Automated Intercompany Cross Charge of Payables Invoices

Create intercompany transactions directly from Payables invoices when the expenses are recorded and paid by one organization on behalf of another organization within the company. You can now automatically create intercompany transactions for Payables cross charge type invoices such as subscription charges paid by a parent company on behalf of a subsidiary, and promotional campaign expenses paid by an entity and charged to multiple entities across countries.

The invoice data is automatically transferred from Payables to Intercompany Document Preparation, where users can assign the beneficiary entity, as well as initiate the creation of intercompany transfer authorization. After the transfer authorization is created, users can review and approve the transfer authorization using the Intercompany Agreement guided process in Multitier Intercompany Operations.

This is the flow to Automate Intercompany Cross Charge of Payables Invoices:

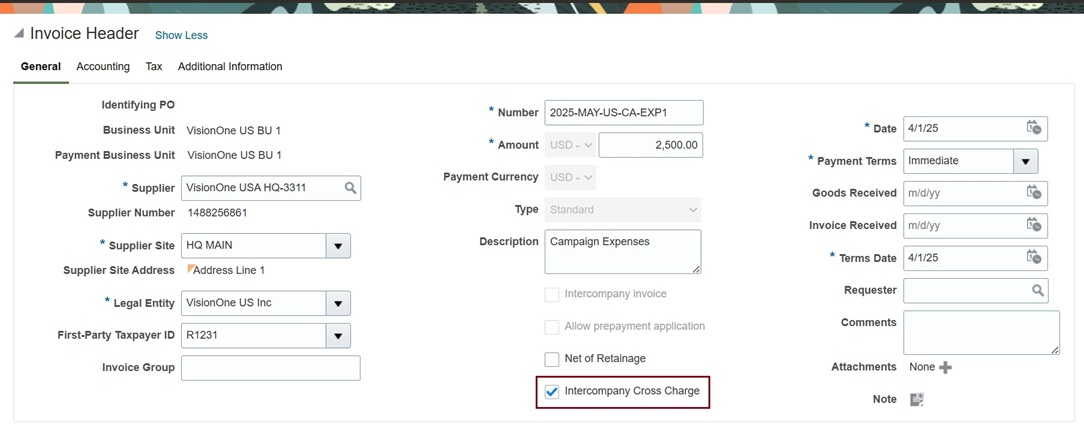

- Identify invoices that need to be cross charged using the Intercompany Cross Charge checkbox on the Invoice Header page. Once accounted, the invoice data becomes available to Intercompany Document Preparation for intercompany processing.

