Turnkey Tax Activation for Avalara with Additional Options

Activate Avalara tax at business unit level and select scope for each application. These new configuration choices give enterprises the flexibility to configure tax determination with Avalara at a more granular level, while supporting ongoing changes that include addition of new business units or implementation of new flows.

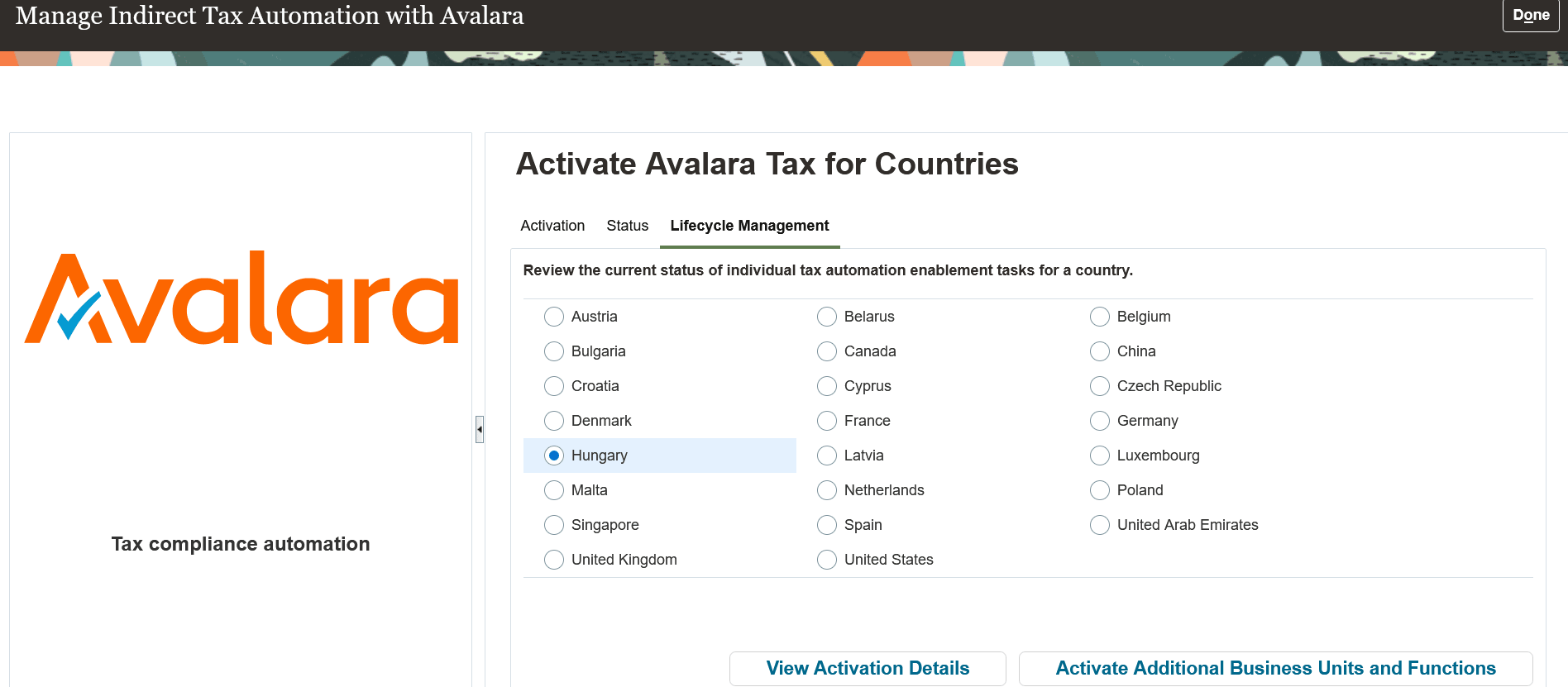

Use the Manage Indirect Tax Automation with Avalara page to initiate Avalara tax activation for specific business units and applications by the country.

