Foreign Currency Lease Right-of-Use Asset Remeasurement

Foreign Currency Lease Right-of-Use Asset Remeasurement

Account for remeasurement of right-of-use assets on foreign currency denominated leases. Lessees may enter into leases with lease payments denominated in a currency different from the ledger currency. Configure alternate right-of-use asset remeasurement options to remeasure the additional right-of-use asset due to modifications using the conversion rate as of the lease amendment date. These options are in addition to the single currency conversion rate option that remeasures the entire right-of-use asset using the conversion rate as of the lease amendment date.

Previously, when a change was made to the right-of-use asset—such as from an amendment, impairment, or termination—the entire right-of-use asset balance was remeasured using the current conversion rate on the amendment date. Some organizations, however, require only the incremental change in the right-of-use asset balance to be converted at the new rate, while the original balance continues to be measured at historical rates.

Configure the system to measure either the incremental change or the entire right-of-use asset balance, in line with your accounting policies or local regulations. Select from one of three methods to manage foreign currency right-of-use asset modifications:

- Measure Changes at Current Rate: Applies the current conversion rate on the amendment date to convert changes (increase or decrease) in the right-of-use asset balance to the ledger currency on lease amendments. Reductions to the right-of-use asset balance on impairments and terminations use the blended historical rate.

- Measure Increases at Current Rate: Applies the current conversion rate on the amendment date to convert increases in the right-of-use asset balance on lease amendments. Reductions to the right-of-use asset balance on amendments, impairments, and terminations use the blended historical rate.

- Remeasure Entire Balance: Applies the current conversion rate on the amendment date to remeasure the entire right-of-use asset balance on amendments, impairments, and terminations.

When processing events such as amendments, impairments, or terminations the system converts amounts using the appropriate current or blended historical rates based on the selected configuration. The system maintains a blended historical rate for each right-of-use asset, reflecting the weighted average of rates applied during booking and subsequent modifications. The blended historical rate ensures monthly amortization entries are converted to the ledger currency considering the different rates that have been applied to the right-of-use asset changes.

Business benefits include:

- Enable accurate remeasurement of the right-of-use asset when amending foreign currency denominated leases.

- Reduce manual adjustments and simplify period-end reporting for multinational entities.

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 26C

To enable this feature:

- Navigate to the Manage Lease Accounting Configuration for the relevant business unit.