Intercompany Cross Charge Checkbox

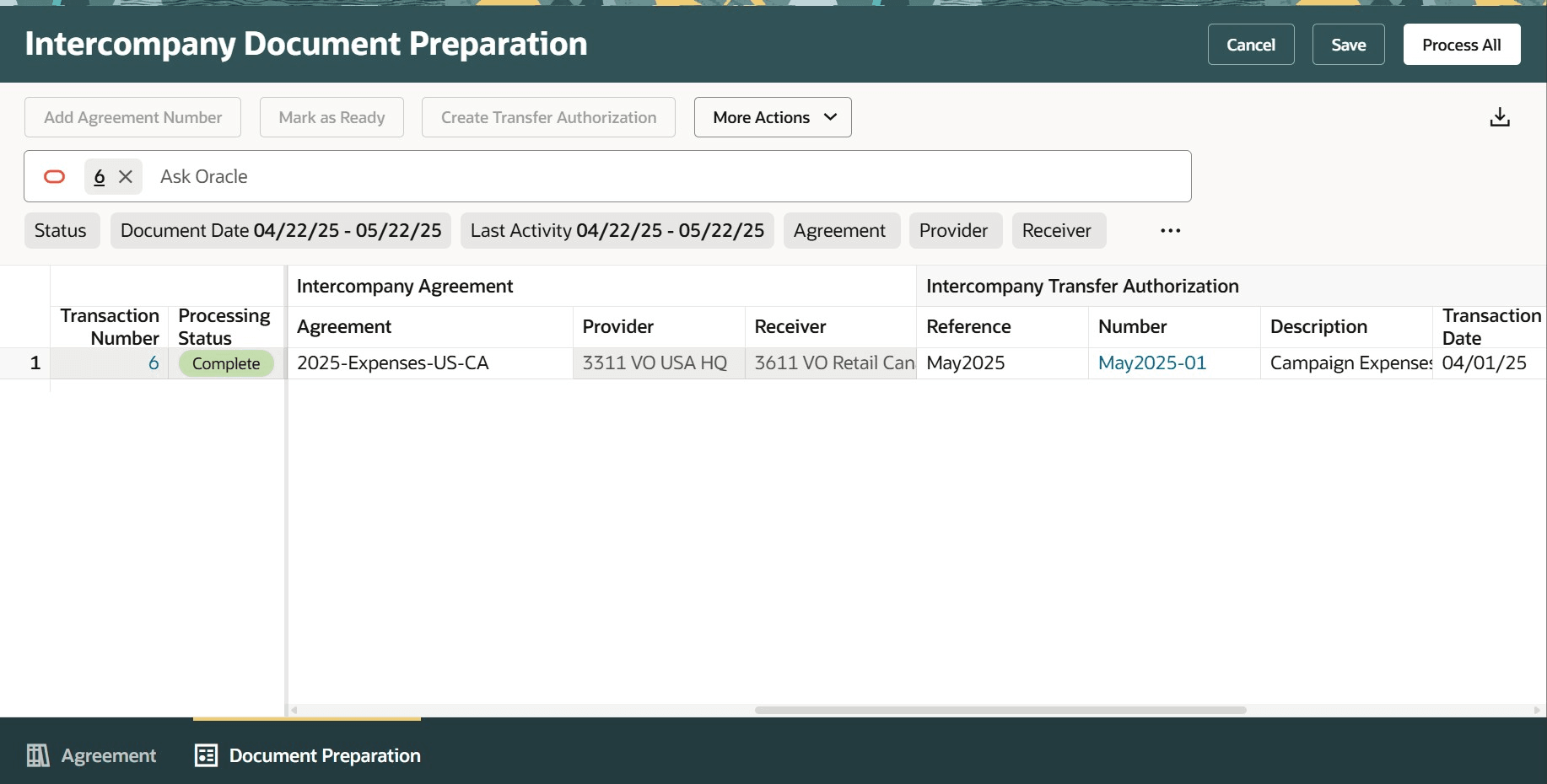

- Assign a beneficiary by linking an intercompany agreement to the cross charge lines in Intercompany Document Preparation.

- Generate intercompany transfer authorizations and continue the process to create the intercompany transactions in Multitier Intercompany Operations.

Document Preparation

NOTE: The cross charge of payables invoice is only available with the Multitier Intercompany Operations. It's not available with the batch based intercompany transactions.

Business benefits include:

- Improved operational efficiency by seamlessly transferring the cross charge expenses to intercompany. The automated data transfer from Payables to intercompany eliminates the need for custom automation and manual entry of intercompany transactions.

- Reduced compliance risk by enhancing auditability and traceability of end-to-end processing of intercompany cross charge expenses. You can navigate from the cross charge invoices to the resulting intercompany transactions and back to the invoices.

- Reduced operational errors by automating intercompany accounting treatment of cross charge expenses.

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

To enable this feature, ensure Multitier Intercompany Operations delivered in 24C remains enabled, and the necessary set-ups specified for Multitier Intercompany Operations are configured.

Key Resources

- Multitier Intercompany Operations section in the Using General Ledger guide – To understand the flow of creating agreement, intercompany transfer authorization, intercompany transaction using the Multitier Intercompany Operations.

- Review the topical essay on Multitier Intercompany Operations to learn more about the rationale for different types of inter-company transactions. The essay can also be referred to for additional guidance on organizational structures.

- Automated Intercompany Cross Charge of Payables Invoice section in the Using General Ledger guide.

- How Payables Standard Invoice Import Data Is Processed section in the Using Payables Invoice to Pay guide – To understand the steps involved in creating invoices.

- Overview

- Prerequisites and Dependencies

- Business Scenario

- Steps to Automate Intercompany Cross Charge of Payables Invoices

- Lifecycle of Processing Status

Access Requirements

The following privileges are available for accessing Intercompany Document Preparation:

- Manage Intercompany Document Preparation (FUN_MANAGE_INTERCOMPANY_DOCUMENT_PREPARATION_PRIV) Allows preparation of source documents for intercompany processing.

- Review Intercompany Document Preparation (FUN_REVIEW_INTERCOMPANY_DOCUMENT_PREPARATION_PRIV) Allows access to view source document and the associated intercompany agreement and transfer authorization.