The page has three tabs:

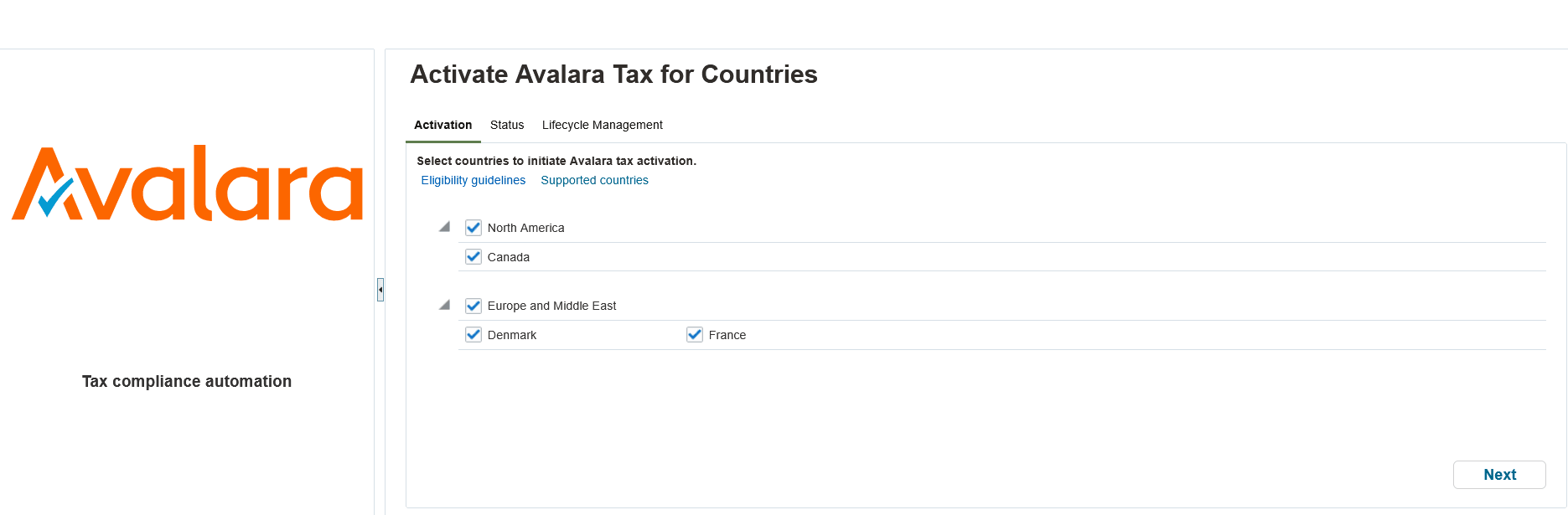

- Activate tab: It displays all eligible countries supported by Avalara for which business units and legal entities are configured. You have the flexibility to select multiple countries, business units, and functional scope for activation within each country.

Select Countries for Tax Activation:

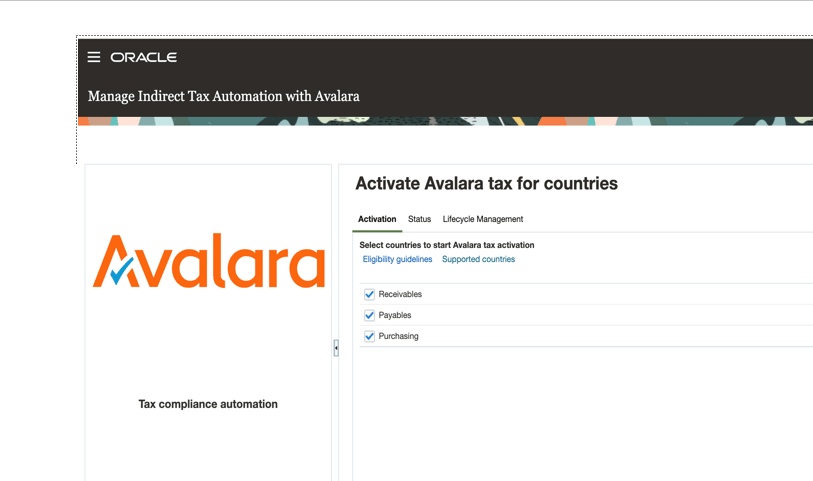

Select functional scope for the country:

