Updates for Brazil VAT Reform in 2026

Generate Brazilian fiscal documents in accordance with the requirements of the Brazilian Government VAT Reform, to take effect in 2026.

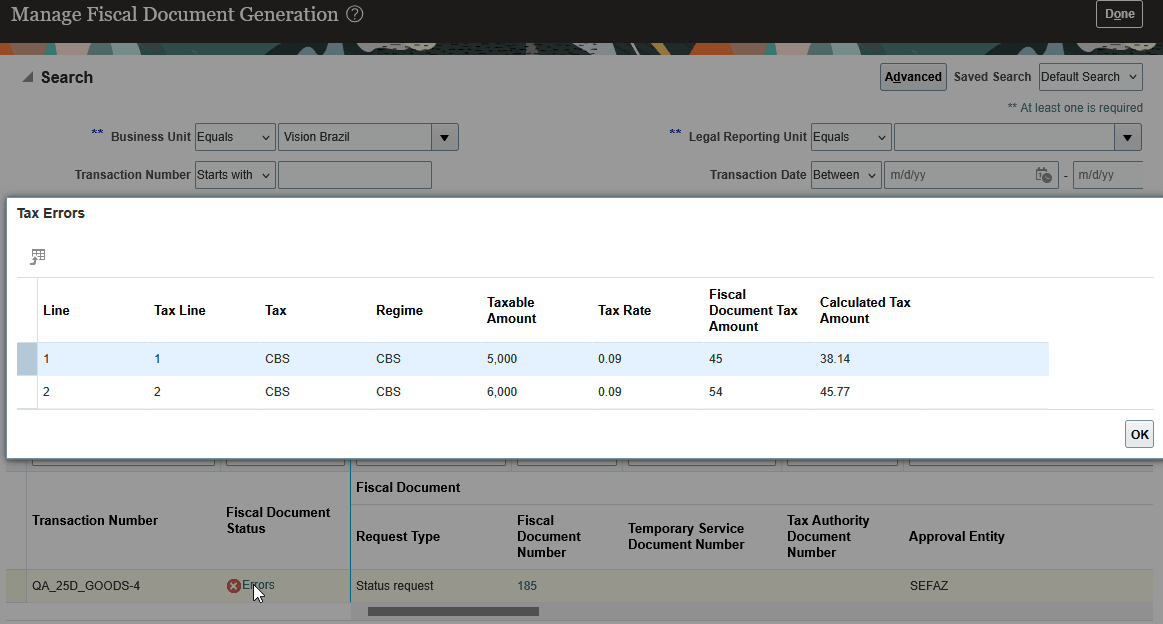

The tax authority integration partner can offer a solution to validate the fiscal document taxes calculated by Cloud ERP using a tax calculation engine provided by the tax authority before sending the fiscal document for approval. If there is any discrepancy in the tax amount, the tax authority integration partner can return such calculated taxes and mark the fiscal document transaction with tax error using the Import Fiscal Document Approval Information FBDI.

You can compare the taxes calculated by the tax authority calculation engine with the Cloud ERP taxes in the Manage Fiscal Document Generation page and reprocess the transaction after the cause is corrected. If the recalculated taxes don't match the taxes calculated by the tax authority calculation engine, the fiscal document status will remain in Error status.

Manage Fiscal Document Generation page, displaying the tax differences

To enable the fiscal document tax validation:

- Navigate to Setup and Maintenance;

- Search for the Manage Localization System Options task;

- Select the business unit;

- Set the Enable Tax Validation on Fiscal Document option to Yes.

Note: You need to enable the Fiscal Document Generation Update for Brazilian VAT Reform feature to use the fiscal document tax validation.

New Taxpayer ID Format and Check Digits Validation Logic

The Brazilian company taxpayer ID (CPNJ), currently numeric, will transition to an alphanumeric format starting in July 2026. It will be applicable to new taxpayer IDs and the current numeric taxpayer ID continues to exist.

The validation of this taxpayer ID type was enhanced in accordance with the tax authority's requirements to allow the entry of an alphanumeric value and to convert the letters to numbers for calculating and validating the check digits. This validation is done on the parties' taxpayer ID setup pages.

Note that the new logic provided by the tax authority does not affect the current numeric taxpayer IDs, as it ensures compatibility for the two types.

The new logic is automatically enabled as of January 1, 2026. If you want to use or test it prior to this date, follow these steps:

- Navigate to Setup and Maintenance

- Navigate to task Manage Standard Lookups

- Query for lookup type ORA_ERP_CONTROLLED_CONFIG

- Create lookup code. Data to be entered:

