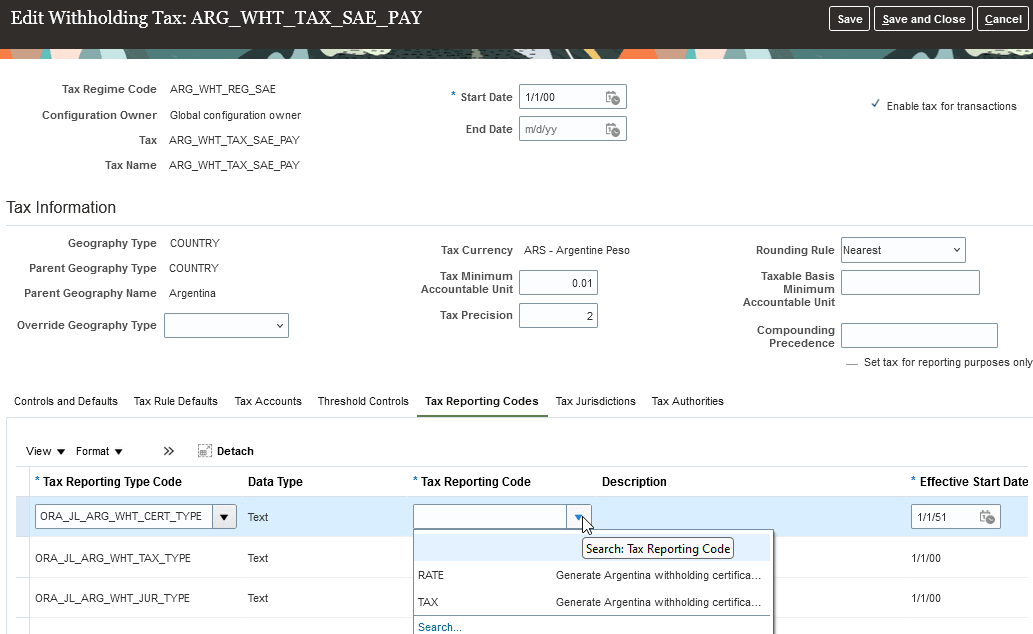

Define if the withholding certificate needs to be generated at the withholding tax or tax rate level at the Withholding Tax page.

You need to add the ORA_JL_ARG_WHT_CERT_TYPE tax reporting type and the level RATE or TAX.

Define what will be the Tax Regime printed in the withholding certificate adding the Tax Reporting Type Code ORA_JL_ARG_WHT_REGIME_CODE to the tax or to the tax rate according to the selected option at ORA_JL_ARG_WHT_CERT_TYPE.

Edit Withholding Tax page

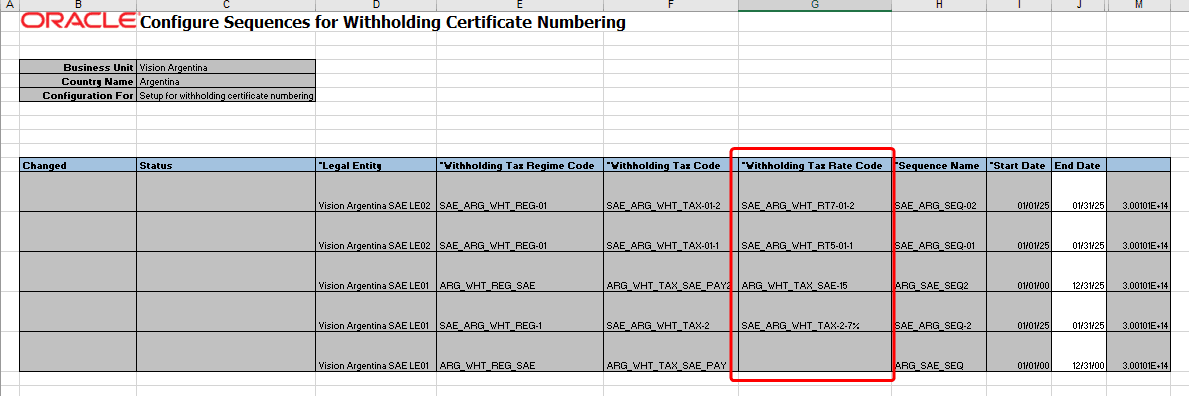

After defining the document sequences you need to associate them to the corresponding tax or tax rate using the Manage Localization Document Numbering task, selecting the Argentina country and the Configure Sequences for Withholding Certificate Numbering option.

A new column Withholding Tax Rate Code is available and can be populated only if the corresponding tax was defined to generate the withholding tax certificate at the tax rate level.

\

Create Document Numbering in Spreadsheet - Configure Sequences for Withholding Certificate Numbering

NOTE: It is highly recommended to define a cut-over date--typically the start of the next fiscal year--if you intend to reverse the existing tax or tax rate level withholding certificate generation. Process all pending transactions before changing the setup and creating new payments.