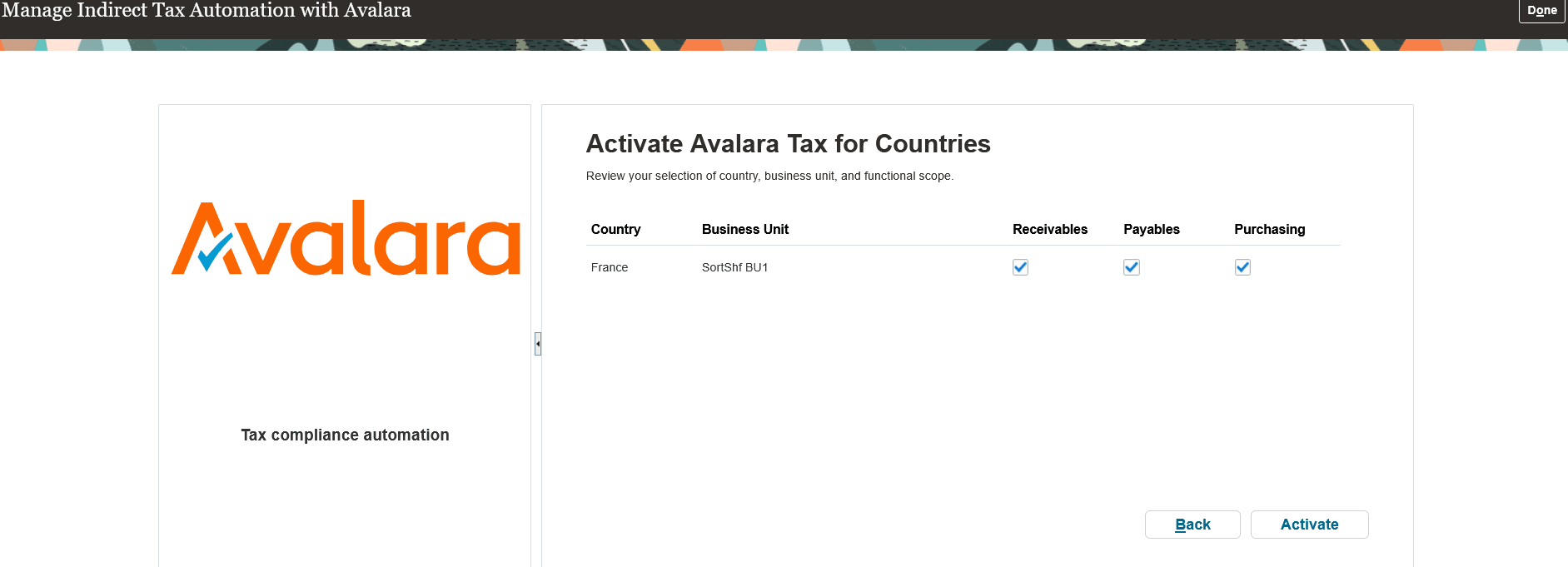

Finalize business units and functional scope for the selected country and click activate:

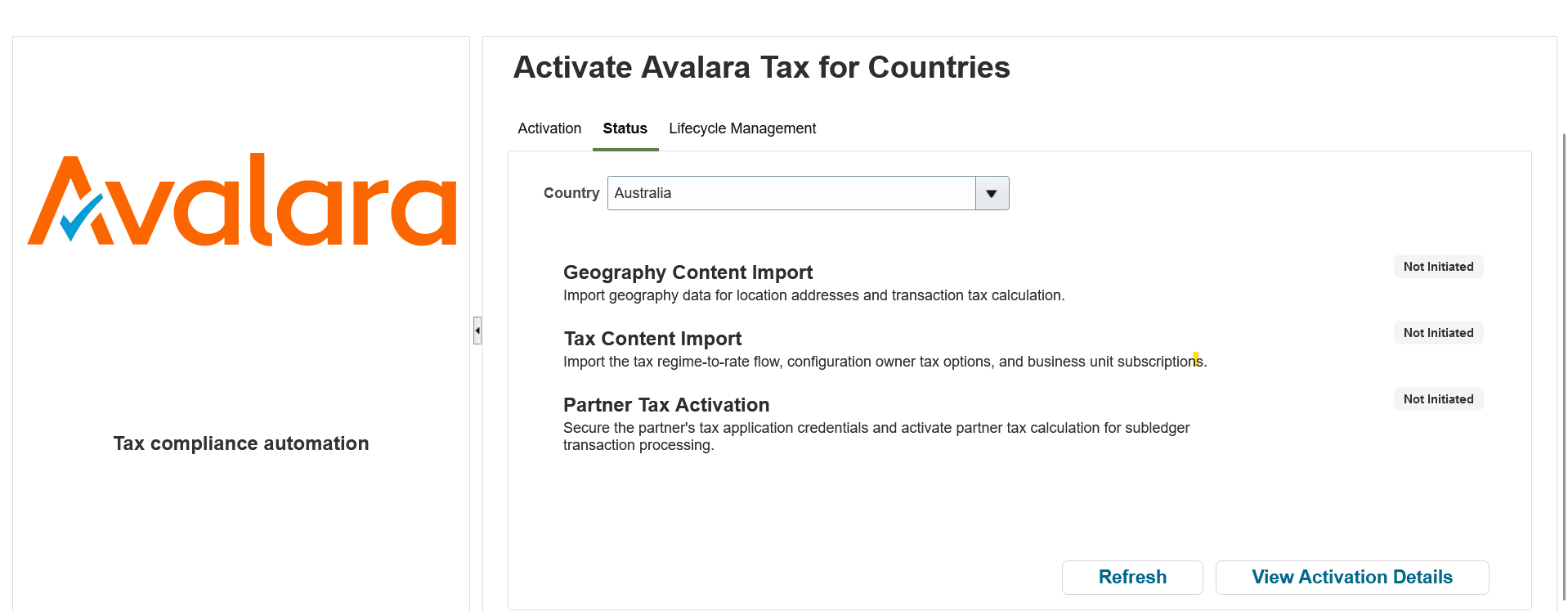

- Status tab: It displays the enablement status for indirect tax activation by country. You have the option to select a country to view its status.

- Lifecycle Management tab: It provides the ability to view the activation details for a country. Additionally, you can add new business units and functions to an existing country activation.

Global enterprises require comprehensive indirect tax compliance solutions as part of their ERP systems. Oracle and Avalara have collaborated to seamlessly integrate and configure both systems, enabling real-time tax calculation for their mutual customers. This embedded service and native integration are further enhanced by supporting tax implementation at a more granular level.

The new, improved solution streamlines the Avalara tax activation process by allowing users to select specific business units and the functional scope (applications) for which the Tax Partner can be activated within a country. Additionally, this enhancement supports the activation of new business units and the implementation of new business flows following country tax activation.

Steps to Enable and Configure

To enable this feature, perform the following steps:

- Click Navigator > Setup and Maintenance > Manage Standard Lookups

- Define the lookup code with these details:

Search Lookup type: ORA_FUN_DATA_MAINT_KEY and add Lookup code: ZX_36969800

Also, you must complete some pre-requisite setups before you can initiate the enablement from the Manage Indirect Tax Automation with Avalara page.

- Complete the registration process with Avalara and get the login details.

- You need to create a new Oracle user account and assign the Tax Administrator role to the user to access Manage Indirect Tax Automation Page.