- Lookup code: ZX_37169094

- Enabled: Yes

- Start Date: 15-SEP-2025

- Meaning: Allow CPNJ alphanumeric validation before 01-01-2026

- Save and close

New Tax Types

Some special conditions that impact the tax amounts require companies to report the deferred tax amounts or the regular tax amounts that are applicable to the transaction unless the special condition applies. New tax types introduced to cover these scenarios are as follows:

| Tax Type Code | Tax Type Name | Description |

|---|---|---|

| ORA_CBS_DIF | CBS tax | Tax type code for the deferred goods and sales contribution. |

| ORA_IBSUF_DIF | IBSUF tax | Tax type code for the deferred goods and sales tax at the state level. |

| ORA_IBSMUN_DIF | IBSMUN tax | Tax type code for the deferred goods and sales tax at the city level. |

| ORA_CBS_REG | CBS tax | Tax type code for the regular goods and sales contribution. |

| ORA_IBSUF_REG | IBSUF tax | Tax type code for the regular goods and sales tax at the state level. |

| ORA_IBSMUN_REG | IBSMUN tax | Tax type code for the regular goods and sales tax at the city level. |

Fiscal Document Generation XML file updates

These new elements are implemented in the output file of the Send Fiscal Document to Tax Authority process:

New Fiscal Document XML file tags at the header level

| ID | Tag | Description | Parent | Type | Cardinality | Size | New |

|---|---|---|---|---|---|---|---|

| A1 | FISCAL_DOC_HEADER | - | GROUP | - | - | No | |

| - | VAT_TAX_VALIDATION_ENABLED | Localization system option to indicate whether tax validation for Brazilian VAT taxes is enabled. | A1 | CHAR | 0-1 | 1 | Yes |

| ATTRIBUTE_CATEGORY | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 30 | Yes | |

| ATTRIBUTE1 | Descriptive Flexfield: segment of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE2 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE3 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE4 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE5 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE6 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE7 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE8 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE9 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE10 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE11 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE12 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE13 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE14 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE15 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | A1 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE_NUMBER1 | A1 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER2 | A1 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER3 | A1 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER4 | A1 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER5 | A1 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE1 | A1 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE2 | A1 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE3 | A1 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE4 | A1 | DATE | 0-1 | 150 | Yes |

New Fiscal Document XML file tags at the line level

| ID | Tag | Description | Parent | Type | Cardinality | Size | New |

|---|---|---|---|---|---|---|---|

| B4 | FSCL_DOC_LINE_ATTRIBUTES | B3 | GROUP | - | - | No | |

| ATTRIBUTE_CATEGORY | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 30 | Yes | |

| ATTRIBUTE1 | Descriptive Flexfield: segment of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE2 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE3 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE4 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE5 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE6 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE7 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE8 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE9 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE10 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE11 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE12 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE13 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE14 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE15 | Descriptive Flexfield: structure definition of the user descriptive flexfield. | B4 | CHAR | 0-1 | 150 | Yes | |

| ATTRIBUTE_NUMBER1 | B4 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER2 | B4 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER3 | B4 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER4 | B4 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_NUMBER5 | B4 | NUM | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE1 | B4 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE2 | B4 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE3 | B4 | DATE | 0-1 | 150 | Yes | ||

| ATTRIBUTE_DATE4 | B4 | DATE | 0-1 | 150 | Y |

New Fiscal Document XML file tags at the line detail level

| ID | Tag | Description | Parent | Type | Cardinality | Size | New |

|---|---|---|---|---|---|---|---|

| C7 | FISCAL_DOC_LINE_DETAILS | B3 | GROUP | - | - | - | |

| - | GLOBAL_ATTRIBUTE_CATEGORY | JLxBRFsclLnDtlAtrbExtSTTax | C7 | CHAR | 0-1 | 150 | Yes |

| GLOBAL_ATTRIBUTE9 | Tax Type | C7 | CHAR | 0-1 | 150 | Yes | |

| GLOBAL_ATTRIBUTE_NUMBER1 | Previous Taxable Basis | C7 | NUM | 0-1 | 18 | Yes | |

| GLOBAL_ATTRIBUTE_NUMBER2 | Previous Tax Rate | C7 | NUM | 0-1 | 18 | Yes | |

| GLOBAL_ATTRIBUTE_NUMBER3 | Previous Tributary Substitution Tax Amount | C7 | NUM | 0-1 | 18 | Yes | |

| GLOBAL_ATTRIBUTE_NUMBER4 | Previous Tax Amount | C7 | NUM | 0-1 | 18 | Yes |

Please refer to Managing Fiscal Document Approvals through a Third Party for the complete list of Fiscal Document Generation XML file tags.

Import Fiscal Document Approval Information FBDI

Follow these steps:

Set the Tax Error column to Yes in the Import Fiscal Document Approval Information FBDI template to indicate the tax authority integration partner identified differences between the taxes calculated by Cloud ERP and the tax calculation engine provided by the tax authority.

Use the Transaction Line ID column to provide the transaction line ID associated with the tax returned by the tax authority integration partner.

NOTE: The tax authority integration partner must populate only the new Brazil VAT taxes in the Import Fiscal Document Approval Information FBDI when there are differences related to these taxes. Otherwise, only the existing city tax information must be populated for a service fiscal document approval.

Business benefits include:

- Allow customers to comply with the recent indirect tax regulation changes introduced in Brazil, while supporting both current and new taxes during the seven-year transition period.

- Validate fiscal document taxes calculated by Cloud ERP by a tax authority integration partner, reducing the risk of submitting incorrect fiscal documents for approval by the tax authorities.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Access Requirements

No new access requirements.