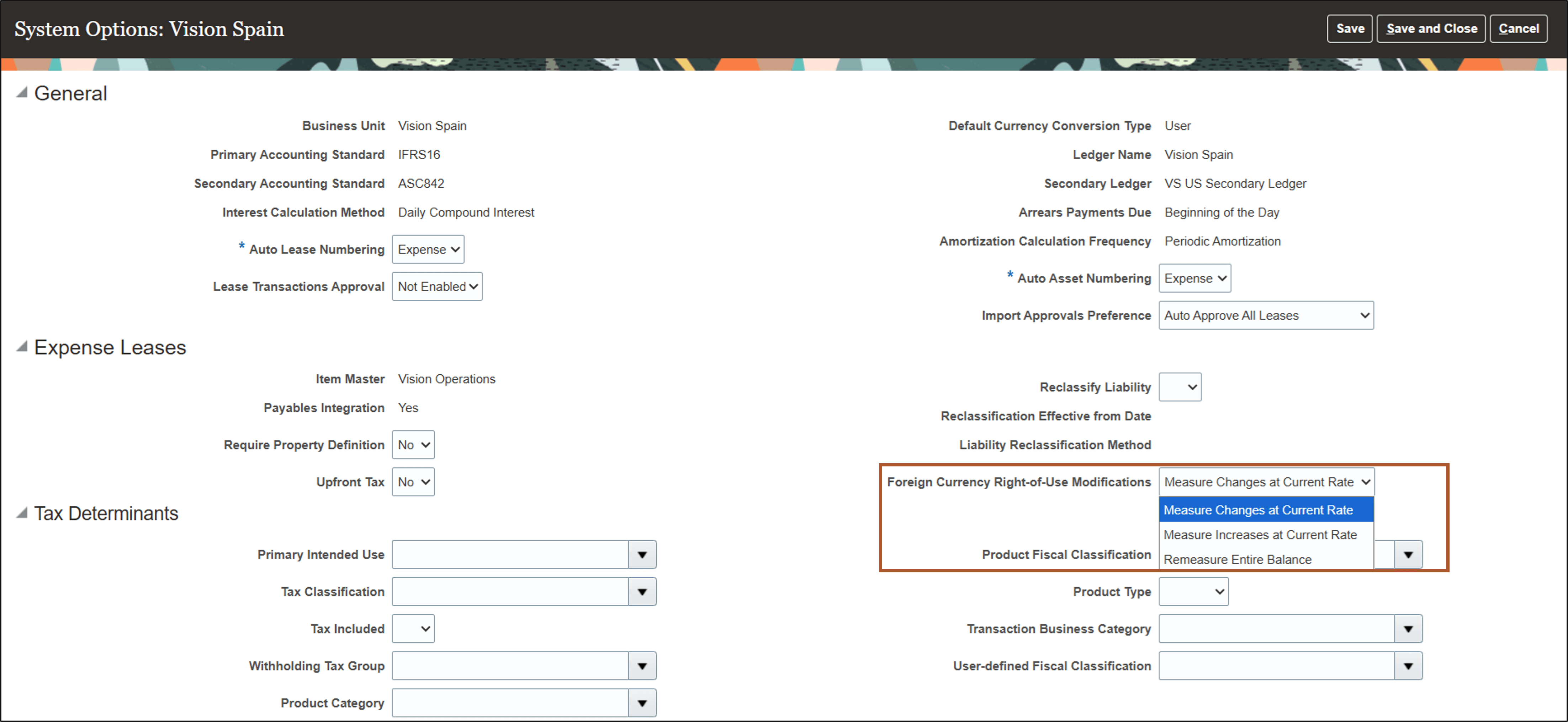

- Locate the Foreign Currency Right-of-Use Modifications system option.

- Select one of the available methods based on your organization’s accounting policy.

The following screenshot describes configuring the Foreign Currency Right-of-Use Modifications system option:

Configure System Options page

- Configure the following new Journal Line Rules when using the new Foreign Currency Right-of-Use Modifications methods:

- Measure Increases at Current Rate, or

- Measure Changes at Current Rate

Journal Line Rules

| Event Class | Journal Line Rule | Accounting Class | Line Type |

|---|---|---|---|

| Lease Revision | Lease Revision Foreign Currency Liability | Liability | Cr |

| Lease Revision | Lease Revision Foreign Currency Liability Reserve | Liability | Dr |

| Lease Revision | Lease Revision Foreign Currency Right-of-Use Reserve | Liability | Cr |

| Lease Revision | Lease Revision Foreign Currency Right-of-Use | Asset | Dr |

| Lease Revision | Lease Revision Foreign Currency Liability Gain or Loss | Lease Gain or Loss | Cr |

| Lease Revision | Lease Revision Foreign Currency Liability Reduction | Liability | Dr |

| Lease Revision | Lease Revision Foreign Currency Right-of-Use Reduction | Asset | Cr |

| Lease Revision | Lease Revision Foreign Currency Right-of-Use Reduction | Lease Gain or Loss | Dr |

| Lease Termination | Lease Termination Foreign Currency Liability Option Exercise | Liability | Cr |

| Lease Termination | Lease Termination Foreign Currency Liability Reserve | Liability | Dr |

| Lease Termination | Lease Termination Foreign Currency Right-of-Use Reserve | Liability | Cr |

| Lease Termination | Lease Termination Foreign Currency Right-of-Use Option Exercise | Asset | Dr |

| Lease Termination | Lease Termination Foreign Currency Liability Gain or Loss | Lease Gain or Loss | Dr |

| Lease Termination | Lease Termination Foreign Currency Liability Termination | Liability | Cr |

| Lease Termination | Lease Termination Foreign Currency Right-of-Use Termination | Asset | Dr |

| Lease Termination | Lease Termination Foreign Currency Right-of-Use Gain or Loss | Lease Gain or Loss | Cr |

Key Resources

Based on Idea 817416 from the Lease Accounting Idea Lab on Oracle Cloud Customer Connect.

Access Requirements

No new access requirements.