Automated Tax Registration Number Validation for Suppliers

Validate supplier tax registration numbers automatically against government agencies during the tax registration number creation process. Many tax authorities, government portals, and electronic invoicing service providers offer application programming interfaces to validate third-party registration numbers which are used to determine tax recoverability and report taxes.

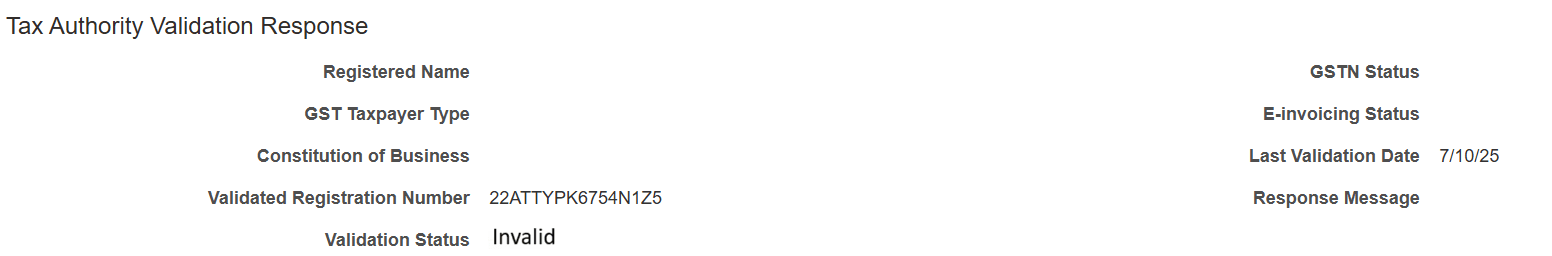

Use the Tax Registration page to enter the tax registration number details. When you click Save, the tax registration is validated. The Tax Authority Validation Response section of the Tax Registration page displays the tax authority validation response.

Tax Authority Validation Response

The business benefit is to ensure supplier details are accurate and valid for payments, input tax recoverability, and tax reporting.

