US 1099 Forms and Electronic Reporting Updates for Tax Year 2025

Generate Forms 1099-MISC, 1099-NEC, 1096, and the corresponding electronic files in compliance with the 2025 US Internal Revenue Service specifications. Excess golden parachute payments are no longer reported in Box 14 on Form 1099-MISC. Amounts previously reported in Box 14 on 1099-MISC for excess golden parachute payments must now be reported in Box 3 on Form 1099-NEC. This update ensures alignment with the latest IRS instructions for excess golden parachute payments, form revisions, electronic file format updates, and changes to state participation in the Combined Federal/State Filing Program.

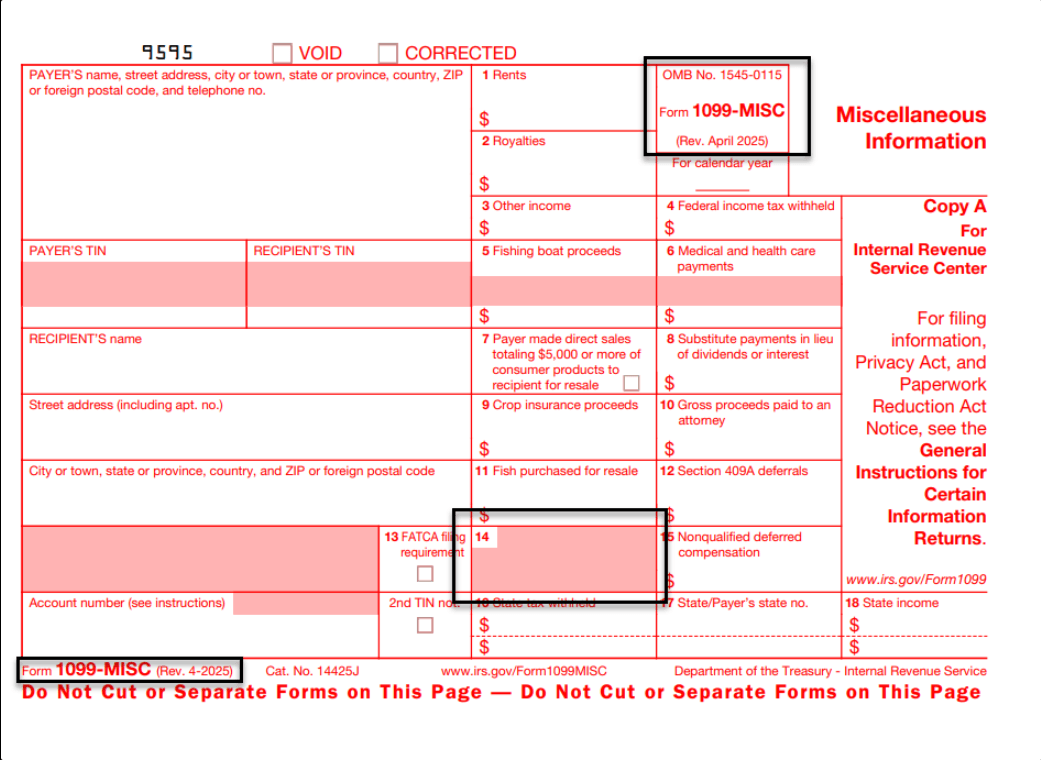

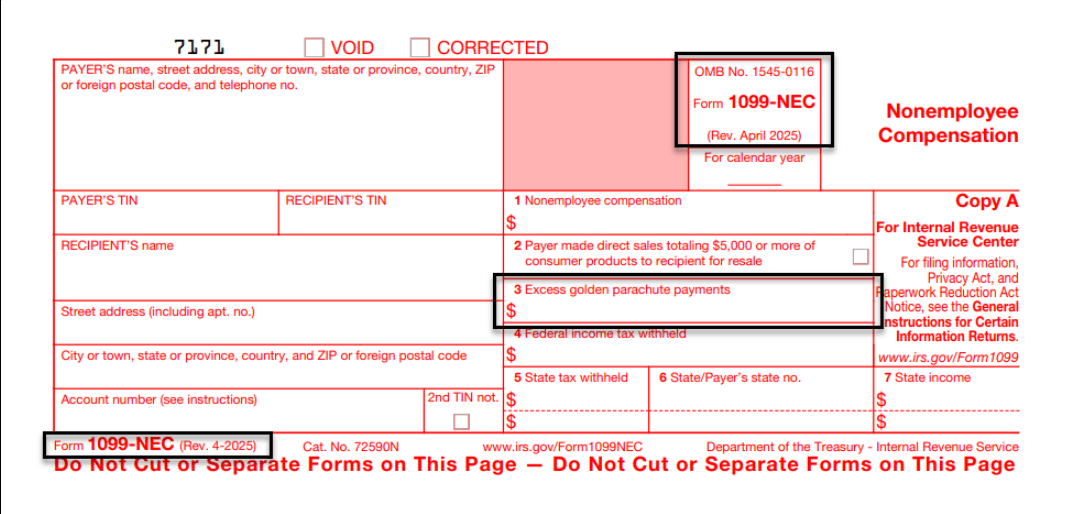

1099-MISC and 1099-NEC Preprinted Form Changes:

- Excess golden parachute payments are no longer reported in Box 14 on Form 1099-MISC.

