Derived Factor Formula for Complex Inclusive Taxes

Use the new Derived Factor Formula to automatically derive the factor needed to adjust the intrinsic price for certain inclusive taxes.

Some countries require complex formulas to calculate taxes, such as the new taxes introduced by the Brazil VAT Tax Reform that will take effect on January 1, 2027.

During the transition period to the Brazil 2026 Tax Reform--when current taxes coexist with new taxes introduced--the current inclusive taxable basis needs to be adjusted by a factor to include both current and new taxes.

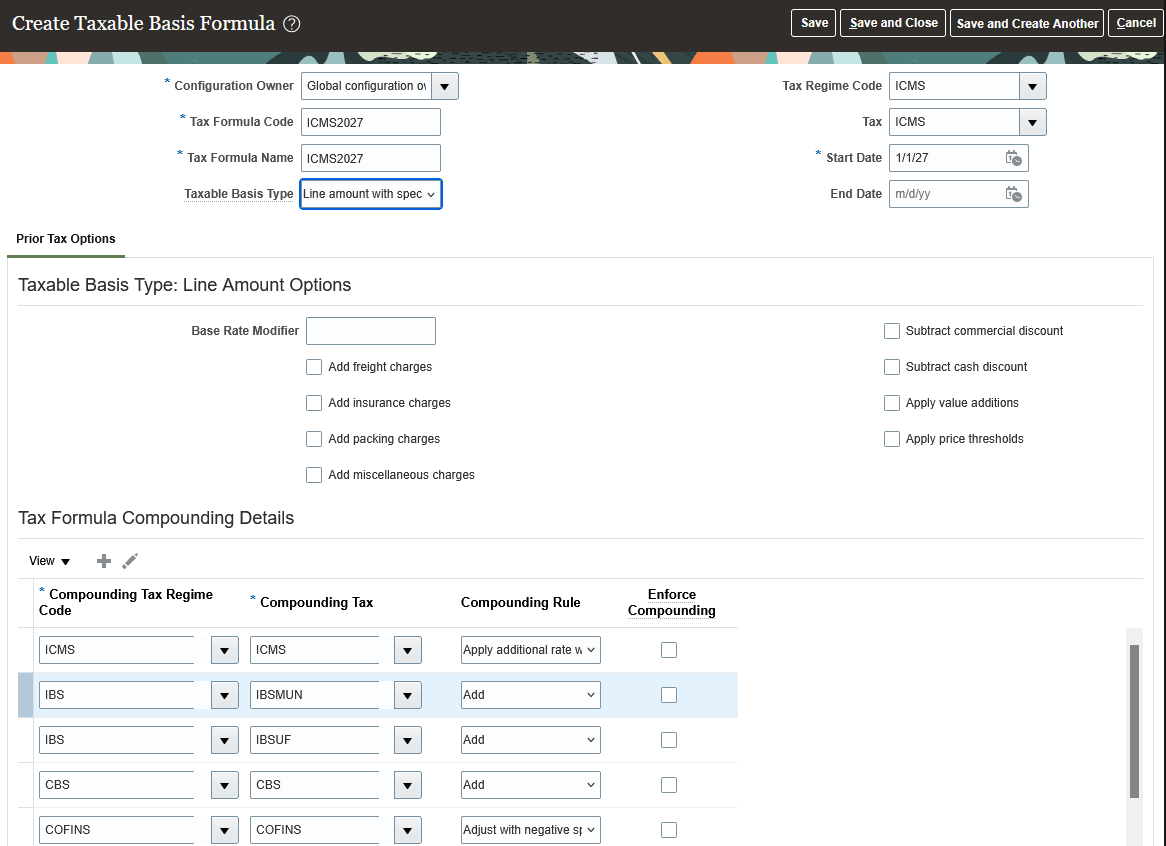

Use the Line amount with special rate factor and base adjustment as Taxable Basis Type in the Create Taxable Basis Formula page to enable the Compounding Rule column.

Create Taxable Basis Formula page

Select the appropriate Compounding Rule:

- Add - Add the tax to the line amount to compound the taxable basis.

- Subtract - Subtract the tax from the line amount to compound the taxable basis.

- Adjust with negative special rate factor - Subtract the line amount with a special rate of 1/(1- special rate%).

- Adjust with positive special rate factor - Add a special rate of 1/(1- special rate%) to the line amount.

- Apply additional rate with special rate factor - Add a rate of (1+additional rate%)/(1- special rate% * (1+additional rate%)) to the line amount.

NOTE: If the selected Taxable Basis Type is Line amount with special rate factor and base adjustment, all the inclusive taxes added to the Tax Formula Compounding Details section must be configured to use the standard inclusive handling method.

For more information on how to set up the new Brazilian VAT taxes, please refer to My Oracle Support Doc ID 2973875.1 Oracle Fusion Cloud ERP: Brazil Tax Reform

The business benefit include the ability to create complex tax formulas to address special tax calculation requirements, such as the new Brazilian VAT taxes that will take effect on January 1, 2027.

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Access Requirements

No new access requirements.