Steps to Enable and Configure

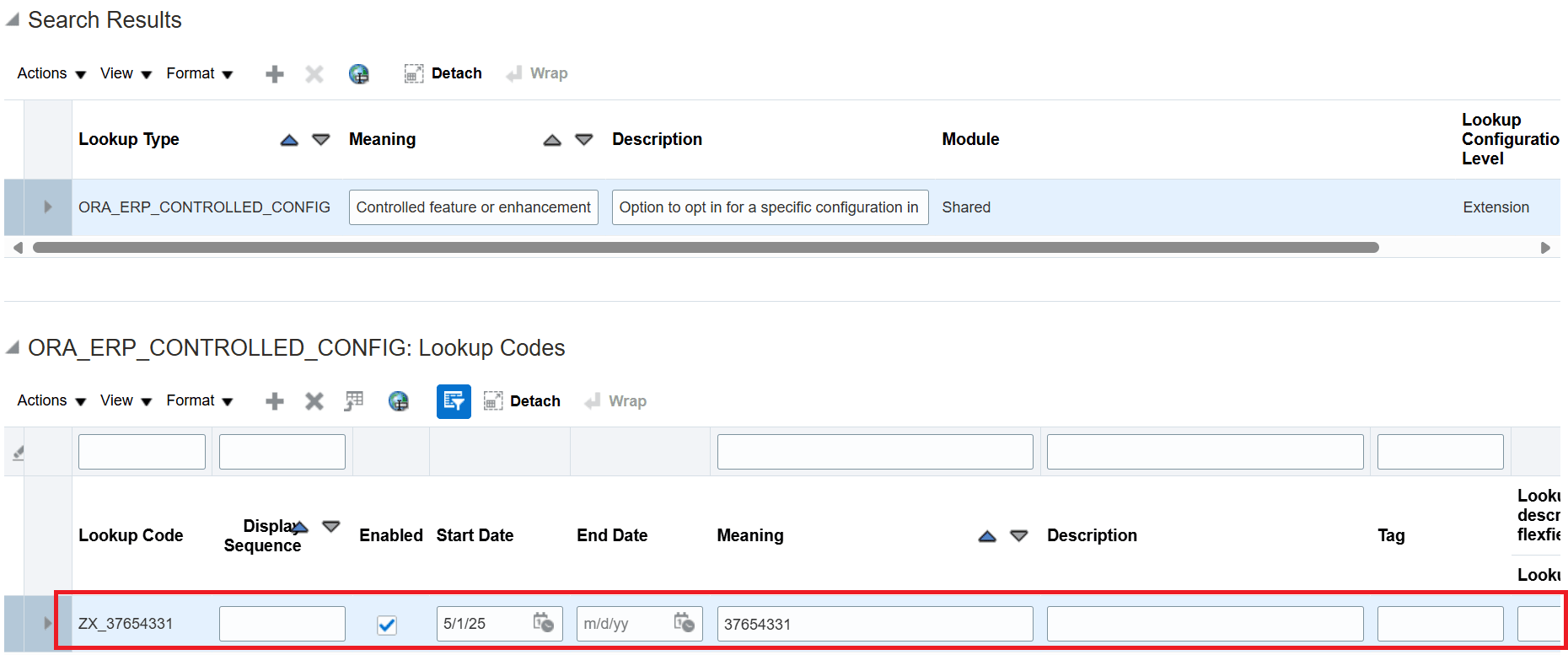

Create and enable a new lookup code ZX_37654331 for the existing ORA_ERP_CONTROLLED_CONFIG lookup type using the Manage Standard Lookups FSM task.

Lookup Details

Use the taxPartnerRegistrations REST API to register the APIs to validate the registration numbers with the appropriate tax authority.

For India

{

"OperationName": "registerTaxPartner",

"ConnectionPassword": "<enter password provided by third-party service provider>",

"ConnectionUserName": "<enter username provided by third-party service provider>",

"EndpointURL": "<enter endpoint URL provided by third-party service provider>",

"TaxPartnerName": "GST_IN"

}

For European Union (EU) countries

{

"OperationName": "registerTaxPartner",

"EndpointURL": "https://ec.europa.eu/taxation_customs/vies/rest-api/check-vat-number",

"TaxPartnerName": "VAT_EU"

}

Tips And Considerations

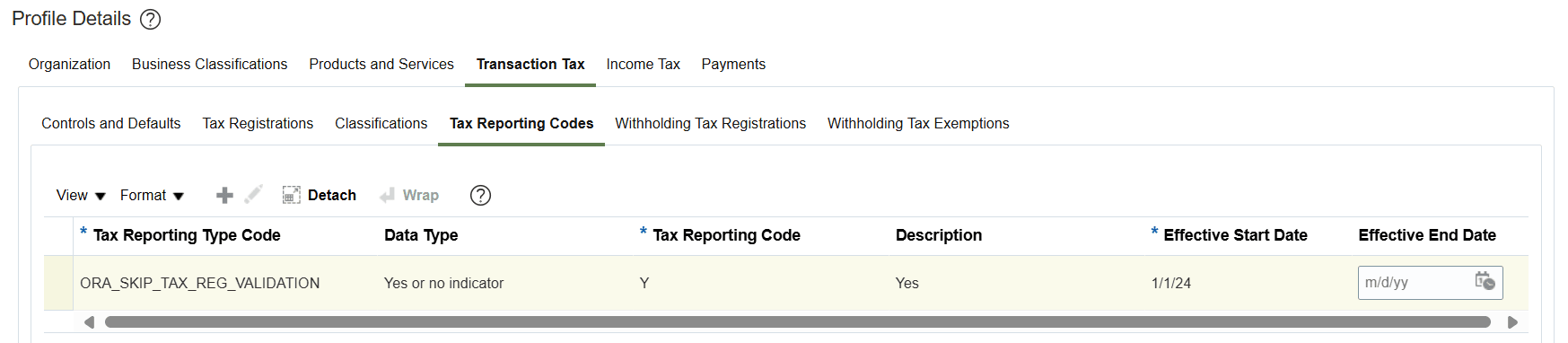

To skip validation for specific suppliers, associate the tax reporting code type ORA_SKIP_TAX_REG_VALIDATION with the supplier and set the reporting code to Y.

Tax Reporting Code to Skip Validation

Access Requirements

No new access requirements