- Amounts previously reported in Box 14 for excess golden parachute payments must now appear in Box 3 on Form 1099-NEC.

- Updated revision details to (Rev. Apr 2025) on all copies.

1099-MISC Form

1099-NEC Form

1099-MISC and 1099-NEC Electronic File Format Changes:

- Excess golden parachute payments are now excluded from FIRE System electronic file output.

- These payments must be filed using the Information Returns Intake System (IRIS) or submitted on paper.

- Corrections for prior-year golden parachute payments filed via the FIRE System must now be made on paper.

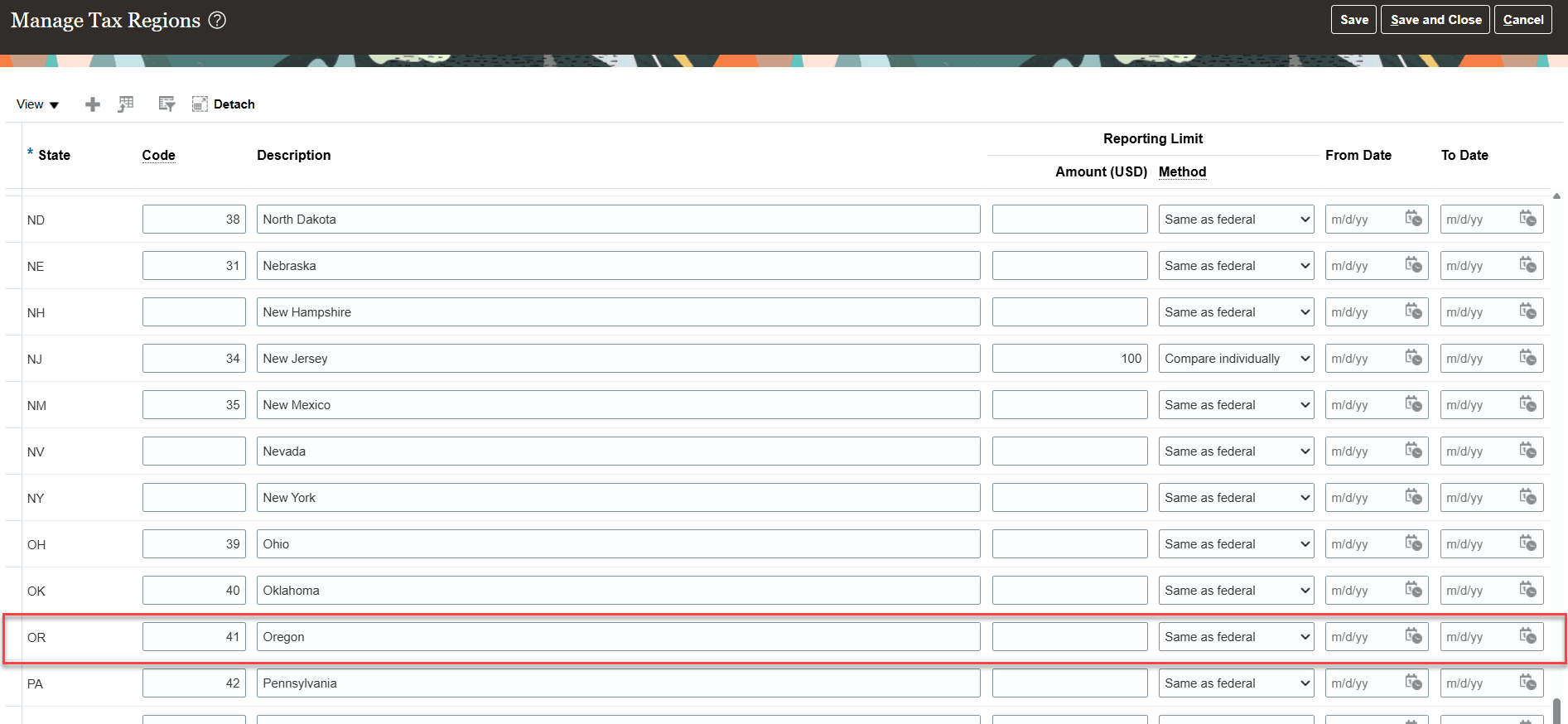

- Combined Federal/State Filing Program updates:

- Oregon (code 41) is added.

- Missouri (code 29) is removed.

Manage Tax Regions Page

1096 Form Changes:

- 1096-NEC will now include excess golden parachute payment summaries.

- 1096-MISC will exclude these amounts.

The business benefits are:

- Enables accurate, up-to-date US tax reporting for 2025.

- Mitigates compliance risk.

- Reduces the potential for penalties due to reporting errors.

- Aligns electronic and paper reporting procedures with current IRS specifications.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

Please note that US 1099 Electronic and Forms Reporting Changes for Tax Year 2025 changes were backported to the 25D update and included in the MOS Note as well.

Access Requirements

No new access requirements.