Supplier Withholding Threshold for Tax Deducted at Source for India

Configure withholding tax amounts and period range deductions at the supplier and supplier site level. Apply these amounts and deductions during withholding tax calculation to comply with complex withholding tax regulations in India.

In India, the tax authority issues certificates to suppliers to deduct tax at rates that are lower than the standard rates, subject to amount and period limits. For example, a supplier can get a certificate to deduct tax at 2% instead of the standard rate of 10% if the total purchase from the supplier is less than 5 million INR for the financial year.

Business benefits include:

- Enterprises can calculate TDS (tax deducted at source) in India accurately and benefit from lower deduction rates.

- Enterprises can reduce setup effort and improve performance with a more efficient configuration.

Steps to Enable and Configure

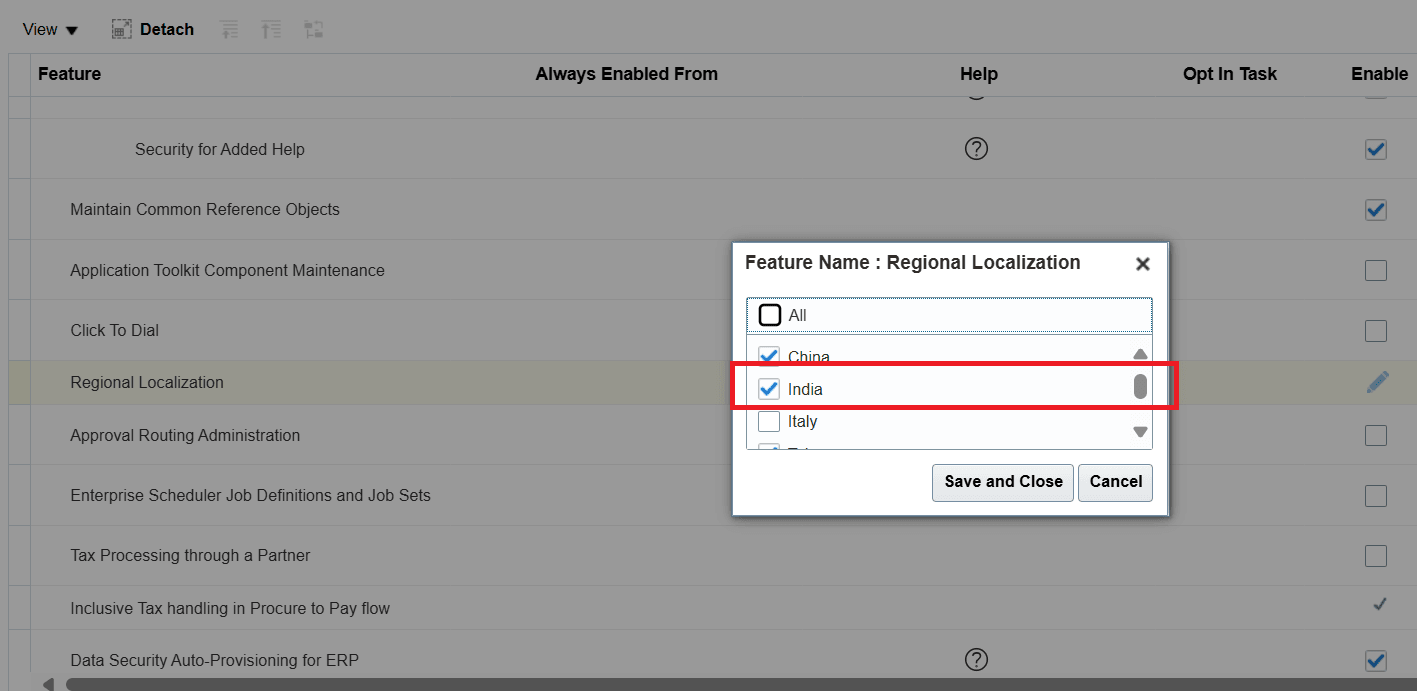

Enable India in Regional Localizations.