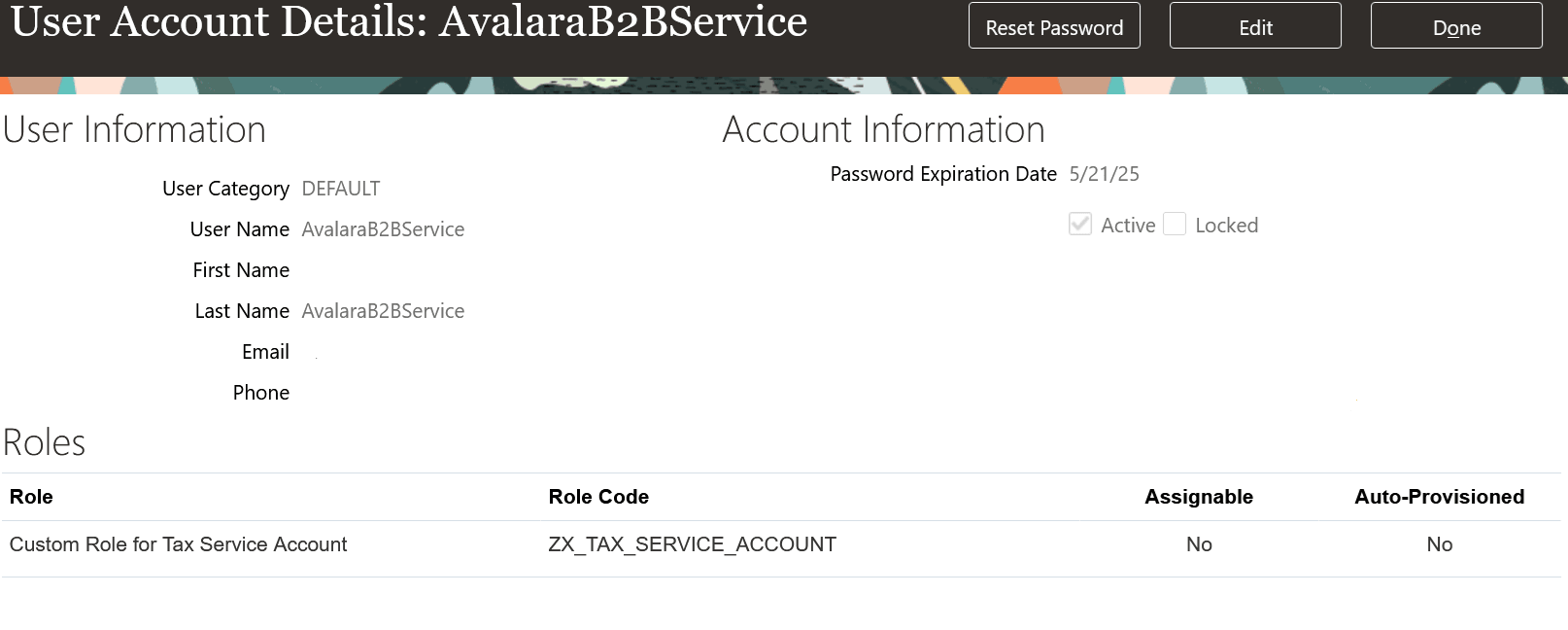

- You need to create Tax Service User Account (recommended username: AvalaraB2BService).

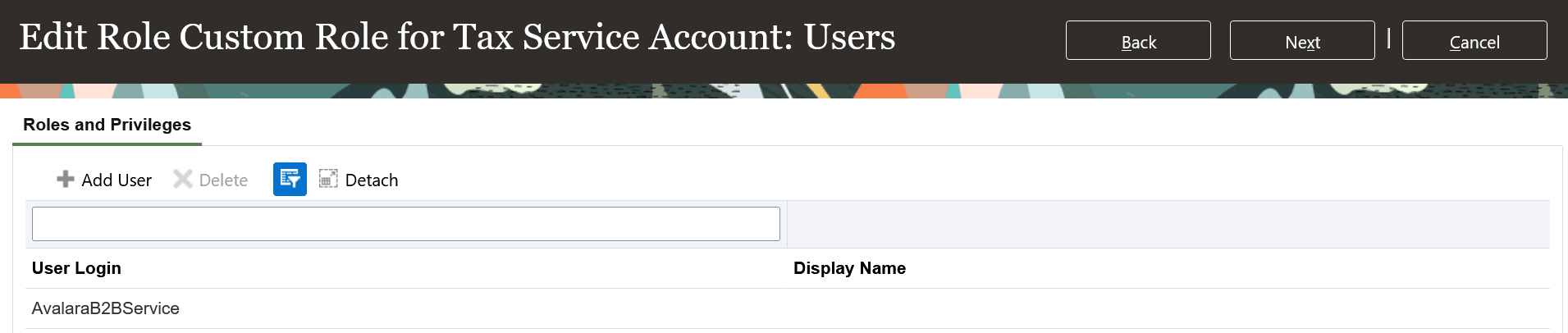

- Create Custom Role for Tax Service User Accountas outlined below to support automated end-to-end Avalara turnkey tax activation.

Role Name: Custom Role for Tax Service Account

Suggested Role Code Name: ZX_TAX_SERVICE_ACCOUNT

Role Category: Financials – Job Roles

Role Description: Enable privileges and roles necessary for tax enablement.

Add the below to this Role: These are the basic set of privileges/roles needed for onboarding.

Under-> Function Security Policy

- Create Tax (ZX_CREATE_TAX_PRIV)

Click Next till you reach the Role Hierarchy node.

Under-> Roles and Privileges

- FSCM Load Interface Administration Role (ORA_FUN_FSCM_LOAD_INTERFACE_ADMIN_DUTY)

- BI Administrator Role (BIAdministrator)

- Geography Administration (ORA_GEO_ADMIN_DUTY)

Click Next until you reach the Users page.Add the tax service user. Save and Close

- From the security console, if you review the “AvalaraB2BService” user account, you will see the user is assigned with Custom Role for Tax Service Account.

- Run the Retrieve Latest LDAP Changes process followed by Send Personal Data for Multiple Users to LDAP process.

You can use this user for turnkey tax activation.

Tips And Considerations

The Oracle Fusion Cloud ERP customers who are also Avalara customers can take advantage of this automated enablement process. There may be limitations on using this process. Contact Oracle for assistance.

Key Resources

Access Requirements

You need to have a job role assigned that has the privilege Manage Tax Partner Configuration (ZX_MANAGE_PARTNER_CONFIGURATIONS_PRIV) to access the Manage Indirect Tax Automation with Avalara page.