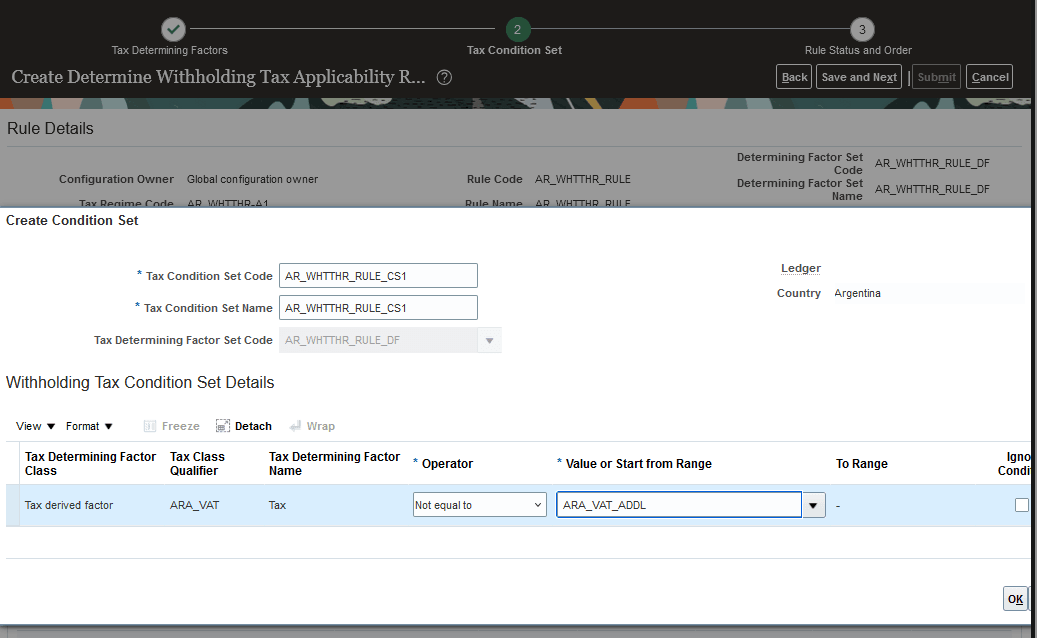

New operator for tax derived factor condition set

Use the Not equal to operator to create simplified tax rules based on tax-derived factors, where only exceptions need to be considered.

For example, in a scenario where withholding tax is not applicable for 5 different transaction taxes except 1, you can create a single rule using the Not equal to operator instead of creating a rule with 5 separate conditions.

This approach simplifies the rule by focusing on the exception rather than listing all the conditions where the rule does not apply.

Create Condition Set page

Business benefits include:

- Flexibility to generate the withholding certificates for Argentina at withholding tax or tax rate level.

- Reduction of withholding tax rules.

Steps to Enable and Configure

To enable this feature, perform the following steps:

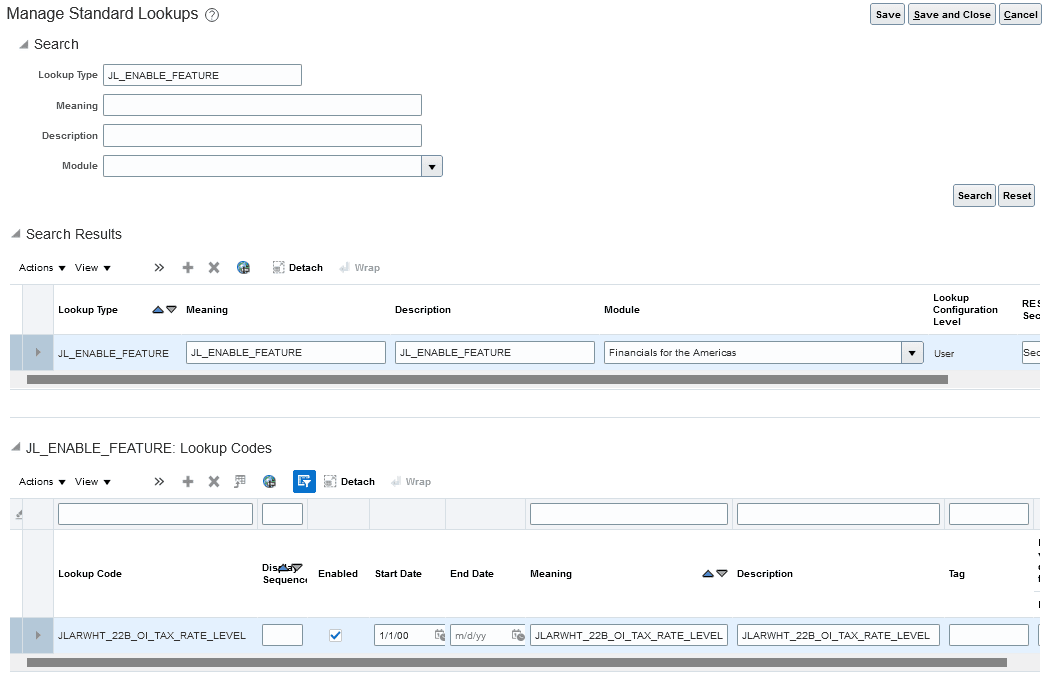

- Click Navigator > Setup and Maintenance > Manage Standard Lookups.

- Define the lookup code with these details:

Lookup type: JL_ENABLE_FEATURE

Lookup code: JLARWHT_22B_OI_TAX_RATE_LEVEL

Manage Standard Lookups page