Regional Localizations

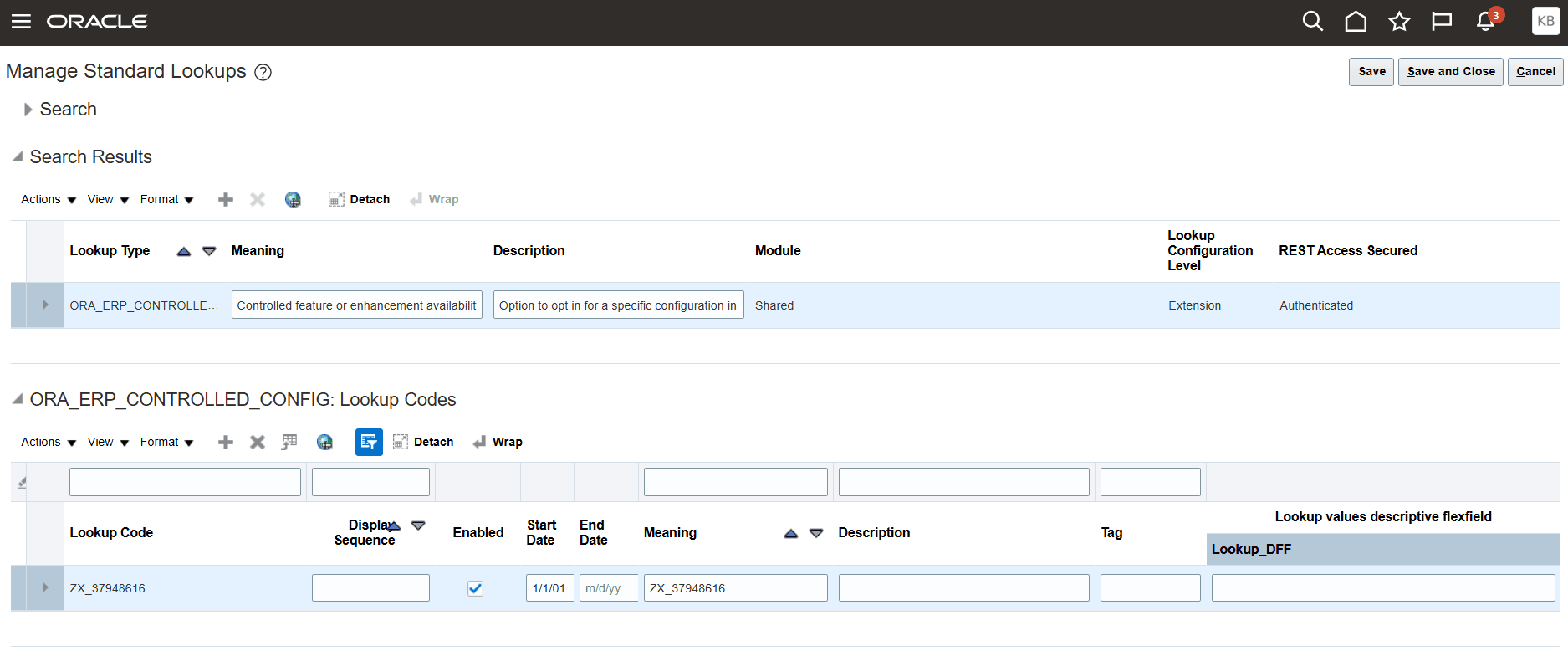

Create and enable a new lookup code ZX_37948616 for the existing ORA_ERP_CONTROLLED_CONFIG lookup type using the Manage Standard Lookups FSM task.

Lookup Details

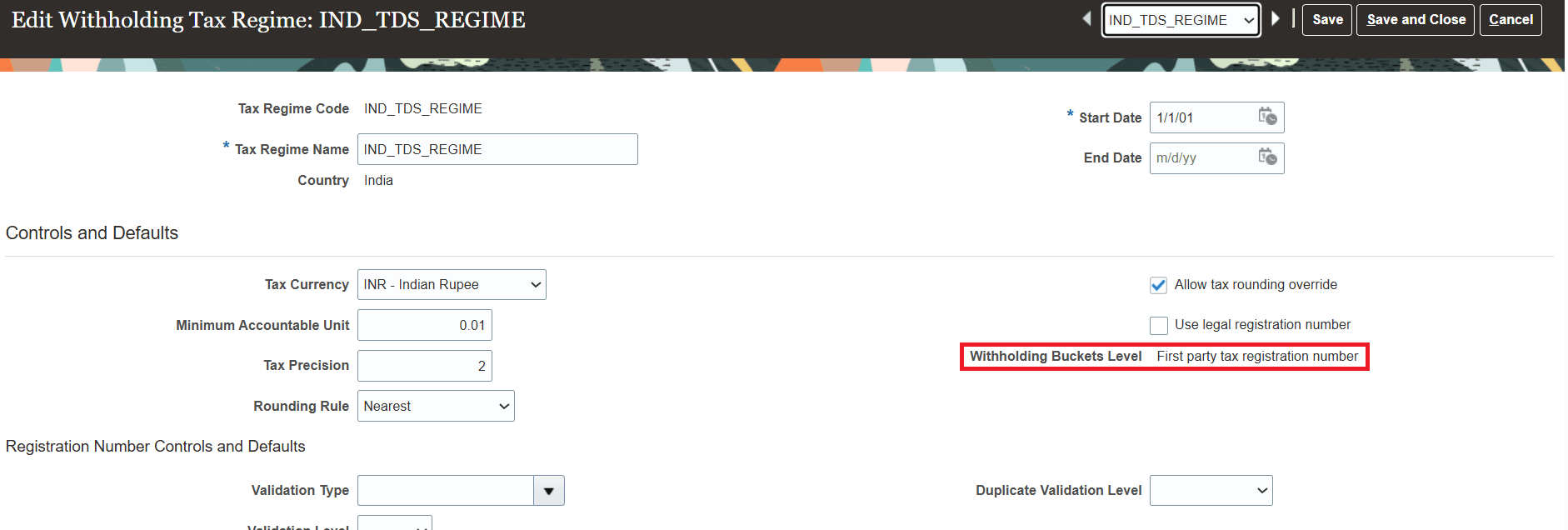

The withholding tax regime defined for India must have the Withholding Buckets Level set to First party tax registration number.

Withholding Tax Regime Buckets Level

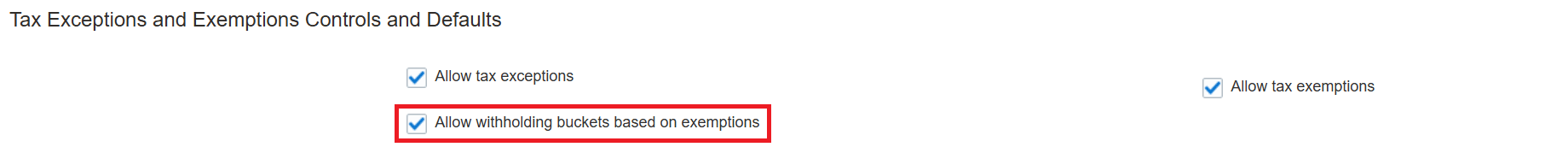

Enable the Allow withholding buckets based on exemptions option for the tax.

Tax Setup

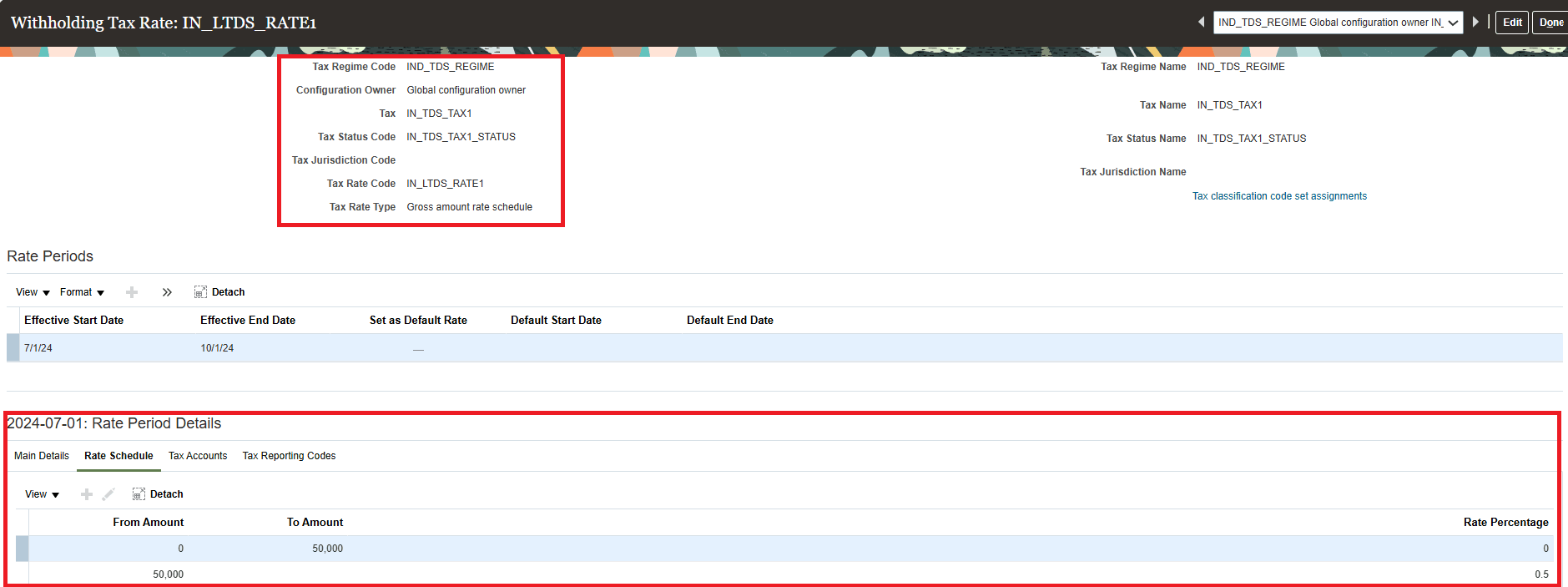

Define a new withholding tax rate for the lower rate.

New Tax Rate for Lower Rate

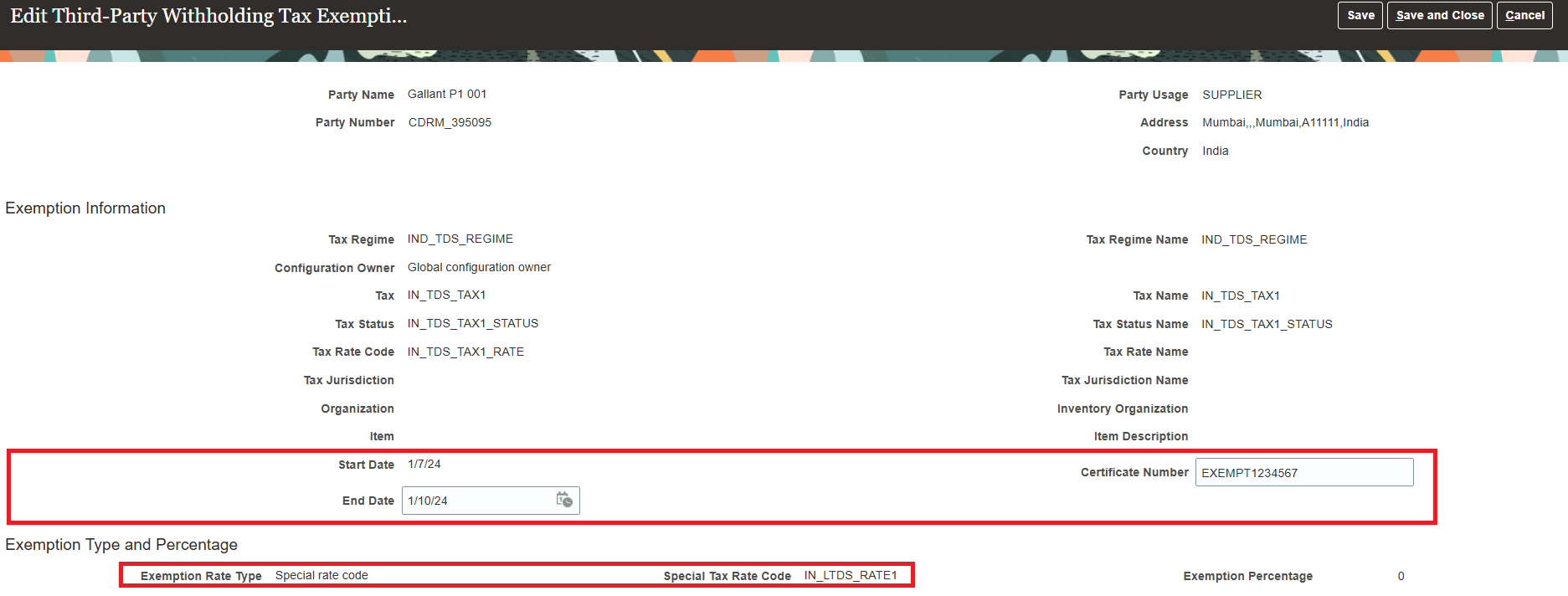

Define a new tax exemption to record the certificate details. Enter the Start Date and End Date based on the certificate's validity period, and enter the Certificate Number. Choose Exemption Rate Type as Special rate code and select the new tax rate defined for the lower rate in the prior step.

Tax Exemption

Access Requirements

No new access requirements